-

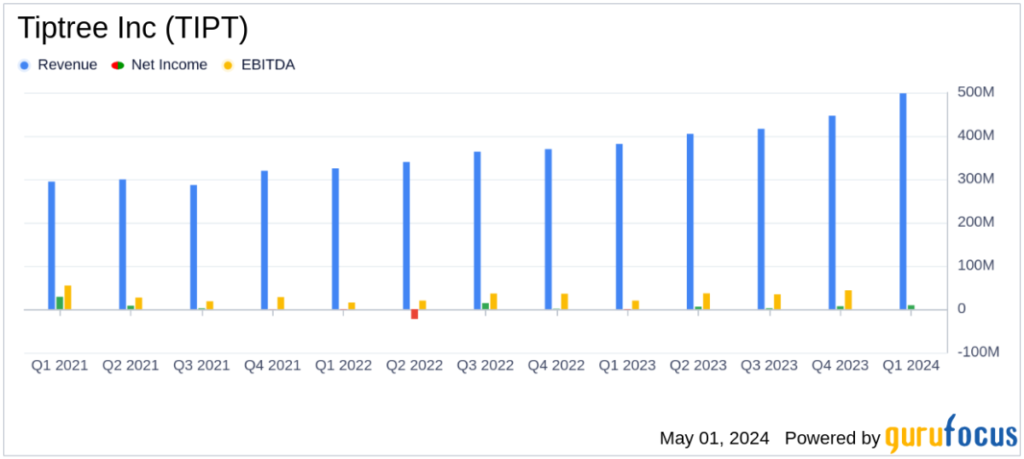

Total income: Q1 2024 was $498.2 million, an increase of 30.6% from $381.6 million in Q1 2023.

-

Net income: The company went from a net loss of $1.06 million in the first quarter of 2023 to a profit of $9.05 million in the first quarter of 2024.

-

Diluted earnings per share: The loss improved from a loss of $0.03 per share in Q1 2023 to $0.22 in Q1 2024.

-

Adjusted net income: It jumped 63.5% from $12.56 million in Q1 2023 to $20.53 million in Q1 2024.

-

Average return on equity: It increased from -1.1% in Q1 2023 to 8.6% in Q1 2024.

-

Adjusted average return on equity: It increased from 12.6% in Q1 2023 to 19.5% in Q1 2024.

-

Cash dividend: Increased from $0.05 per common share in the first quarter of 2023 to $0.06 per common share in the first quarter of 2024.

Tiptree, Inc. (NASDAQ:TIPT), a prominent specialty insurance and mortgage company, announced significant improvement in its financial results for the first quarter of 2024. The company announced the earnings details in his May 1 8-K filing. , 2024 revealed solid growth in both revenue and net profit, driven by strategic growth in the insurance business and effective capital management.

Financial performance summary

Tiptree's total revenue for the quarter ended March 31, 2024 was $498.2 million, a significant increase of 30.6% from $381.6 million in the first quarter of 2023. This growth was primarily driven by investments and the expansion of Fortegras' specialty insurance products. Growth and growth in mortgage income. The company's net income also showed a surprising improvement, posting a net loss of $9.1 million compared to a net loss of $1.1 million in the same period last year.

Segment highlights and business successes

The Insurance division, which operates under the Fortegra Group umbrella, delivered impressive results with gross written premiums and premium equivalents increasing by 6.8% to $663.4 million. The segment's revenue increased 29.9% to $478.8 million, reflecting strong premium growth and higher investment income. Notably, the insurance division's pre-tax profit increased significantly from $19.4 million in the first quarter of 2023 to $36.8 million.

Tiptree Capital also showed positive activity, with total revenue reaching $19.5 million, a notable increase from $13.2 million a year ago. This improvement was primarily due to increases in mortgage income and investment returns.

Strategic development and future outlook

During the quarter, Tiptree continued to strengthen its financial position and strengthen its ownership through strategic initiatives, including a significant capital contribution to Fortegra. The company also announced a dividend of $0.06 per share, highlighting its commitment to providing shareholder value.

Tiptree's management team remains focused on leveraging its robust platform to drive sustainable growth and increase profitability. Strategic investments in core business areas are expected to continue to deliver positive results, supported by a favorable economic environment and solid industry fundamentals.

Investor and Analyst Perspective

Analysts may view Tiptrees' first-quarter results as a strong indicator of the company's operational efficiency and strategic direction. The significant improvement in net profit and sustained revenue growth are a good reflection of the company's management and business model, and are likely to be seen as positive developments.

conclusion

Tiptree Inc.'s first quarter 2024 results highlight a period of significant financial and operational success. With a focus on strategic expansion and capital management in the insurance and mortgage sectors, Tiptree is well-positioned to maintain its growth trajectory and continue to deliver value to its shareholders.

For more insight and additional information, please visit Tiptree Inc.'s Investor Relations website or access the complete earnings report from the 8-K filing provided.

For more information, see Tiptree Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.