Much of the ongoing discussion about artificial intelligence (AI) revolves around the “Magnificent Seven” stocks. Over the past 18 months, big tech companies have made a series of high-profile, multibillion-dollar investments in AI initiatives.

The major companies in the Magnificent Seven include: NVIDIA and Amazon (Nasdaq: AMZN)Nvidia appears to be a powerful force in all aspects of the AI field, but I wouldn't overestimate the company's dominance.

Let's take a closer look at what's driving Nvidia's growth today and explore how Amazon may overtake the company in the long term.

Nvidia is the leader in AI chips, but…

Nvidia designs advanced semiconductor chips called graphics processing units (GPUs), which have a wide range of uses, including training large language models, machine learning, and autonomous driving.

Beyond the technology sector, generative AI is also being used in the healthcare sector. Nvidia's GPUs are also used by major pharmaceutical companies, such as: Novo Nordisk — The makers of Ozempic and Wegovy.

Unsurprisingly, Nvidia's widespread influence has given the company a staggering 80% share of the AI chip market.

Nvidia's lead may seem insurmountable, but we must remember that the AI revolution is still in its early stages, and while Amazon may seem to be lagging behind, I would argue that the company is simply picking up the pace and preparing for a marathon-style race.

…Some big tech companies are making their own moves.

The AI startup scene is packed. One of the hottest companies is machine learning company Hugging Face. SalesforceAmazon, Google, NVIDIA, Intel, Advanced Micro Devices, Qualcommand IBM As an investor.

Have you noticed anything from that syndicate of investors, many of whom are either chip companies or cloud computing experts?

Conveniently, Amazon has both: In addition to Amazon Web Services (AWS), the company is developing a line of training and inference chips. Named Trainium and Inferentia, the chips are a new source of growth for AWS as cloud computing becomes increasingly competitive.

Additionally, Hugging Face recently announced that it will partner with AWS to deploy workloads on the latest version of Inferentia, which I see as a big win for Amazon and a stepping stone for the company to wean itself off its Nvidia reliance in the long term.

Another way Amazon is starting to gain traction is with its $4 billion investment in another AI startup, Anthropic. Like Hugging Face, Anthropic trains its generative AI models on Amazon's Trainium and Inferentia chips, and also uses AWS as its primary cloud provider.

That's not enough to explain why Amazon is a serious AI contender. The company plans to invest $11 billion in building data centers. Nvidia is also a data center competitor, but it's not Amazon or Oracle It has its own plan.

Is now a good time to invest in Amazon stock?

Currently, Amazon stock is trading at about $179 per share, very close to the company's all-time high of $189.

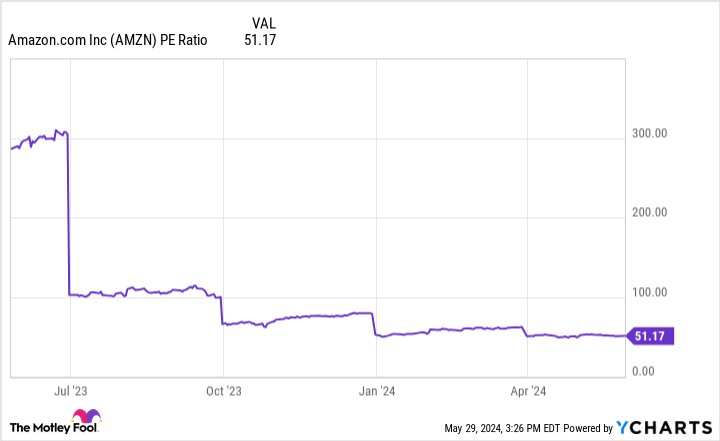

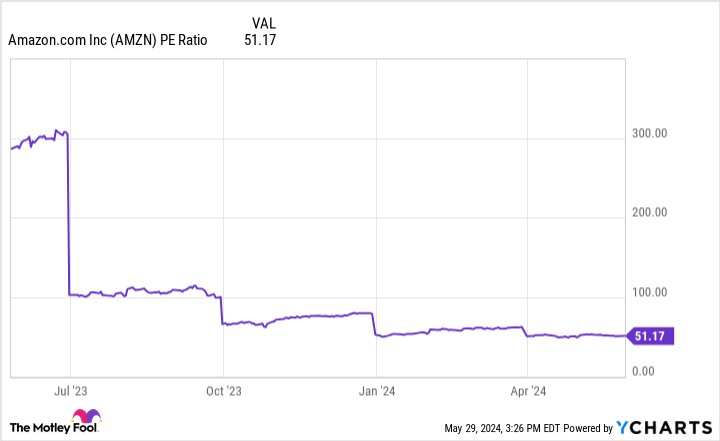

With that in mind, you might think that Amazon's stock price is high, but the chart below shows otherwise.

Over the past 12 months, Amazon's share price has risen by roughly 50%. In contrast, the company's earnings per share (EPS) over the past 12 months has increased by 181%.

Amazon's price-to-earnings (P/E) ratio is actually 4.5% higher than its stock price because the company's earnings growth is accelerating faster than its stock price. Decreased Year-over-year, which means that even though the stock is at an all-time high, Amazon is technically cheaper than it was last year.

I believe Amazon is undervalued when it comes to AI. The company is investing aggressively and is already starting to gain new momentum. Over time, I believe the moves it is making now will pay off big time and give Amazon more flexibility against its competitors.

To me, Amazon stock is very cheap and represents a compelling long-term opportunity in AI. While Nvidia will continue to be the poster child for AI in the short term, I think Amazon is making some clever chess moves to ultimately position itself for the long term.

Should I invest $1,000 in Amazon right now?

Before you buy Amazon stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Amazon isn't one of them. These 10 stocks have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $671,728.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a director of The Motley Fool. Adam Spatacco invests in Amazon, Novo Nordisk, and NVIDIA. The Motley Fool invests in and recommends Advanced Micro Devices, Amazon, NVIDIA, Oracle, Qualcomm, and Salesforce. The Motley Fool recommends Intel, International Business Machines, and Novo Nordisk and recommends buying Intel's January 2025 $45 calls and selling Intel's May 2024 $47 calls. The Motley Fool has a disclosure policy.

Did Amazon say 'checkmate' to Nvidia? was originally published by The Motley Fool.