Investors are often guided by the idea of discovering the “next big thing.” Even if that means buying “story stocks” that don't yield any returns, let alone profits. But as Peter Lynch said, One Up on Wall Street, “Long shots rarely pay off.” Investors should be careful not to put good money after bad money, as loss-making companies can act like sponges for capital.

If this kind of company isn't your style, but you like companies that generate revenue and even profits, you might probably be interested in companies like: Afia (NASDAQ:AFYA). Profit is not the only metric to consider when investing, but it is worth evaluating companies that can consistently generate profits.

Check out our latest analysis for Afia.

How fast is Afya growing its earnings per share?

Generally, if a company is growing its earnings per share (EPS), the share price should follow a similar trend. This means that most successful long-term investors consider his EPS growth to be substantially positive. Impressively, Afya has grown his EPS by an average of 18% per year over the past three years. If this kind of growth continues into the future, shareholders will have plenty to smile about.

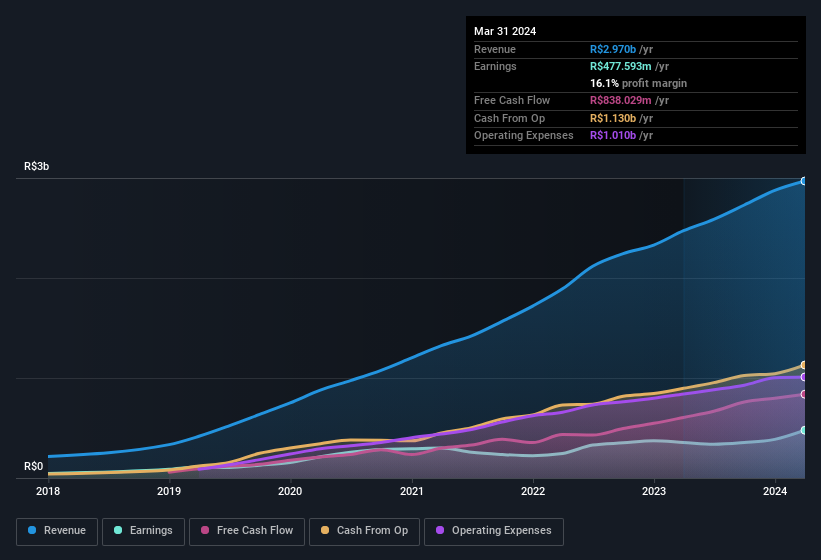

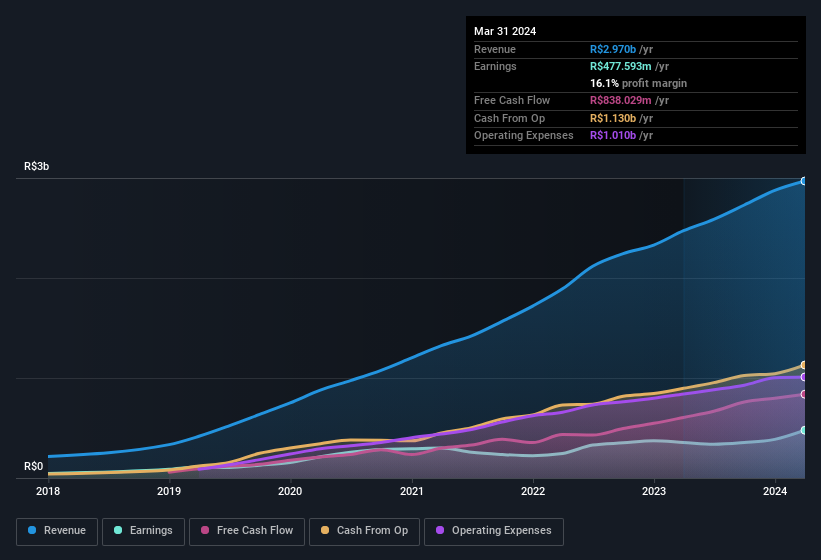

To reassess the quality of a company's growth, it's often helpful to look at its earnings before interest and tax (EBIT) margin, as well as its revenue growth. Afya achieved his EBIT margin similar to last year, but revenue increased by 20% and reached R$ 3 billion. That's encouraging news for the company!

The graph below shows how the company's revenue and revenue have trended over time. Click on the image for more details.

Fortunately, we have access to analyst forecasts for Afia. future profit. You can make your own predictions without looking at anything, or you can take a look at the predictions of experts.

Are Afia's insiders aligned with all shareholders?

Investors can feel secure in owning shares in a company when insiders also own shares, and their interests are closely aligned. So it's good to see Afia insiders have significant capital invested in the stock. We note that their impressive stake in the company is worth R$450 million. This equates to 28% of the company, meaning insiders are powerful and aligned with other shareholders. That's a very optimistic view for investors.

Should you add Afya to your watchlist?

For growth stock investors, Afia's earnings growth is a beacon. This EPS growth is something the company can be proud of, so it's no surprise that insiders own a significant amount of shares. Rapid growth and confident insiders should be enough to warrant further investigation, making it seem like a good stock to follow. Of course, just because Afya is growing doesn't mean it's undervalued. If you're wondering about valuation, check out this gauge of its price-to-earnings ratio compared to its industry.

There's always a chance that buying stocks will work out. is not Expanding profits and please do not Have insiders buy stock. However, when considering these important metrics, we recommend checking out companies such as: do It has those characteristics. Access a customized list of companies that have demonstrated growth with recent insider purchases.

Please note that the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.