Unlimited Travel Group UTG AB (public) (STO:UTG) shares have maintained their recent momentum, rising 26% in the last month alone, and looking back further, it's encouraging to see that the share price is up 47% over the past year.

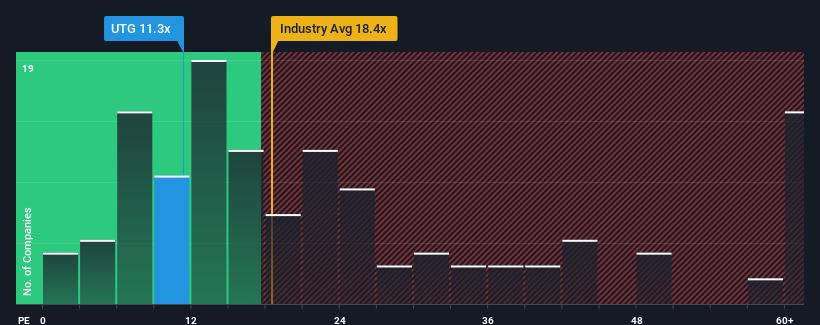

Even after such a sharp rise in its share price, Unlimited Travel Group UTG may still be sending out a very bullish signal at present, with a price-to-earnings (P/E) ratio of 11.3, as almost half of Swedish companies have P/E ratios above 23, and P/Es above 42 are not uncommon. That said, we need to dig a little deeper to determine whether there is a rational basis for the significantly lower P/E.

For example, the recent decline in earnings at Unlimited Travel Group (UTG) is thought-provoking. One possibility is that the price-to-earnings multiple is low because investors believe the company won't do enough to avoid underperforming the broader market in the near future. If you're interested in the company, you'll hope that's not the case, so you could buy shares while they're out of favor.

Check out our latest analysis for Unlimited Travel Group UTG

While there are no analyst forecasts, checking the company's recent developments can give you an idea of what the future holds for the company. free Unlimited Travel Group UTG earnings, revenue and cash flow report.

What are the growth trends of Unlimited Travel Group (UTG)?

The only time it's truly reassuring to see a falling price-to-earnings ratio, like Unlimited Travel Group (UTG), is if the company's growth is clearly on a track to underperform the market.

Looking back first, the company's earnings per share growth last year was nothing to cheer about, as it was a disappointing 14% decline. At least EPS, overall, avoided a complete reversal from three years ago thanks to a period of growth earlier. So it's fair to say the company's recent earnings growth has been inconsistent.

Comparing the recent medium-term earnings trajectory with the market's overall one-year growth forecast of 27% shows a significant decline in attractiveness on an annualized basis.

With this in mind, it's not surprising that Unlimited Travel Group (UTG) has a lower price-to-earnings multiple than most other companies, as many shareholders were apparently uneasy about holding a stock that they thought would continue to lag the index.

Unlimited Travel Group UTG P/E Conclusion

Even after such large share price movements, Unlimited Travel Group's (UTG) P/E still lags the broader market by a large margin. While the price-to-earnings ratio isn't a deciding factor in whether or not to buy a stock, it can be a very useful barometer for gauging earnings expectations.

As expected, research into Unlimited Travel Group UTG reveals that the company's three-year earnings trend is worse than current market expectations, leading to a low P/E. Currently, shareholders are accepting that future earnings will probably not bring any pleasant surprises and are accepting the low P/E. Unless recent medium-term conditions improve, the stock will likely continue to have a barrier around this level.

That being said, be careful Unlimited Travel Group UTG is showing 2 warning signs In our investment analysis, you need to know:

You may find better investments than Unlimited Travel Group (UTG). If you want to narrow your options, check out these options. free A list of interesting companies trading at a low P/E (but that have proven they can grow earnings).

Valuation is complicated, but we can help make it simple.

investigate Unlimited Travel Group UTG By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.