At first glance, cybersecurity experts Fortinet (NASDAQ:FTNT) tells the story of two cities. On the positive side, the company is benefiting from the growing cybersecurity market. As a protection agent against malicious online threats, it can save businesses from a lot of trouble. Fortinet, on the other hand, is underperforming its competitors. Still, the market downturn has made FTNT's valuation relatively attractive. That's why I'm bullish on his FTNT stock.

The case for FTNT stock being good but not great

When evaluating FTNT stock (especially recently), it's hard not to draw some fundamental conclusions. That said, Fortinet is good, but not necessarily better. And this poses a competitive risk, as the company's rivals have seemingly superior appearances.

For example, TipRanks reporter Sirisha Bogaraju noted that Fortinet announced better-than-expected revenue and profits in the first quarter of 2024. Perhaps most notable is that revenue increased by 7% year over year to $1.35 billion. Additionally, adjusted earnings per share increased 26.5% to 43 cents during the same period.

Still, FTNT stock did not benefit from the earnings release. I was actually punished. “Investors were disappointed that first-quarter 2024 claims, a key indicator of future growth, fell 6.4% to $1.41 billion,” Bogaraju wrote. .

If that wasn't enough, the reporter said, “The midpoint of the company's guidance range for second-quarter billings indicates a 1% decline.” We expect headwinds impacting the business to ease in the second half of the year. ”

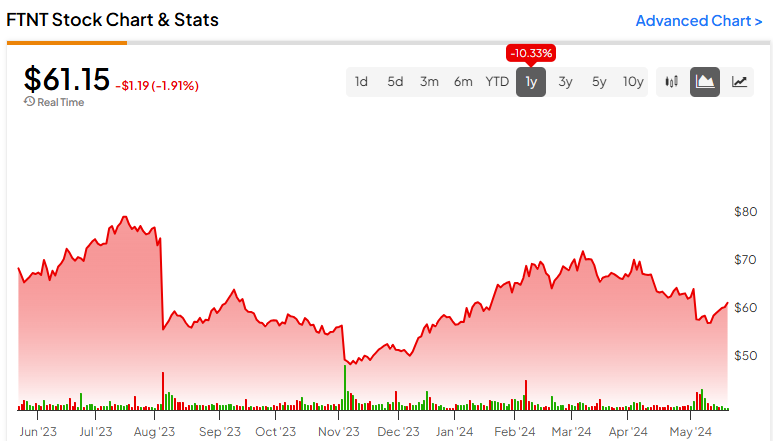

Essentially, Fortinet has identified that enterprise software spending is a big challenge. Additionally, “competition from companies offering integrated cybersecurity platforms” is impacting Fortinet. This is not the best situation for FTNT stock. Since then, FTNT stock has risen by just over 6% year-to-date.

Price fluctuation is inferior compared to rival Palo Alto Networks (NASDAQ:PANW). Year-to-date, PANW is up 10%, but that's not just pure performance. In the month that followed, PANW was up over 14%, while FTNT was down 3%. In other words, Palo Alto's short-term momentum is growing, while Fortinet's is declining.

Even Zscaler (NASDAQ:ZS) has had a tough start to 2024, but is up almost 6% in the past month. This doesn't look very encouraging for FTNT stock until you consider its valuation.

A Better Deal Makes a Compelling Case for Fortinet

Currently, FTNT is trading at 8.91x trailing-year earnings. Objectively, this is quite high for the underlying software infrastructure sector, with an average sales multiple of 4.24x. Still, compared to its competitors, Fortinet looks very attractive.

Palo Alto, in particular, is getting a lot of attention for cybersecurity, but it's coming at a price. PANW trades at his 14.85 times trailing year earnings. Additionally, Zscaler trades at 13.88 times sales, even though ZS is down nearly 16% year-to-date.

Of course, valuation isn't everything. There are many other factors to consider when investing. But the argument for FTNT stock is that while its underlying company may not offer the best story of the three cybersecurity companies, it does offer the biggest deal in terms of earnings. , and it is said that it is far apart from that.

Yes, it's true that declining corporate spending is a problem for Fortinet. However, this is also a problem for the rest of the cybersecurity ecosystem. At the same time, cybersecurity is non-negotiable, as serious damage can occur if a company operates without proper protection.

According to one report, the global average cost of a data breach in 2023 was $4.45 million. But as recent cyberattacks have shown, one breach can affect millions of customers. This can lead to a variety of problems, including ongoing reputational damage.

So, in the field of cybersecurity, the old adage “an ounce of prevention is better than a pound of cure” really holds true.

Fortinet could easily latch onto this story and capitalize on the uptrend. Additionally, with a much lower sales multiple, FTNT stock arguably has less fundamental risk.

Investigate the context of projected demand

To be fair to the competition, FTNT stock may have a low earnings multiple, but there's one more factor to consider. That means analysts are expecting a decline in the demand profile.

In fiscal 2024, Wall Street expects Fortinet to generate $5.8 billion in revenue. This is a 9.3% increase from last year's $5.3 billion. In contrast, Palo Alto's revenue could reach $7.98 billion, or a 15.8% increase over the previous year.

At that rate, PANW's sales would be about 12.9 times. For Zscaler, analysts expect fiscal 2024 sales to increase by $2.12 billion, or 31.1%. Here, ZS would be trading at 12.64 times his sales. While these statistics represent improvements over their respective current multiples, they are still significantly higher than FTNT's historical multiple of 8.91x as of now.

So in theory, FTNT stock should enjoy a valuation “buffer of safety” against its two rivals.

Is Fortinet stock a buy, according to analysts?

Turning to Wall Street, FTNT stock has a Hold consensus rating based on 9 Buy ratings, 18 Hold ratings, and 2 Sell ratings. FTNT's average price target is $70.46, suggesting 15% upside potential.

Conclusion: FTNT stock offers good value for related sectors

Overall, Fortinet is a decent player in the fast-growing proper cybersecurity industry. At the same time, it doesn't have the power of other rivals. Still, this isn't necessarily a bad thing, as FTNT stock happens to be trading at a relative discount compared to its peers. As such, investors shouldn't overlook Fortinet.

disclosure