Embedded Finance Business and Investment Opportunities Market in Africa and the Middle East

Dublin, May 29, 2024 (GLOBE NEWSWIRE) — The “Africa & Middle East Embedded Finance Business & Investment Opportunity Databook – 75+ KPIs for Embedded Lending, Insurance, Payments & High Net Worth Segments – Updated Q1 2024” report has been added. ResearchAndMarkets.com Recruitment.

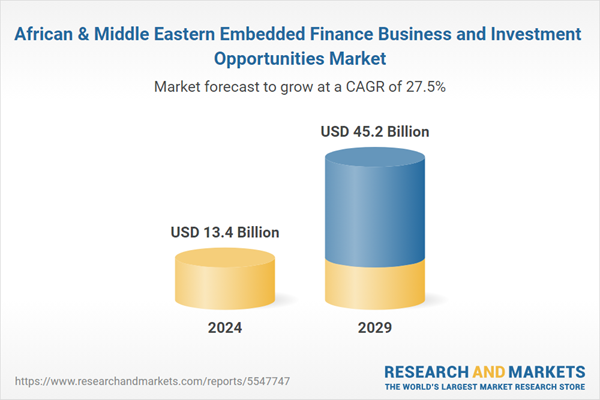

The embedded finance industry in Africa and the Middle East is expected to grow by 36.4% on an annual basis to reach USD 13.43 billion in 2023. The embedded finance industry is expected to grow steadily during the forecast period, registering a CAGR of 27.5% between 2024 and 2029. Embedded finance revenues in the region will increase from USD 13.43 billion in 2024 to USD 45.22 billion by 2029.

The Middle East and Africa (MEA) region is seeing a surge in adoption of embedded finance, which integrates financial services such as payments, lending, and insurance within non-financial platforms, creating a seamless user experience and removing friction from traditional financial processes.

High smartphone penetration and a young, tech-savvy population: The MEA region is experiencing a rapid rise in the number of smartphone users, especially among the younger demographic. This creates fertile ground for the adoption of mobile-first financial solutions. According to GSMA Intelligence, by 2025, mobile subscribers in the MEA region are expected to reach 535 million, representing a penetration rate of 65%.

Unbanked population: A significant percentage of the MEA population is unbanked or underbanked. Embedded finance enables financial inclusion by providing access to financial services through familiar platforms. The World Bank estimates that 31% of adults in the Middle East and North Africa (MENA) region and 41% of adults in sub-Saharan Africa do not have an account with a formal financial institution.

Growing e-commerce and on-demand services: The rise of e-commerce and on-demand services, such as ride-hailing, has naturally led to built-in financial solutions that offer seamless payment and lending options within the platform. Online sales on the continent are expected to reach $180 billion by 2025, according to Jumia, Africa's leading e-commerce platform.

Increased focus on financial inclusion: Governments in the MEA region are actively pursuing financial inclusion efforts. Embedded finance aligns with these goals by providing alternative access to financial services. According to the World Bank's Global Findex database, the percentage of adults in sub-Saharan Africa with a mobile money account has increased from 21% in 2014 to 34% in 2021.

Key Trends in the Embedded Finance Market in the Middle East and Africa

-

The rise of buy now, pay later (BNPL): BNPL solutions are becoming more popular, allowing consumers to spread the cost of purchases over multiple installments. This trend is expected to continue as built-in financing drives the integration of BNPL options within various platforms.

-

Adoption of Open Banking: Open banking regulations are being gradually introduced in some Middle Eastern and African countries, encouraging greater collaboration between financial institutions and fintech companies and driving innovation in embedded financial solutions.

-

Emerging technologies: Integrating technologies such as artificial intelligence (AI) and blockchain can personalize financial services and enhance security within embedded financial solutions.

Key Deals and Innovations in the Middle East and Africa Embedded Finance Market

-

Qashio and CredibleX (2024): Qashio and CredibleX have partnered in an effort to provide financing to businesses in the Middle East and North Africa (MENA) region. The new Qashio financing solution offers instant approval and disbursement, competitive rates, and an easy-to-use application process for Qashio customers.

-

Partnership with Souqalmal (MENA) (2023): Souqalmal, a price comparison platform in the Middle East and North Africa (MENA) region, partnered with multiple banks to offer in-built loan options within the platform in 2023. This streamlines the shopping experience as users can compare prices and seamlessly apply for financing for their desired products directly through Souqalmal.

-

Tabby Funding (UAE, 2024): Tabby, the UAE's leading Buy Now, Pay Later (BNPL) provider, has raised a massive $950 million in funding in 2024. This significant investment highlights investor confidence in the potential of embedded financing, particularly in the BNPL segment within the MEA region.

-

In 2024, OmniRetail plans to expand its embedded finance in Nigeria, Ghana and Côte d'Ivoire.

-

In 2023, CredibleX, MENA's pioneering embedded finance platform, announced its launch after being granted regulatory licenses from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi Global Market (ADGM). These licenses provide a robust regulatory framework for the launch, providing confidence and trust for CredibleX's partners and customers. The company also announced its partnership with ADGM as the first fintech partner for Numou, a finance platform for SMEs, as well as partnerships with partners in FMCG and financial services.

Competitive Landscape: The embedded finance space in MEA is becoming increasingly competitive, with incumbent financial institutions partnering with fintech startups to leverage their expertise. Global technology giants are also eyeing this market, offering embedded finance solutions in addition to their core services.

Existing financial institutions:

-

Standard Bank (South Africa): A leading African bank that offers embedded financial solutions for businesses, including payment processing and merchant cash advance options.

-

Emirates NBD (UAE): A leading UAE bank that partners with fintech companies to provide embedded financial services such as BNPL solutions and in-app payments.

-

National Bank of Egypt (Egypt): A major player in the Egyptian market, exploring embedded financial solutions through partnerships with e-commerce platforms and telecommunications companies.

Fintech Startups:

-

Thriive (Kenya): A Kenyan fintech startup that provides embedded financial solutions for businesses, focusing on microloans, payments and savings accounts.

-

Telda (South Africa): A South African fintech company that provides on-demand services and embedded insurance solutions for e-commerce platforms.

-

Mpesa (Kenya and East Africa): While not strictly an embedded finance operator, Mpesa’s mobile money platform serves as the foundation for embedded financial services in the region, facilitating payments and allowing for integration with other financial products in the future.

The report covers market opportunities and risks for lending, insurance, payments, wealth and asset-based finance sectors across various verticals and provides an in-depth data-centric analysis of the embedded finance industry. With 75+ KPIs at country level, the report provides a comprehensive understanding of embedded finance market dynamics, market size and forecast.

Key attributes:

|

Report Attributes |

detail |

|

number of pages |

1125 |

|

Forecast Period |

2024 – 2029 |

|

Estimated market value in 2024 (USD) |

$13.4 billion |

|

Market value forecast to 2029 (USD) |

$45.2 billion |

|

Compound Annual Growth Rate |

27.5% |

|

Target area |

Africa, Middle East |

A bundled product that combines the following nine reports:

-

Embedded Finance Business and Investment Opportunities in Africa and the Middle East

-

Embedded Finance Business and Investment Opportunities in Egypt

-

Israel's Embedded Finance Business and Investment Opportunities

-

Embedded Finance Business and Investment Opportunities in Kenya

-

Embedded Finance Business and Investment Opportunities in Nigeria

-

Embedded Finance Business and Investment Opportunities in Saudi Arabia

-

Embedded Finance Business and Investment Opportunities in South Africa

-

Türkiye's Embedded Finance Business and Investment Opportunities

-

Embedded Finance Business and Investment Opportunities in the UAE

For more information on this report, please visit: https://www.researchandmarkets.com/r/iwn9bj

About ResearchAndMarkets.com

ResearchAndMarkets.com is a leading global source of international market research reports and market data providing the latest information on international markets, regional markets, key industries, top companies, new products and latest trends.

Attachments

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900