Geneva, May 9, 2024 – Trafigura Securitization Finance Plc (“TSF”), the receivables securitization vehicle of Trafigura Group Pte Ltd (“Trafigura”), has decided to price a new series of 144A/RegS asset-backed securities (“TSF 2024-1”). Succeeded. Securities (“ABS”) Market.

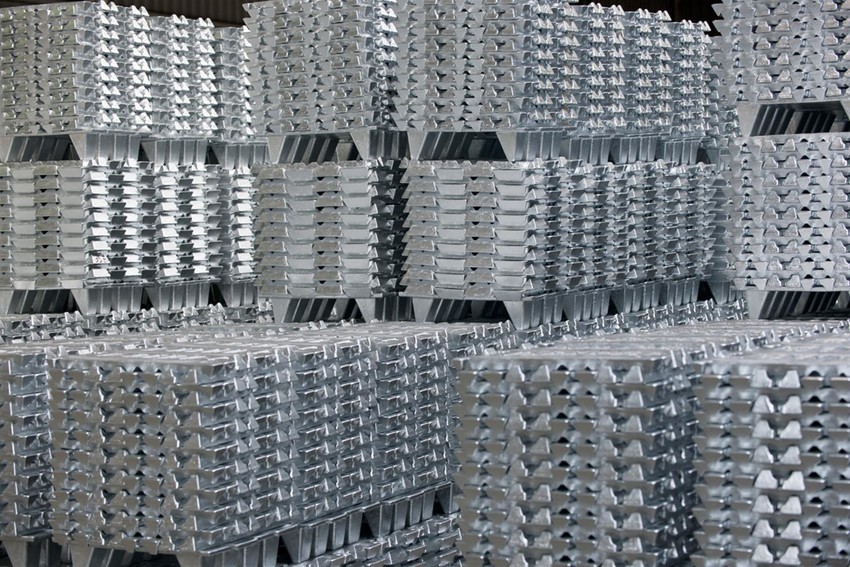

This is Trafigura's seventh public ABS transaction since the program's inception in November 2004. Since then, TSF has become the world's largest publicly rated AAA/Aaa receivables securitization program. This provides investors with rare access to a mixed portfolio of short-term credit exposures to oil majors, non-ferrous metals and mineral buyers, and highly rated banks through our payments business.

USD 500 million of public debt (3 year term) including USD 125 million of SOFR +140bps floating rate class A1 bonds (AAA/Aaa) and USD 340 million of fixed rate class A2 bonds (AAA/Aaa) issued to investors. +140bps on the US Treasury I Curve and +275bps on the USD 35M Fixed Rate Class B Bond (BBB/Baa2) US Treasury I Curve.

The transaction was well received with a total of 18 investors participating in the fixed rate tranche and floating rate tranche. The deal was announced on May 3rd and pricing was completed on May 8th.

Laurent Christophe, Group Finance Director at Trafigura, said:For the seventh time since our first public market offering in 2007, we have successfully opened the ABS market from our flagship TSF program. The ABS market provides access to a rich pool of liquidity. Today's successful pricing demonstrates not only the attractiveness of trade receivables as an underlying asset class, but also the quality of its structure. We are pleased to see so much interest in this new series.

“This year marks our 20th anniversary.th Anniversary of the program's founding. TSF's long lifespan and consistent AAA/Aaa ratings over the past 20 years have established TSF as the gold standard for accounts receivable securitization. We are focused on the ABS market, which provides access to deep liquidity pools and a sophisticated investor base. TSF will continue to publish new series regularly, so” concluded Laurent Christophe.

Lloyds, Mizuho, SMBC and Société Générale (structuring) acted as joint lead managers, with Natixis and MUFG joining as joint bookrunners on the transaction.

Bloomberg Ticker: TRFIG 2024-1

end

For more information, please contact us below.

Trafigura Press Office: +41 (0) 22 592 4528 or media@trafigura.com

About Trafigura

Trafigura is a leading employee-owned merchandise group founded 30 years ago. As a global supply hub, Trafigura connects critical resources to power and builds the world. We deploy the infrastructure, market expertise, and global logistics network to move oil and petroleum products, metals and minerals, gas and power from where it's produced to where it's needed, making supply chains more efficient, Form strong relationships that make it safe and sustainable. We invest in renewable energy projects and technologies that accelerate the transition to a low-carbon economy, including through H2Energy Europe and our joint venture Nala Renewables.

The Trafigura Group also includes industrial assets and operating businesses such as the multimetal manufacturing company Nyrstar, the fuel storage and distribution company Puma Energy, and the joint venture Impala Terminals. The group has more than 12,000 employees and operates in 156 countries.

Access: www.trafigura.com