According to SEC filings, Yvette Butler, Director of Voya Financial Inc (NYSE:VOYA), sold 2,165 shares of the company's stock on May 24, 2024. This transaction reduces Voya Financial Inc shares owned by the insider to 0. The shares were sold for $73.78 per share.

Voya Financial Inc operates in the financial services sector, providing retirement, investment and insurance solutions. The company's goal is to help Americans plan, invest and protect their savings for a better retirement.

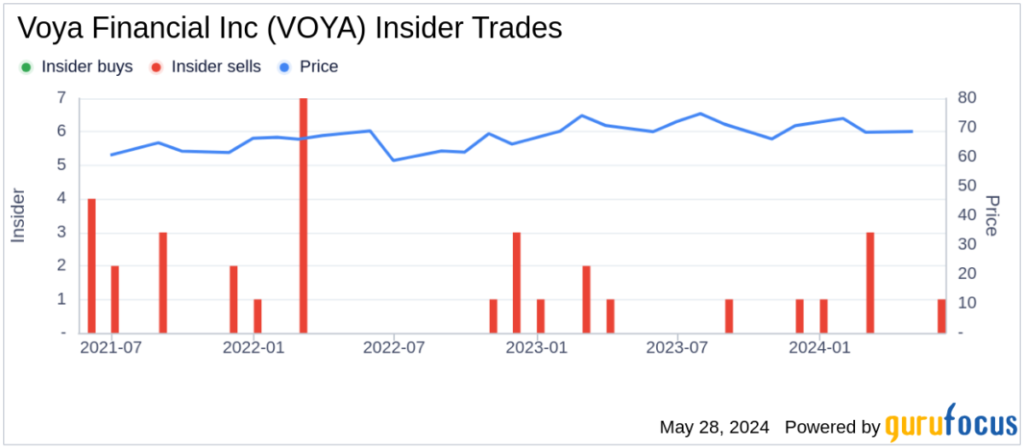

In the past year, Yvette Butler has sold a total of 4,239 shares but hasn't bought any shares in Voya Financial Inc. The insider trading history for Voya Financial Inc shows that there have been no insider purchases in the past year, and a total of 7 insider sales in the same period.

Voya Financial Inc. shares were trading at $73.78 on the trading day. The company's market capitalization is approximately $7.45 billion. The company's price-to-earnings ratio of 10.51 is below the industry average of 47.94 and also below the company's historical average.

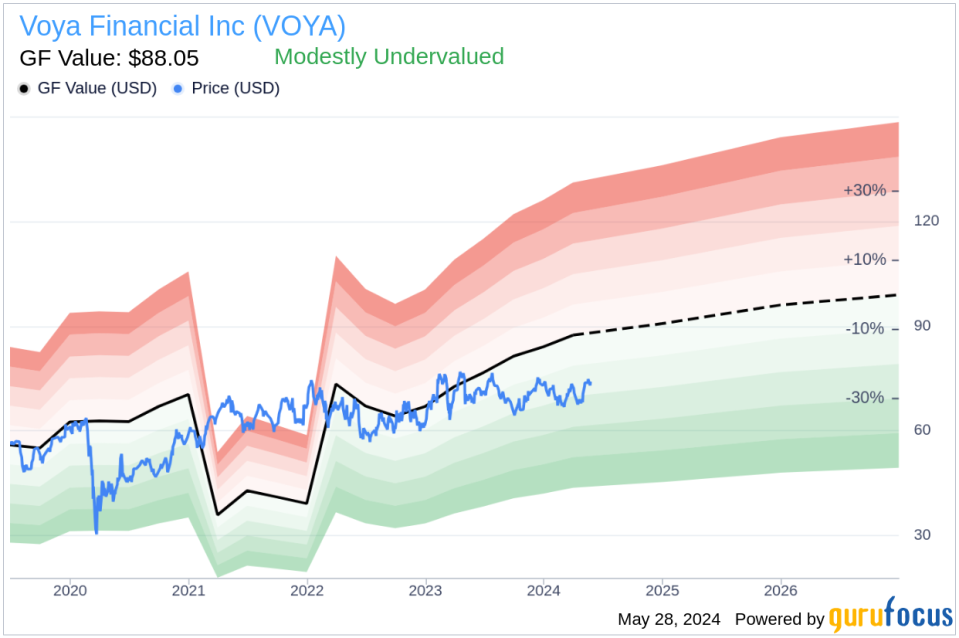

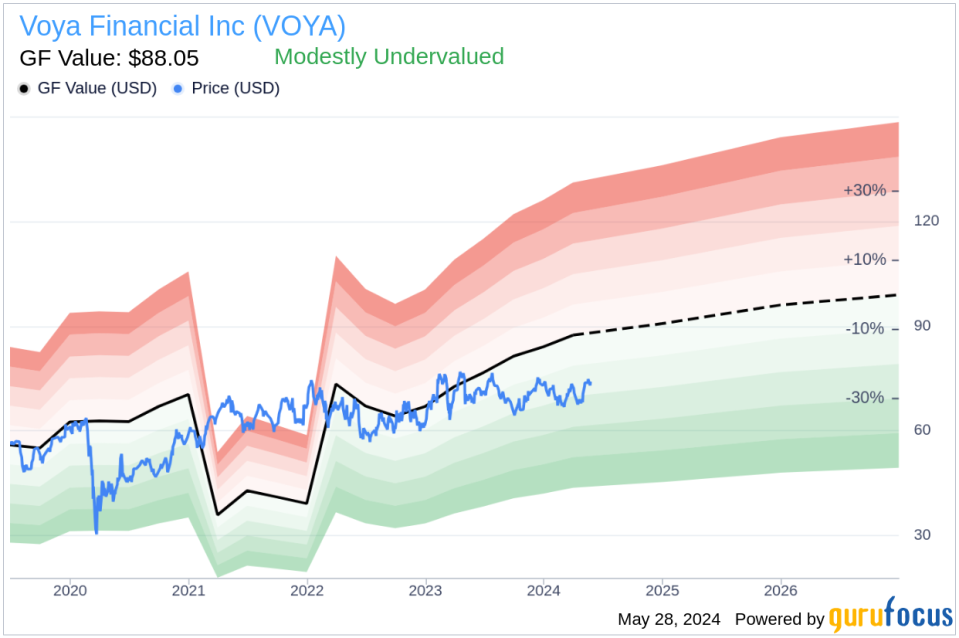

According to GF Value, Voya Financial Inc's intrinsic value is estimated at $88.05 per share, giving the stock a price-to-GF Value ratio of 0.84, making the stock slightly undervalued.

GF Value is calculated by considering historical multiples such as price-to-earnings multiples, price-to-sales multiples, price-to-book multiples and price-to-free cash flow multiples, as well as a GuruFocus adjustment factor based on historical earnings and growth, and Morningstar analyst estimates of future earnings performance.

This insider sale provides insight into how insiders are reacting to the company's share valuation and market conditions and may be of interest to current and potential investors.

This article written by GuruFocus is intended to provide general insights and is not tailored financial advice. Our commentary is based on historical data and analyst forecasts, uses an unbiased methodology and is not intended to serve as specific investment guidance. It is not a recommendation to buy or sell stocks, nor does it take into account individual investment objectives or financial situation. Our objective is to provide long-term, fundamental data-driven analysis. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus has no position in the stocks mentioned herein.

This article was originally published on GuruFocus.