Cybersecurity is a large industry, and its importance has never been greater. Hackers are adept at breaking into systems and wreaking havoc on businesses. Precautions must be taken to protect internal and customer data.

This requires implementing one (or more) cybersecurity solutions, resulting in huge demand for their products, so investors should consider adding cybersecurity stocks to their portfolios. there is.

The two most popular are; palo alto networks (NASDAQ:PANW) and cloud strike (NASDAQ:CRWD). But which one is better to buy? Let's check it out.

Palo Alto and CrowdStrike are fierce competitors

First, we will explain each company's main business in the cybersecurity field.

Palo Alto divides its business into three segments: network security, cloud security, and security operations. The company's network security business includes firewalls and zero trust platforms that prevent outsiders from accessing networks. The company's cloud security platform protects cloud workloads, and its security operations platform includes products such as endpoint security (an endpoint is a network access device such as a laptop) and threat detection response.

CrowdStrike has a similar product line, but its original business wasn't firewalls like Palo Alto's. It started with a cloud-first security approach that started with endpoint protection and has since expanded to other areas such as identity protection, cloud security, threat intelligence, and endpoint detection response. Therefore, Palo Alto and CrowdStrike are direct competitors for many of their services.

But when you take a closer look at their financials, leaders begin to emerge.

CrowdStrike's growth is expected to remain strong this year as well.

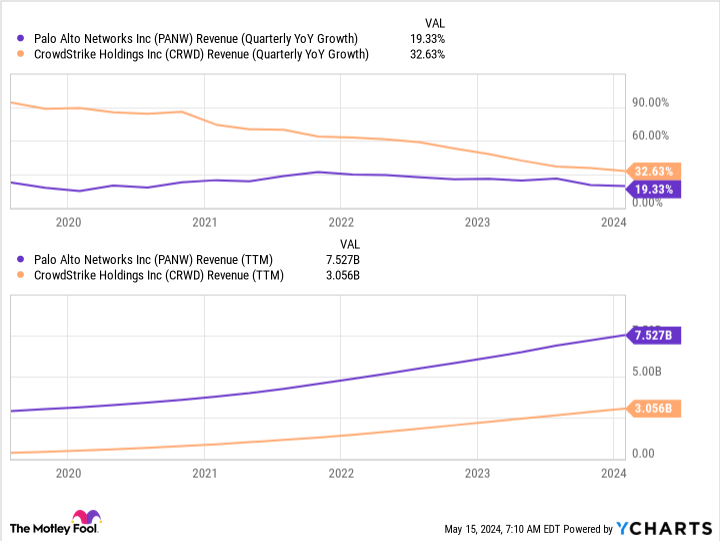

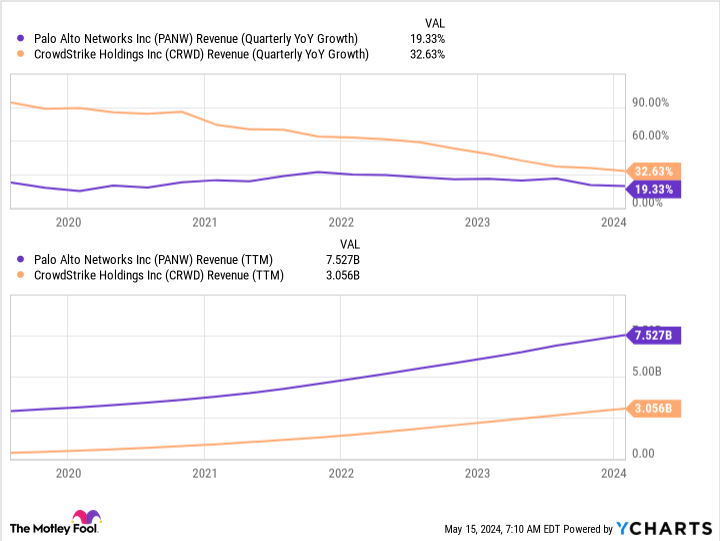

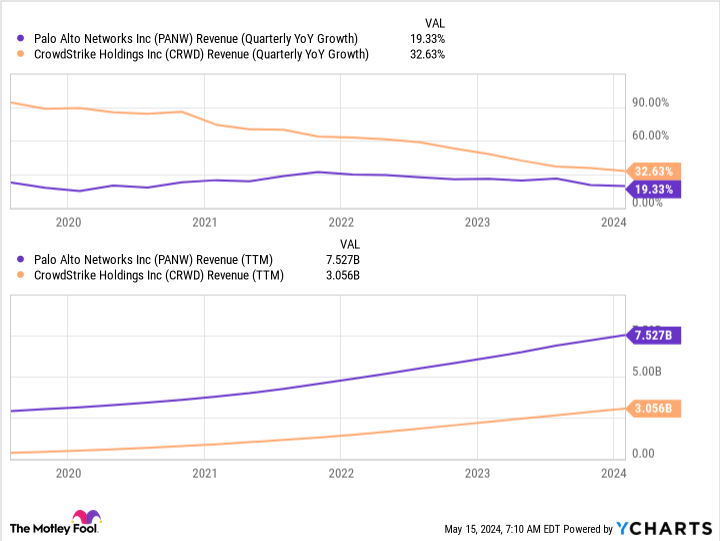

Looking at revenue growth alone, CrowdStrike appears to have an advantage. However, this is a side effect of being a small business. This is evident in CrowdStrike's growth trajectory, with year-over-year revenue growth slowing as the company scales up.

CrowdStrike is growing faster than Palo Alto, but the roles could be reversed if Palo Alto reaches CrowdStrike's size. But the future doesn't look so bright for Palo Alto.

Palo Alto's sales growth for the quarter ending April 30 is expected to be only 3%. (An earnings report is scheduled for Monday.) This is a big red flag, especially when compared to CrowdStrike and other cybersecurity companies.

For the quarter ending April 30, CrowdStrike expects revenue of approximately $904 million, representing 31% growth. (Earnings reports are scheduled for June 4.) That's a significant difference, and an indication that Palo Alto is struggling.

Or is it?

Palo Alto's management said in a February conference call with analysts that the guidance was “the result of a strategic shift in our desire to accelerate both platformization and integration and energize our AI leadership.” Ta. This change makes sense because artificial intelligence (AI) can play a major role in powerful cybersecurity products.

However, since its inception, CrowdStrike has used AI to automatically detect and respond to threats without human intervention. This gives CrowdStrike an edge over Palo Alto Networks in the endpoint protection game.

Which stock?

For me, that's all I need to declare CrowdStrike the winner. Palo Alto already has significant AI experience, but Palo Alto is a latecomer.

CrowdStrike is by far the better buy here, and I wouldn't be surprised if CrowdStrike starts taking Palo Alto customers in the future.

Should you invest $1,000 in Palo Alto Networks right now?

Before buying Palo Alto Networks stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palo Alto Networks wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $566,624!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of May 13, 2024

Keithen Drury has a position at CrowdStrike. The Motley Fool has a position in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure policy.

Improving Cybersecurity Stocks: Palo Alto Networks vs. CrowdStrike was originally published by The Motley Fool