Key Insights

-

With a high level of institutional ownership, we can see that KKR Real Estate Finance Trust's share price is sensitive to their trading actions.

-

The top seven shareholders own 51% of the company.

-

Ownership research and analyst forecast data can help you better understand a stock's opportunities.

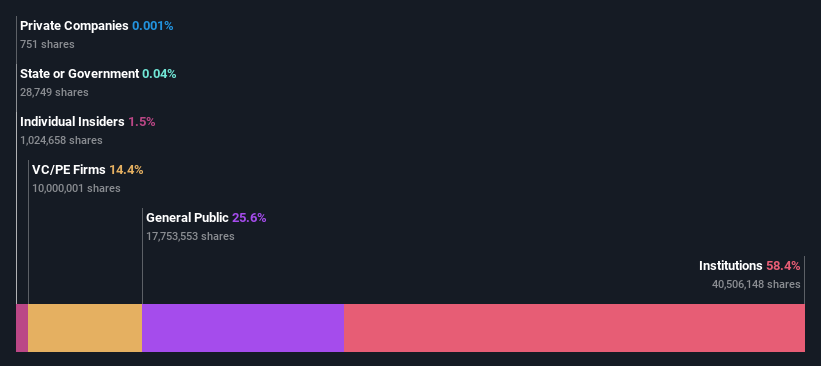

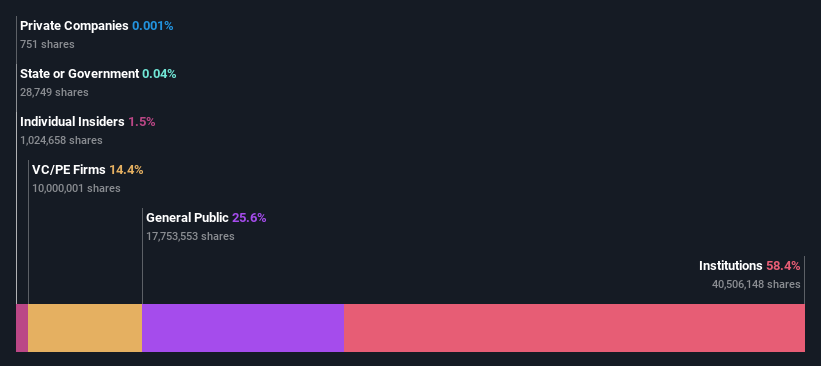

A look at the shareholders of KKR Real Estate Finance Trust Inc. (NYSE:KREF) can tell us which group is most powerful. With a 58% stake, institutional investors hold the largest stake in the company. In other words, this group stands to gain the most (or lose the most) from their investment in the company.

Because institutional investors have access to huge amounts of capital, their market movements tend to be subject to closer scrutiny from individual and small investors, so having a large amount of institutional money invested in a company is often seen as a desirable characteristic.

Let's take a closer look to see what the different types of shareholders can say about KKR Real Estate Finance Trust.

Check out our latest analysis for KKR Real Estate Finance Trust

What does institutional ownership tell us about KKR Real Estate Finance Trust?

Many institutions measure their performance against an index that approximates the local market, so they usually pay particular attention to companies that are included in major indexes.

We can see that KKR Real Estate Finance Trust has institutional investors who hold a fair amount of shares in the company. This means that the analysts working for these institutions have looked at the stock and think it is favorable. However, just like everyone else, the analysts can also be wrong. If multiple institutions change their view on a stock at the same time, the share price could fall sharply. It is therefore worth looking at KKR Real Estate Finance Trust's earnings history below. Of course, it's the future that really matters.

Institutional investors own more than 50% of the company's shares, and together they can strongly influence board decisions. KKR Real Estate Finance Trust is not owned by hedge funds. Our data shows that BlackRock, Inc. is the largest shareholder holding 15% of shares outstanding. KKR & Co. Inc. is the second largest shareholder holding 14% of common stock, and The Vanguard Group, Inc. holds about 8.3% of the company's shares.

After further investigation, we found that the top 7 shareholders account for approximately 51% of the shareholder register, suggesting that there are a few smaller shareholders besides the larger ones, balancing each other's interests to some extent.

Researching institutional ownership is a good way to predict and sift through a stock's expected performance. The same can be achieved by studying analyst opinions. There are plenty of analysts covering the stock, so it might be worth seeing their forecasts as well.

Insider Ownership of KKR Real Estate Finance Trust

While the precise definition of an insider can be subjective, almost everyone considers directors to be insiders. A company's management should report to the board of directors, which should represent the interests of shareholders. Notably, top-level managers themselves may sit on the board of directors.

Insider ownership can be a positive if it signals management are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company, which can be a negative in some circumstances.

Shareholders will likely be interested to know that insiders own shares in KKR Real Estate Finance Trust Inc. They own US$9.7m worth of shares in their own names, in a company with a market capitalization of US$656m. It's good to see some insider investment, but it might be worth checking if they've actually been buying.

General public property

The general public (including retail investors) own 26% of the company's shares, which is not something that can be easily ignored. While this size of ownership is significant, it may not be enough to change the company's policy if the decision is not in line with other large shareholders.

Private Equity Ownership

Private equity firms hold a 14% stake in KKR Real Estate Finance Trust, suggesting they may be able to influence important policy decisions. While there are cases where private equity is around for the long term, they generally have a short investment horizon and, as the name suggests, don't invest much in public companies. After a while, they may look to sell and reallocate capital elsewhere.

Next steps:

It's very interesting to look at who owns a company, but to gain real insight, you need to consider other information as well. For example, we've identified: 2 warning signs for KKR Real Estate Finance Trust (1 is important) Things you should know.

If you want to know what analysts are predicting future growth, then don't miss this. free Report analyst forecasts.

Note: The figures in this article are calculated using data from the last 12 months, which refers to the 12-month period ending on the last day of the month in which the financial statements are dated, which may not match the figures in the annual report.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.