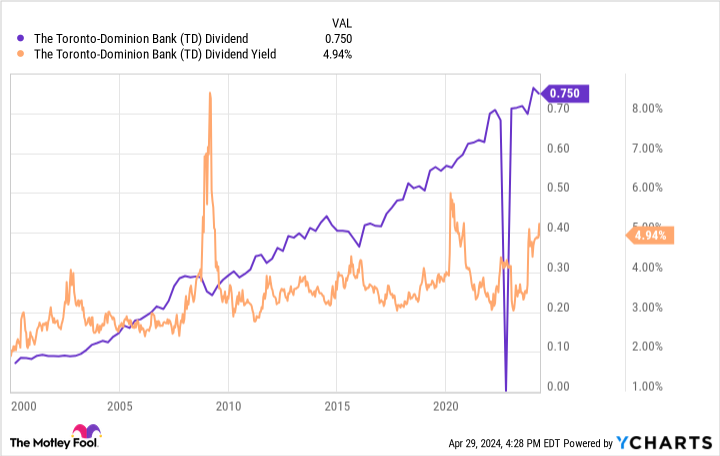

toronto dominion bank (New York Stock Exchange: TD), commonly known as TD Bank, has long been a great dividend stock. For more than 20 years, the stock has been paying out cash to shareholders every quarter. Additionally, the dividend yield has typically hovered between 3% and 4%, but recently that yield has increased to nearly 5%.

If you want to outperform the S&P 500 by investing in reliable dividend stocks, look no further than TD Bank. Here are three compelling reasons to buy stocks today.

1. TD Bank is a dividend superstar

When it comes to dividend stocks, it's important to not only pay attention to the size of the dividend, but also its consistency. Sure, TD Bank stock currently offers a 5% dividend yield, but can you trust that? The answer is a resounding yes.

For more than 20 years, TD Bank has consistently increased its dividend with few hiccups along the way. For example, the quarterly dividend rate in 2000 was approximately $0.08 per share. The quarterly dividend rate for 2010 rose to $0.30 per share. The current stock price is $0.75 per share.

Even during difficult times, TD Bank's dividend has proven to be surprisingly stable. Dividends were slightly reduced during the 2008 financial collapse. But within two years, the dividend rate was exactly where it left off. Meanwhile, the bank's dividends continued to rise during the 2020 flash crash, and just recently hit a new all-time high.

Few stocks can match TD Bank's history of increasing dividends.

2. Dividends allowed the stock price to outperform the S&P 500

Dividends can make a big difference to a stock's long-term performance. Since 2000, TD Bank stock has increased approximately 340%. For comparison, the S&P 500's total return was approximately 450%. However, when you factor in TD Bank's dividends, the equation changes dramatically, and since 2000, TD Bank stock has delivered his 940% total return. That's nearly twice the return of the S&P 500.

Bank stocks are generally known for their high dividend yields, but their dividends are often at risk due to recessions and financial deterioration. TD Bank's conservative capital approach, combined with Canada's integrated banking market, stable economy, and strong financial regulations, results in consistent outperformance that outperforms the S&P 500 over the long term, with dividends driving that performance. It plays a superior role.

^SPXTR data by YCharts

3. Now seems like a great time to invest in TD Bank stock.

Just because TD Bank has outperformed the S&P 500 over the long term doesn't mean it's outperforming the market every year. For example, over the past 12 months, TD Bank's stock price has increased. lost Its value is +2% compared to the S&P 500's performance of +24%. Meanwhile, the increase in dividend rates has pushed TD Bank's dividend yield to the highest level in years, currently at approximately 5%.

The last time TD Bank's dividend yield reached this high, the stock turned out to be a screaming buy. For example, if he had bought the stock in 2008, he would have more than tripled his original investment. Meanwhile, the stock more than doubled after its dividend yield exceeded 5% in 2020.

Indeed, bank stocks are known to be sensitive to economic conditions. TD Bank is no exception. Profits fell sharply last year as the company struggled to adapt to rising interest rates, hampering loan growth and compressing deposit returns. Costs in certain segments also increased significantly due to acquisition-related costs and higher compensation levels. Separately, the company said this week it plans to set aside $450 million for an ongoing anti-money laundering investigation. There may still be additional penalties that are not covered by this original provision, which would be a further blow to banks struggling to regain previous profitability levels.

There's no question that TD Bank currently faces multiple headwinds. This is why stocks trade at historic discounts. However, over the long term, TD Bank has proven to be very well managed. If you can be patient, hope that management will fix the problem. A 5% dividend yield pays for waiting while securing a discounted valuation for what was once the market's best-performing bank stock.

Should I invest $1,000 in Toronto-Dominion Bank right now?

Before buying Toronto-Dominion Bank stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Toronto-Dominion Bank wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $544,015!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 30, 2024

Ryan Vanzo has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Beat the S&P 500 with this cash-guzzling dividend stock originally published by The Motley Fool