This month marks the third anniversary of the passage of the American Rescue Plan Act (ARPA) and the $350 billion Coronavirus State and Local Financial Recovery Fund (SLFRF) program administered by the U.S. Treasury. State, local, and tribal governments have three years to allocate, obligate, and spend SLFRF funds to address the health, economic, and fiscal impacts of the COVID-19 pandemic. It was done.

Since the inception of the SLFRF program, Brookings Metro, the National League of Cities, and the National Association of Counties have focused on how the nation's largest cities and counties (those with populations of 250,000 or more) will receive their share of $65 billion in these funds through their local governments. I've been watching to see if it's being used. Government ARPA investment tracker. This update covers how large local governments have used SLFRF funds over the past three years to promote an equitable economic recovery from COVID-19, as well as the impending Treasury bill. We provide new insight into the progress made so far in obligating these funds to meet the December 2024 deadline. As of ARPA's third anniversary, all SLFRF recipients have just over nine months left before this deadline before they must return unobligated funds to the Treasury Department.

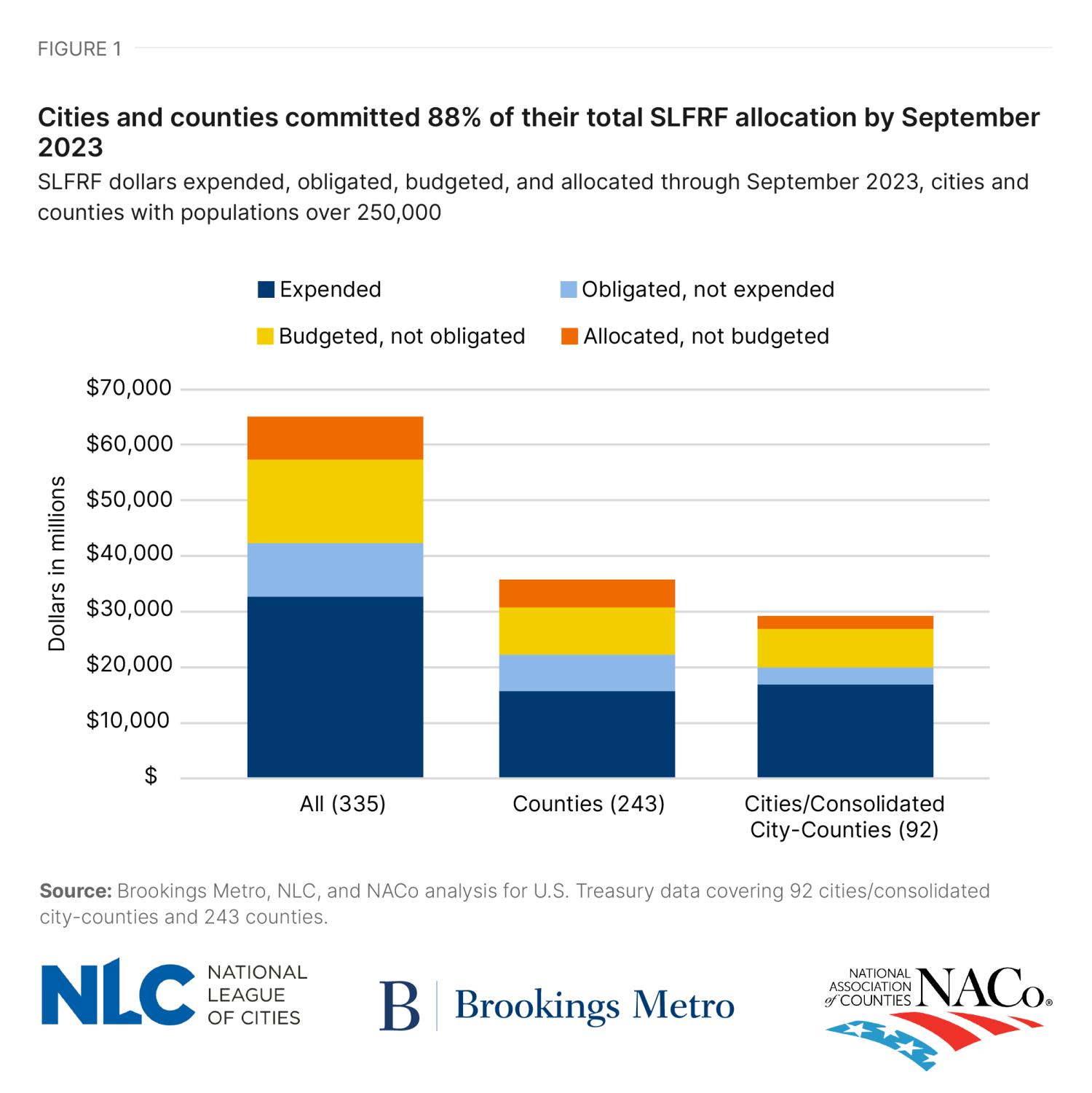

As of September 2023, metropolitan areas and counties have allocated 88% of the total allocation

As of September 30, 2023, 335 metropolitan areas and counties reported allocations, obligations, and expenditures for a total of 14,186 projects. This is an increase of 7% from the previous reporting period. (See the glossary at the end of this article for definitions of these terms.) However, even though the total number of projects underway in these large municipalities continues to increase , spending increased by only 3 percentage points during June 2023 (85%). ) and September 2023 (88%).

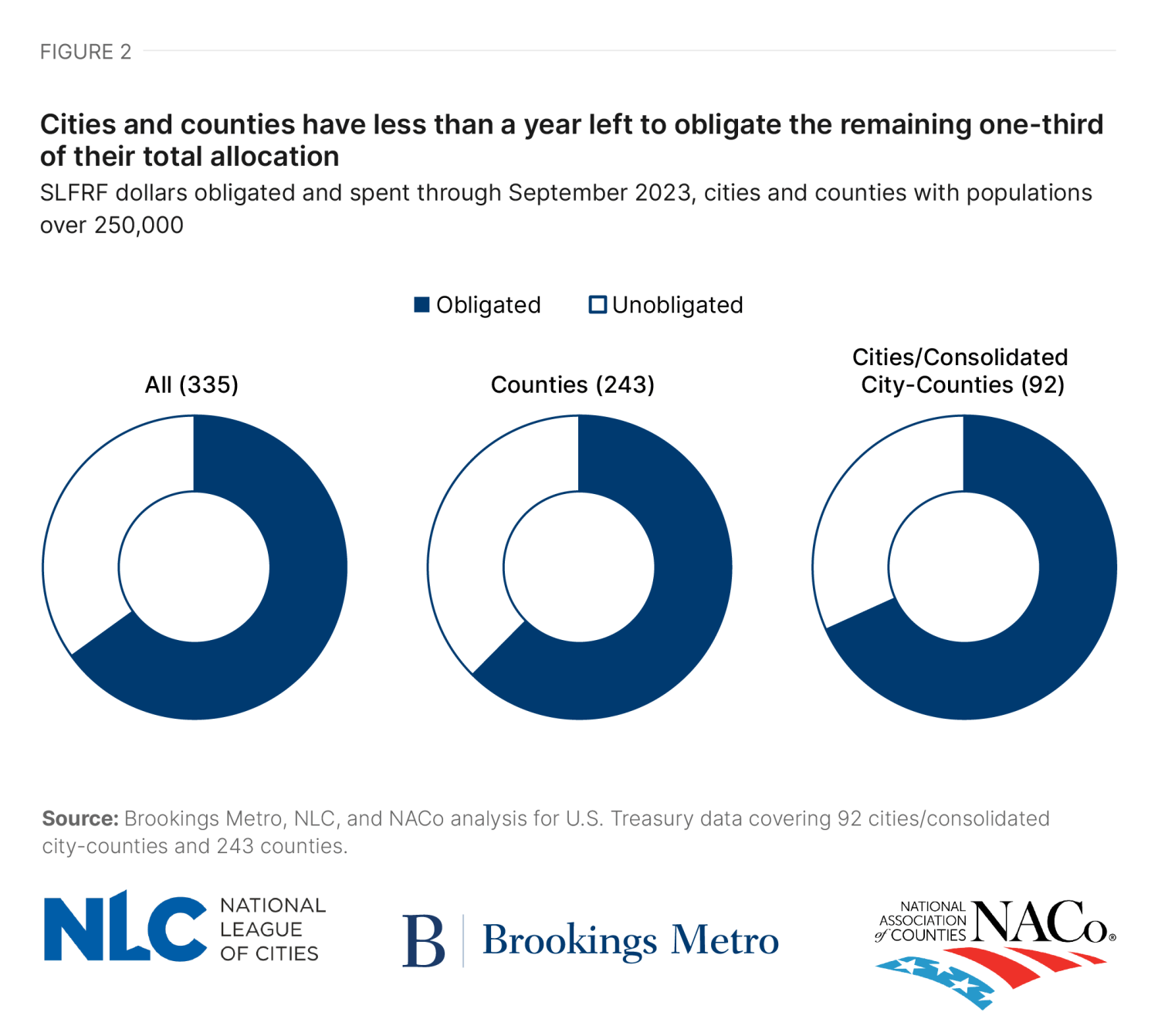

Three years into ARPA, it has become increasingly important to also focus on the amount of funding cities and counties have. mandated The Treasury Department requires that all allocations of SLFRF be obligated by the end of December 2024, so they are earmarked for specific projects. Large cities and counties have obligated about two-thirds (65%) of their allocations so far. A total of $22.8 billion remains unpaid.

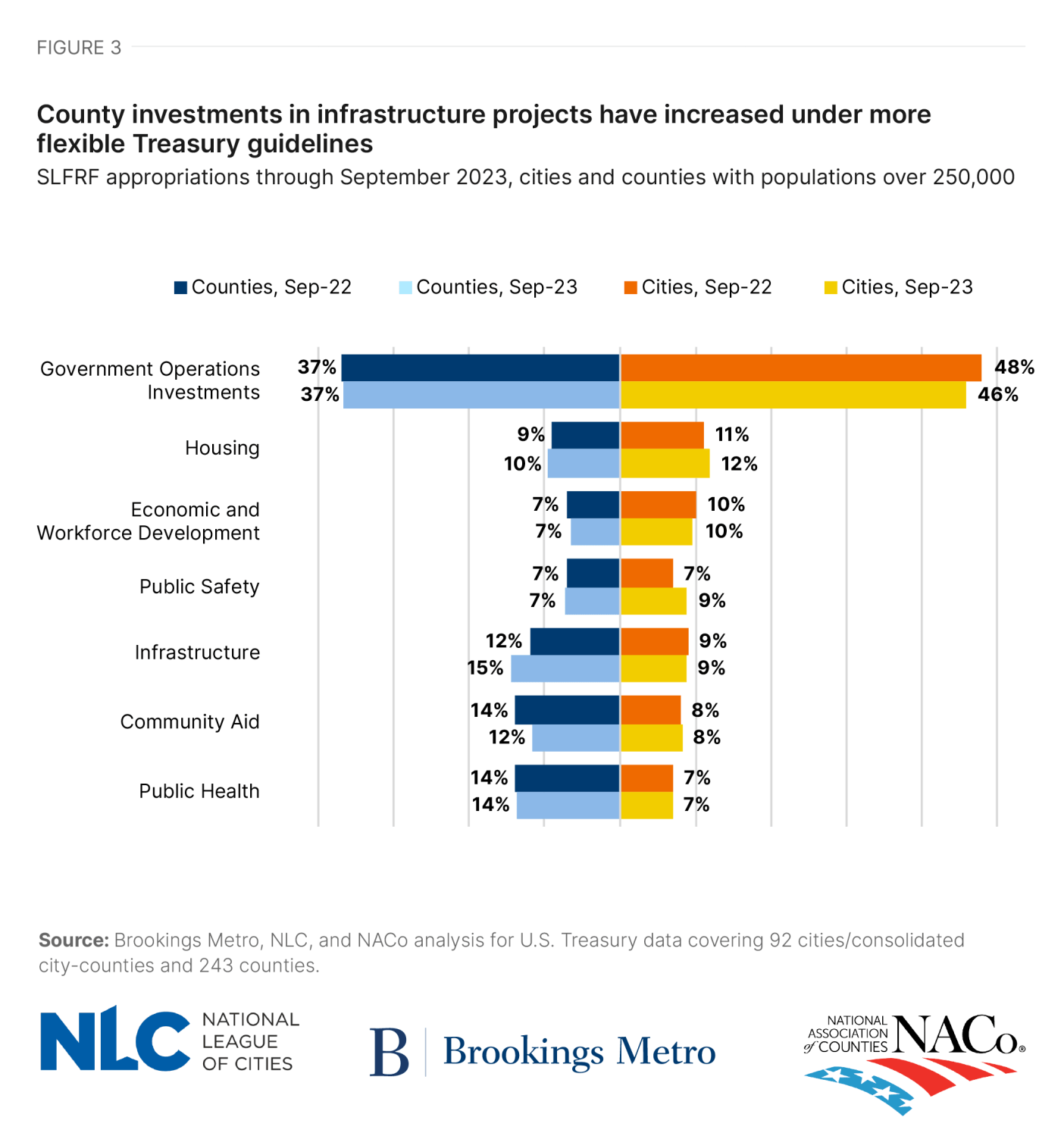

Government projects account for the largest SLFRF allocations in large cities and counties, with infrastructure allocations increasing in large counties over the past year

Investment priorities for large cities and counties have remained largely stable over the past year. Similar to previous updates of the tracker, government operations accounted for the largest share of investment in large cities (46%) and counties (37%). However, large counties have seen a marked increase in the proportion of spending devoted to infrastructure investments. This could potentially be the result of new Treasury Department guidelines allowing cities and counties more flexibility in using his SLFRF funds for infrastructure and disaster relief. Meanwhile, cities are increasing their funding for public safety investments in response to pandemic-era crime increases (though these trends have largely declined since 2020).

Unpacking Revenue Replacement: What is a Revenue Loss Clause?

As the SLFRF dollar mandate deadline approaches, local decision makers, media outlets, and community members are increasingly concerned about the program's revenue loss provisions. This revenue loss provision introduced a “revenue replacement” classification with significantly fewer restrictions on how SLFRF dollars can be spent. All his SLFRF recipients will be able to classify at least $10 million of their allocation in this way and also use the formula provided by the Treasury Department to calculate the actual income lost as a result of the pandemic. You can also categorize larger amounts using

Cities and counties can benefit greatly by classifying funds as revenue replacement. First, fiscal stability: State and local governments lost at least $117 billion in revenue expected at the beginning of the pandemic. Revenue replacement provisions have prevented public sector layoffs and furloughs, maintained essential government services, and kept public finances healthy. Second, it reduces administrative burden. The flexibility afforded by the forbearance clause is much needed for smaller municipalities, where building comprehensive compliance and reporting systems has been impractical as they deal with the COVID-19 emergency. It has been with. Therefore, by reducing the burden of federal program compliance in these areas, Treasury is now able to implement the SLFRF program in even the smallest local governments. Third, meet the Treasury's obligation deadlines: Classifying SLFRF dollars as “revenue replacement” immediately counts them as expenditures, thereby avoiding the December 2024 obligation deadline for large cities and counties and the December 2026 obligation deadline. The pressure to meet spending deadlines is relieved.

How can local governments balance speed, efficiency and transparency?

The previous section outlined many of the benefits of revenue replacement for local governments. One drawback, however, is that it can be difficult for Treasury, local stakeholders, and the public to track what happens to SLFRF resources once they are classified as revenue replacement. is. In fact, Treasury intended the SLFRF program to be used to “support a truly equitable recovery and address health and economic disparities in our most underserved communities that have been exacerbated by the pandemic.” . By providing flexibility to local authorities, it is possible to deviate from this stated objective.

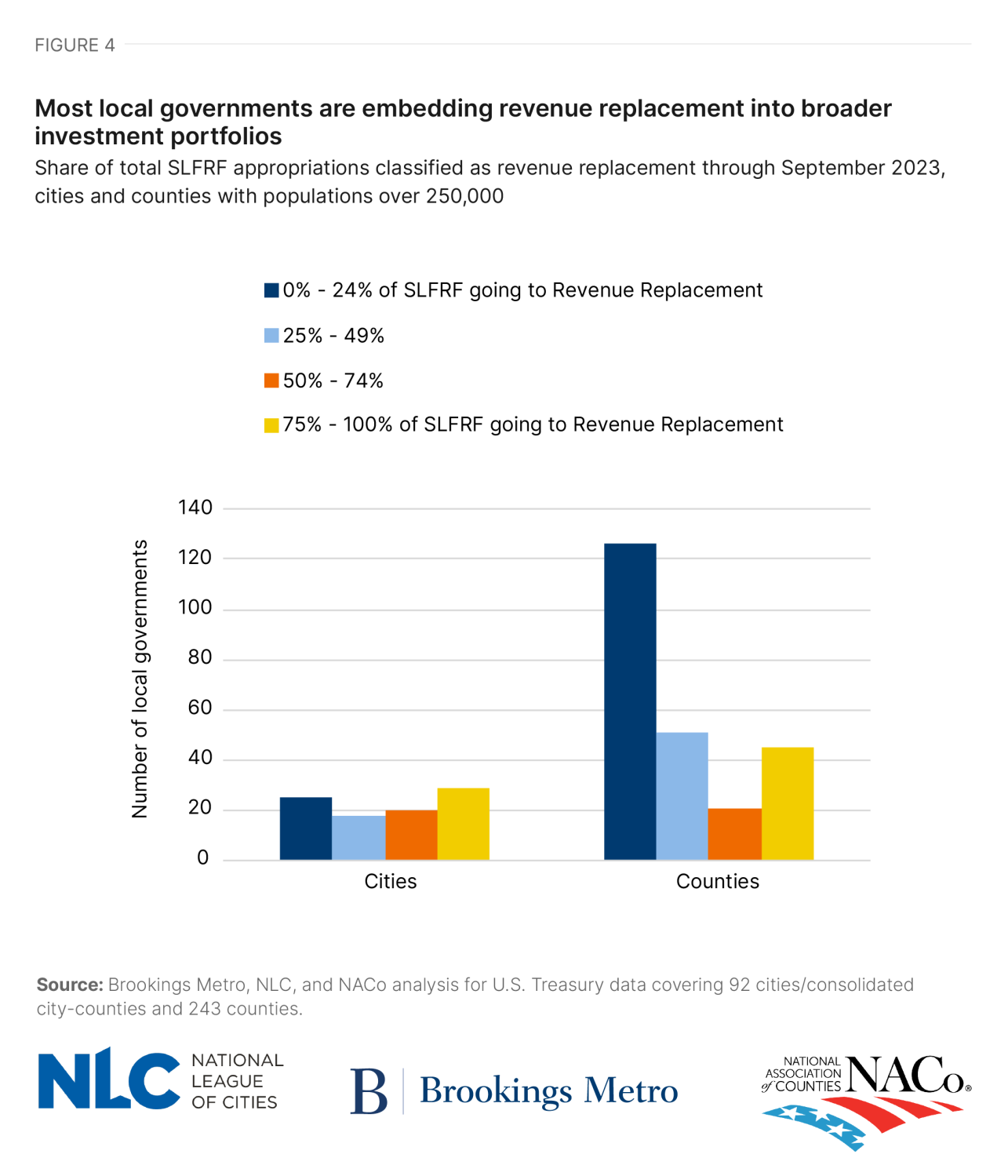

Most large cities and counties take advantage of the revenue reduction provision to some extent, but relatively few use it to exempt their entire allocation. As of September 2023, two-thirds of large local governments classified less than half of their expenditures as revenue replacement, and 13% of them did not use any revenue loss provisions for their expenditures. Only 11% of metropolitan areas and counties classify 100% of their SLFRF allocations as revenue replacement.

Consistent with previous Brookings research, the majority of expenditures that large local governments classify as revenue replacement are formally used for government operations ($18.7 billion). Approximately 75% of these revenue replacement investments in government operations are further classified as “fiscal consolidation” in our Municipal ARPA Investment Tracker. This category is typically reserved for large lump sum deposits into a city or county's general fund, with little detail on how the funds will be invested. will be used. But even if local governments provided more detailed information about how these funds were used, the flexibility of the revenue reduction provisions makes it difficult to determine what types of projects were truly ARPA-enabled. . For example, large cities and counties may officially expend ARPA funds classified as revenue replacement for expenses normally supported by general fund revenues, such as public sector wages. This would free up general fund resources for other his ARPA-enabled investments, but the jurisdiction would not report such indirect investments to Treasury.

Local governments can benefit from the flexibility provided by revenue replacement while maintaining fiscal transparency and community awareness. Examples of local governments that have summarized federal reports in this way without limiting local-level impact tracking efforts include:

- Kalamazoo County, Michigan, reported 100% of its spending through September 2023 as a single $51.5 million revenue replacement project, which it described as covering “numerous departmental and community partner projects within the county.” However, counties maintain a separate ARPA dashboard for the public that clearly communicates total expenditures, obligations, and expenditures through the most recent Treasury reporting period. Breaking down these budgets by her six strategic recovery priorities for the county. It also provides detailed award data for all of the county's 79 ARPA-funded subprojects. This website also has direct links to the county's federal performance report and ARPA-related financial documents.

- Greensboro, North Carolina, reported 100% of its spending through September 2023 as two general budget consolidation projects classified as revenue replacements. The City also maintains a website that provides comprehensive updates on the usage of SLFRF allocations (categorized into the City's three strategic recovery priorities) and status tracking of the amount of funds appropriated and obligated by the City. We also operate And spent it. In addition, the website also provides links to detailed funding authorizations and program descriptions for all Congressionally approved projects realized through the SLFRF program.

Project portfolio may need to evolve as Treasury mandate deadlines approach

With less than a year left until the December 2024 deadline, more than a third of the funds earmarked for large local governments remain unobligated. Recent Treasury guidance has launched a new, more flexible revenue alternative classification to help local governments meet this deadline. As local leaders continue to look for ways to leverage their allocations to promote an equitable economic recovery for their communities, they will be able to complete all allocations by the December deadline while prioritizing their communities. You should ask your colleagues for ideas on how to ensure that funds are disbursed. levels of transparency, awareness and financial responsibility.

allocation is the total amount of funds distributed to states and local governments through the Coronavirus State and Local Financial Recovery Fund (SLFRF) program.

American Rescue Plan Act (ARPA) This is the $1.9 trillion Economic Stimulus and Pandemic Recovery Act signed by President Joe Biden on March 11, 2021. This bill is also known as the “American Rescue Plan” or “ARPA.” This article focuses solely on the Coronavirus State and Local Financial Recovery Fund (SLFRF) program, so “ARPA” and “SLFRF” are used interchangeably.

Spending Funds allocated to state and local governments through the SLFRF program that earmark or commit to specific initiatives or programs. In this article, “budget,” “investment,” and “commitment” are used interchangeably.

Coronavirus State and Local Fiscal Reconstruction Fund (SLFRF) This is a $350 billion program authorized by the American Rescue Plan Act (ARPA) to provide economic stimulus and pandemic recovery funds to U.S. states, territories, cities, counties, and tribal governments. This article focuses only on the SLFRF program, so “ARPA” and “SLFRF” are used interchangeably.

duty Funds distributed to states and local governments through the SLFRF program that are legally dedicated to specific uses and often (but not exclusively) used through contractual arrangements. The Treasury Department's latest guidance defines obligations as “entering into contracts, grants, and similar transactions that require the ordering and payment of real property or services.” The Treasury Department is requiring recipient cities and counties to commit to 100% of their SLFRF allocations by December 2024.

revenue loss is a provision in the SLFRF that allows local governments to classify some or all of their allocations as “revenue replacement.” Local authorities do not have to prove a loss of income and can claim up to $10 million in “revenue replacement” as a standard allowance. You may also be able to claim more if you can prove your loss of income due to the coronavirus pandemic.

Revenue replacement Eligible use classification established in the SLFRF program. Funds classified as “revenue replacement” by the SLFRF program's revenue loss provisions can be used for any government service permitted by state law and are not subject to many SLFRF program reporting requirements.

First-class local government Large cities and counties with populations over 250,000. These jurisdictions are also referred to as “large municipalities” or “large cities and counties.”