Exchange-traded funds (ETFs) are a great way to achieve superior long-term performance for your portfolio without ongoing effort. Whether you invest in individual stocks or not, a high-quality index fund forms a solid backbone for your nest egg and can help provide peace of mind during market turbulence.

Two great low-cost index fund ETFs are: Vanguard S&P 500 ETF (NYSEMKT: VOO) And that Vanguard High Dividend Yield ETF (NYSEMKT:VYM). While it's hard to properly argue that either ETF is a bad choice, there are some key differences between ETFs.

Two low-cost ETFs with great portfolios

The Vanguard S&P 500 ETF bets on America's largest companies. As the name suggests, this fund invests in his 500 companies that make up his S&P 500 benchmark index and aims to match the performance of the index over the long term. And with a minimum annual expenditure of 0.03% of fund assets, long-term performance should be very close to actual index performance.

Since 1965, the S&P 500's annual total return has been 10.2%. While there is no guarantee that the S&P 500 Index will match this rate of return in the future, the important point is that investing in the S&P 500 Index is a winning strategy over the long term and is likely to remain so for the foreseeable future. is.

The Vanguard High Dividend Yield ETF, on the other hand, tracks an index of companies that pay an above-average dividend yield. As of last update, the ETF contains 557 stocks and is a weighted index similar to the S&P 500, meaning large companies account for a larger portion of the fund's assets.

To get an idea of what the fund invests in, its top holdings include: JP Morgan Chase, broadcom, exxon mobiland home depotto name a few examples.

Important differences to know

Of course, the obvious difference between these two ETFs is that one focuses on income while the other does not. Although both pay dividends, the S&P 500 ETF and High Dividend Yield ETF yield around 1.4% and 3%, respectively, making the latter perhaps a natural fit for investors who rely on their portfolios for recurring income.

There are some other important differences to keep in mind. First, the Vanguard S&P 500 ETF is heavily weighted towards very large tech companies, meaning that its performance will depend on just a few large companies (in some cases). Nvidia and tesla –quite volatile) stock.

In general, the stocks held by the Vanguard High Dividend Yield ETF tend to be more mature companies, so the ETF may become less volatile over time. Granted, you can still experience fairly large price swings in the short term, but overall we think this is the less volatile of the two.

Another important factor to point out, especially in the current climate, is that dividend stocks tend to be more sensitive to changes in interest rates than non-dividend-paying stocks. The simple explanation is that when yields on risk-free instruments (such as U.S. Treasuries) rise, the yields on “riskier” income investments, such as dividend stocks, tend to rise as well. Since price and yield are inversely related, rising interest rates put pressure on the price of dividend stocks.

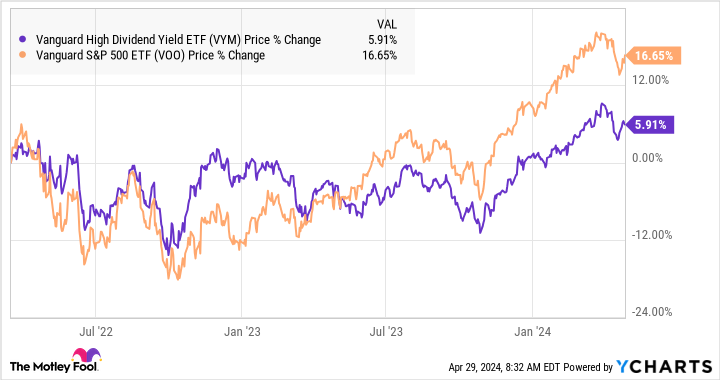

To illustrate this, consider that the Vanguard S&P 500 ETF has outperformed high-yield ETFs by nearly 11 percentage points since the Federal Reserve began its current rate hike cycle in March 2022 .

VYM data by YCharts

Which one is best for you?

There is no clear winner between the two. Both are great ETFs with low fees and a high potential for high returns over the long term.best fit for you depends on your personal investment goals and risk tolerance, so be sure to keep the key differences in mind when deciding which is best for your portfolio.

Should I invest $1,000 in the Vanguard S&P 500 ETF right now?

Before purchasing Vanguard S&P 500 ETF shares, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and the Vanguard S&P 500 ETF wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $537,557!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 22, 2024

JPMorgan Chase is an advertising partner of The Motley Fool's Ascent. Matt Frankel has a position in the Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Home Depot, JPMorgan Chase, Nvidia, Tesla, Vanguard S&P 500 ETF, and Vanguard Whitehall Fund (Vanguard High Dividend Yield ETF). The Motley Fool recommends his Broadcom. The Motley Fool has a disclosure policy.

Vanguard S&P 500 ETF vs. Vanguard High Dividend Yield ETF: Which is Best for You? Originally published by The Motley Fool