-

Revenue: It was reported at $354.2 million, up 2.5% year-over-year, and slightly below estimates of $354.75 million.

-

Net loss: The net loss was $500,000, significantly lower than the estimated net income of $14.75 million.

-

Earnings per share (EPS): Diluted EPS was reported at $0.00, below expected EPS of $0.09.

-

Existing store sales: It increased by 0.3%, with a notable increase of 2.3% in the United States, but a decrease of 2.6% in Canada.

-

Store development: We acquired a thrift store chain with seven stores in Georgia, and plan to add a total of 29 new stores in 2024.

-

Adjusted EBITDA: Sales increased 2.1% to $60.3 million, but margin decreased 10 basis points to 17.0%.

-

Loyalty program growth: Total active members enrolled in loyalty programs in the U.S. and Canada increased 12.2% to 5.5 million.

Savers Value Village, Inc. (NYSE:SVV) released its 8-K filing on May 9, 2024, detailing its financial results for the first quarter ended March 30, 2024. The company is a major commercial thrift store operator in the United States. and Canada reported increased sales and strategic expansion from acquisitions.

Company Profile

Savers Value Village Inc operates a network of thrift stores in the United States and Canada and partners with nonprofit organizations to collect and sell used items. This model not only supports philanthropy but also promotes environmental sustainability through reuse.

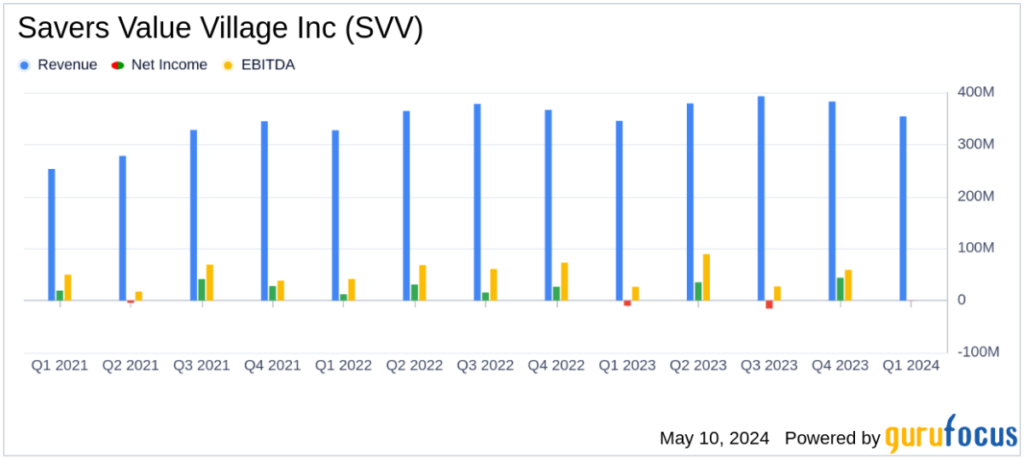

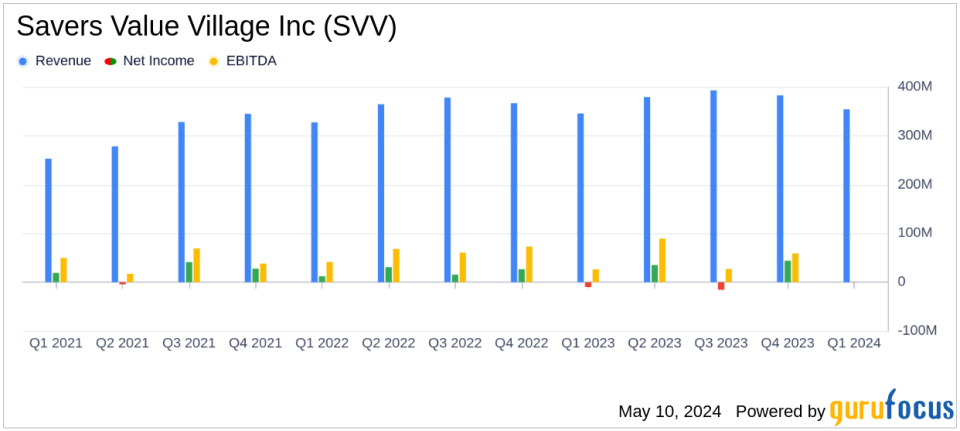

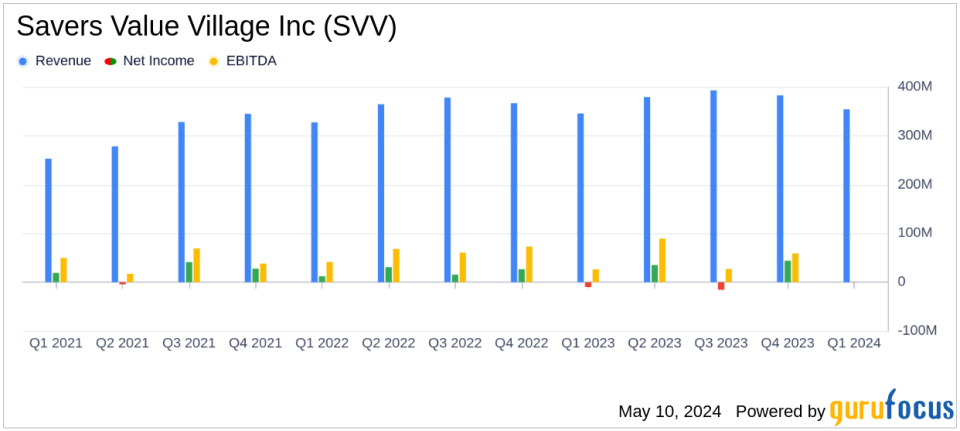

financial highlights

SVV reported first-quarter 2024 net sales of $354.2 million, up 2.5% year-over-year, but slightly below analyst expectations of $354.75 million. The company achieved modest same-store sales growth of 0.3%, with a notable 2.3% increase in the US offset by a 2.6% decline in Canada. Despite the increase in sales, SVV posted a net loss of $0.5 million, or $0.00 per diluted share. This was an improvement from his $10.195 million net loss in the year-ago period.

Adjusted net income increased significantly by 32.3% to $13.9 million, and adjusted EBITDA increased by 2.1% to $60.3 million. However, adjusted EBITDA margin decreased by 10 basis points to 17.0%. The company increased its store count by 2.8% to 326 stores in the third quarter due to organic growth and strategic acquisitions.

strategic development

Underscoring its strategic efforts, SVV has acquired 2 Peaches Group, LLC, a thrift store chain with seven stores in Atlanta, Georgia. This acquisition marks SVV's entry into the Southeastern U.S. market, a market previously untapped by the company. This acquisition is in line with SVV's strategy to expand its geographic footprint and exploit new market opportunities.

In addition to the acquisition, SVV announced the appointment of Michael Maher as its new Chief Financial Officer, replacing Jay Stasz. Mr. Maher's extensive experience in retail sector finance is expected to strengthen SVV's financial strategy and operations.

Outlook for 2024

SVV now expects net sales to be in the range of $1.57 billion to $1.59 billion and targets net income in the range of $85 million to $92 million, which has been revised upward from previous expectations. Masu. The company also expects to open a total of 29 new stores, including the seven he acquired through Peaches 2. This expansion reflects confidence in SVV's business model and growth trajectory despite Canada's challenging macroeconomic environment.

Financial situation and issues

On the balance sheet, cash and cash equivalents decreased from $179,955,000 to $102,183,000 primarily due to increased capital expenditures and debt service activity. The company's long-term debt was $735,863,000, down slightly from the previous quarter. These numbers support the company's continued efforts to manage debt levels while investing in growth opportunities.

Macroeconomic pressures in Canada are particularly impacting and creating challenges for low-income customer groups. However, SVV's strategic adjustments to processing levels and expansion into more robust markets, such as the Southeastern United States, are part of a broader strategy to mitigate these risks.

conclusion

Savers Value Village Inc's first quarter of fiscal 2024 reflects a company navigating economic uncertainty with strategic clarity. By expanding into new markets and focusing on financial health, SVV aims for sustainable growth. Investors and stakeholders will be watching closely to see how these strategies play out in the coming quarters.

For more information, please see the full 8-K earnings release from Savers Value Village Inc. here.

This article first appeared on GuruFocus.