(Bloomberg) — Profits on the riskiest parts of secured loan obligations are surging, reaching roughly 20% annualized rates on both sides of the Atlantic, thanks to improving loan performance, narrowing debt spreads and rising payments.

Most read articles on Bloomberg

In some cases, structural quirks that allow managers to take on new debt on old deals have also helped boost returns on the equity portion, the first part to take losses.Managers of CLOs, which are bonds backed by groups of leveraged loans, have been taking advantage of lower funding costs to issue more lower-rated debt rather than holding on to lower-rated debt.

Many companies are now selling what are called “deferred Class F tranches” and attaching them to older CLOs, with the proceeds from the sale being able to be returned to shareholders as new dividends.

“Managers can simply roll the proceeds straight into equities, which could lead to big gains,” said James Bailey, a structured credit partner at Paul Hastings in London.

The deferred tranche is another example of how issuers are taking advantage of a strong rally in riskier debt as recession fears recede and prices recover after a long period of volatility.More than 10 such transactions have been done in Europe so far this year by CLO managers including Invesco and Capital Four.

Equity returns have also improved as many CLOs have reached the end of their non-call periods and can be refinanced, reopened or liquidated. New pricing and longer investment periods could also free up more cash to be allocated to the equity portion, Bailey added.

“Both approaches involve moving from a low to a high leverage position and potentially earning an equity dividend,” he said.

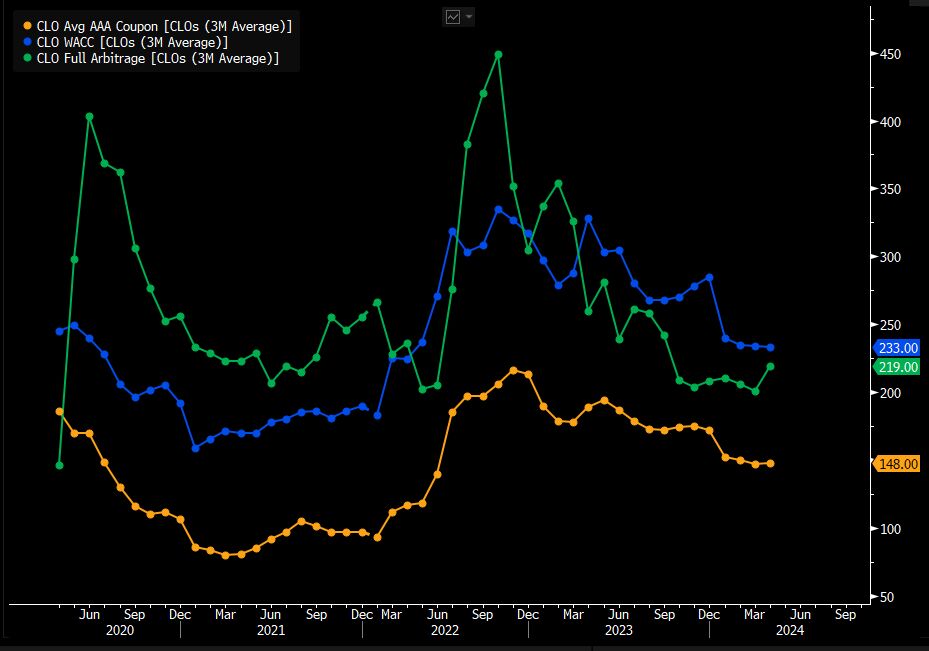

CLO equity returns have been volatile in recent years due to arbitrage fluctuations — the difference between the yields managers earn on the loans they buy and the funding costs of the bonds they issue.After falling in 2023, arbitrage levels in Europe have stabilized at about 200 basis points this year and recently started to rise slightly, according to Bloomberg Intelligence.

“Spreads have widened on both assets and liabilities in 2022 and 2023, making third-party CLO equity placements more difficult,” Ben Hunsaker, portfolio manager at Beach Point Capital Management, said of the U.S. market. He said these deals have since experienced strong equity payouts, which should allow for debt refinancing when the non-call period ends.

The problem is that these returns may not last. If global central banks start to cut interest rates later this year, CLO equity investors could see arbitrage opportunities shrink again. A wider financial crisis could also reduce returns, but only to a limited extent for now.

“While the market was expecting default rates of 3% to 4% last year and 4% to 6% this year, default rates in CLO portfolios have come down significantly, benefiting CLO equity,” said Dan Ko, senior principal and portfolio manager at Eagle Point Credit Management.

Click here for a podcast about Invesco buying REITs and bank bonds in the “golden age” of credit

Review of the week

-

Credit bulls point to a series of indicators that show high-quality debt has rarely been this cheap, making corporate bonds more attractive with few advantages over Treasuries.

-

Investment banks including Goldman Sachs Group Inc. are offering to refinance some of the riskiest private credit through broad syndications, the latest sign that Wall Street is trying to wrest business back from direct lenders.

-

For the first time since the financial crisis, investors in the highest-rated bonds backed by commercial real estate debt are suffering losses.

-

Robot investors are increasingly taking over credit markets, a shift that is pitting investors with tech PhDs against traditional portfolio managers with business degrees.

-

United Parcel Service Inc. issued $2.6 billion in high-grade bonds as companies rush to raise new debt ahead of the Memorial Day holiday. Coca-Cola Consolidated Co. raised $1.2 billion in bonds to buy back stock, and data-center owner Equinix Inc. re-issued $750 million in bonds after pulling back on a planned initial public offering in March following a short-seller attack.

-

Alibaba Group Holding Ltd. sold $4.5 billion worth of convertible bonds, the largest dollar-denominated sale ever by an Asian company.

-

Oak Hill Advisors is leading a roughly $1.4 billion debt package to help finance Advent International's proposed acquisition of a stake in Prometheus Group.

-

Banks plan to sell bonds as early as next week to help finance Roark Capital Group's acquisition of restaurant chain Subway.

-

Peloton Interactive Inc. sold $1 billion in financing and secured more favorable terms after the deal garnered attention among investors.

-

Seafood restaurant chain Red Lobster has filed for bankruptcy, succumbing to onerous leases, high labor costs and the failure of its all-you-can-eat shrimp promotions.

-

Lenders of embattled utility Thames Water are considering repaying about 500 million pounds ($635.5 million) of the company's loans.

-

Chinese companies have cut their overseas borrowing to the lowest levels in a decade or even all time by some measures.

-

China Vanke Group Inc. repackaged some of its privately issued debt into asset-backed securities, essentially allowing the construction company to postpone payments that were already on hold.

-

Cerberus Capital Management and Intrum AB are in talks to buy a portfolio of about 7 billion euros ($7.6 billion) of European non-performing loans.

Move

-

Blackstone has hired credit industry veteran Matthew Humphrey to its multi-asset investment team in London, after 11 years at Barclays, where he was last head of synthetic risk transfer structures.

-

Bobby Jain's multi-strategy hedge fund has appointed Cyril Pathmanathan, who was most recently at D.E. Shaw & Co., to lead its synthetic risk transfer investment effort.

-

Fidelity International has shut down its direct lending operations in Europe and laid off members of its private markets team.

-

Barings has hired Bob Shettle again as a managing director, who will join the firm's North American private finance investment committee at the end of May.

-

Bayview Asset Management has hired Craig Scholl as managing director of insurance asset management, who previously served as head of North American insurance at AllianceBernstein.

–With assistance from Amedeo Goria.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP