The May 14 budget changes will reduce the student loans of more than 3 million people and eliminate more than $3 billion in debt.

Effective June 1 of last year, the government will limit the application rate of the HELP index to the lower of the Consumer Price Index (CPI) or the Wage Price Index (WPI). Currently, indexing is based on CPI.

The new indexing arrangements will apply retrospectively to all HELP, VET student loans, Australian Apprenticeship Support and other student support loan accounts that were in operation on 1 June last year.

The government's recent university agreement report pointed out the need for reform of the student debt system, and recommended a review of the indexation of inflation, although it did not go so far as to make it retroactive.

“Australians should not be deterred from pursuing higher education by increased student loan burdens,” the report said.

australian government

Those in debt have been hit hard by high inflation, with the CPI sliding rate rising to 7.1% last year.The indexation rate in 2023 based on the wage price index should be 3.2%

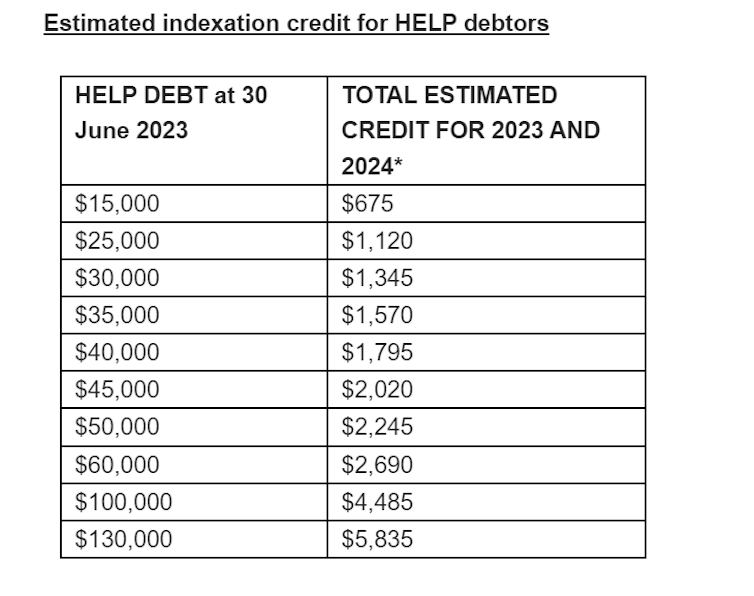

People with an average HELP loan of $26,5000 will see about $1,200 written off from their HELP loan balance this year.

Approximately 525,302 Australians have debts of between $20,000 and $30,000.

This change will require legislation.

Education Minister Jason Clare said: 'The University Agreement recommends that HELP loans be indexed to the lower of the CPI and WPI.

“We're doing this and we're going further. We're going to extend this reform back to last year. This will wipe out what happened last year and make sure it never happens again.”

Minister for Skills and Training Brendan O'Connor said: 'This will reduce the cost of living for more apprentices, trainees and students and continue our work to reduce and remove financial barriers to education and training. ” he said.

“By backdating this reform to last year, we are ensuring that apprentices, trainees and students who were affected by last year’s price index rise receive this important cost of living relief.”