(Bloomberg) — A series of exchange-traded funds that invest directly in cryptocurrencies debuted in Hong Kong on Tuesday, ushering in potential competition for U.S. bitcoin products whose popularity has sparked a record rally for the digital asset. became.

Most Read Articles on Bloomberg

A partnership between Harvest Global Investments, the local arm of China Asset Management, Hashkey Capital and Vocera Asset Management (International), has listed Bitcoin and Ether ETFs respectively in the city. .

The level of capital demand will provide a clue as to whether Hong Kong's push for a highly regulated digital asset hub is gaining momentum. Officials hope the cryptocurrency pivot will help restore the city's reputation as a modern financial center, which has been tarnished by a crackdown on dissent.

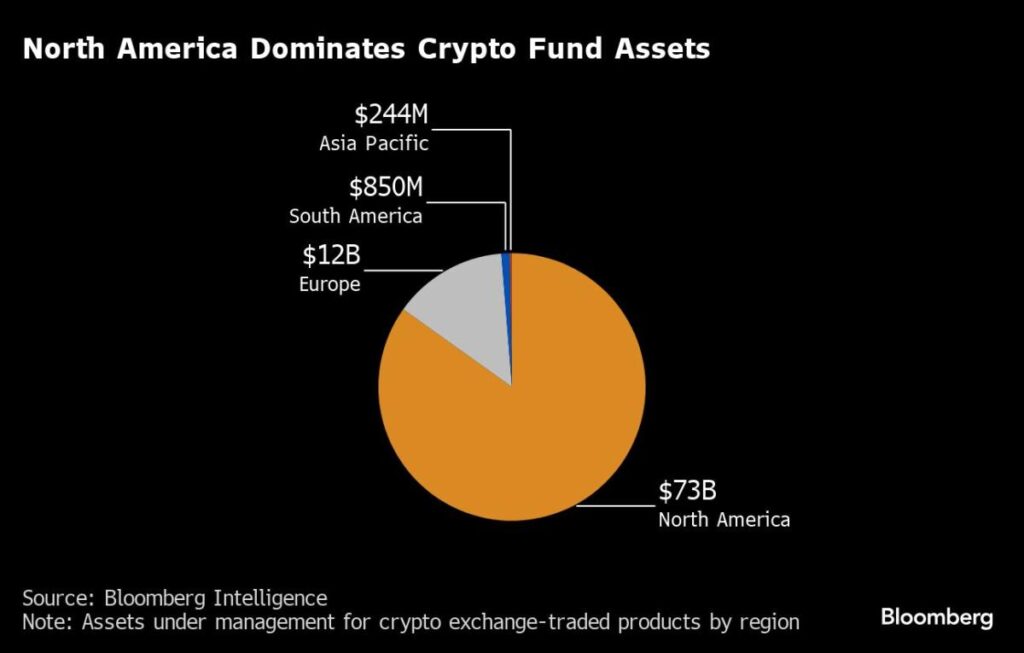

The U.S. Spot Bitcoin ETF, from issuers including BlackRock Inc. and Fidelity Investments, began operations in January and has held $53 billion in assets to date in a historic development. Regarding Hong Kong, Rebecca Shin of Bloomberg Intelligence estimates that Hong Kong's Bitcoin and Ether funds could reach $1 billion in two years.

west and east

Harvest Global CEO Han Tongli said in an interview that such prospects are “too small.” Part of the reason, he said, is that Hong Kong's financial products and services are “accepted by both Western and Eastern investors,” while the U.S. primarily caters to the former. .

Possible sources of inflows into Hong Kong products include Chinese wealth based in Hong Kong, as well as crypto exchanges and market makers operating in the Asia-Pacific region. Cryptocurrency trading is banned in mainland China, activity is underground, and future fund launches remain beyond the scope of a program that gives Chinese investors access to some Hong Kong ETFs. There is a high possibility that it will become.

Hong Kong has adopted a physical ETF subscription and redemption mechanism, allowing the exchange of underlying assets into fund units and vice versa, whereas US Bitcoin funds have adopted a cash redemption model. There is.

Harvest Global's Han said the spot-trading approach makes Hong Kong products even more attractive, and is one reason why Hong Kong ETFs could end up with up to three times as much ingestion as U.S. funds. He said that it is.

asia trade

Some warn that expected demand will need to be tailored to Hong Kong's small financial sector. The city has already authorized a crypto futures-based ETF, but its total assets of about $164 million are a fraction of the $2.3 billion of the ProShares Bitcoin Strategy ETF, a U.S. derivatives-based product. It's nothing more than that.

Hong Kong has lagged behind the US in launching spot crypto ETFs and may have a smaller market for passive funds, but the ease of access to local products remains attractive, especially during Asian trading hours. According to the head of Vocera Asset Management (International), Regarding the product, Ethan Lee said in an interview:

CEO Doris Lien said Vocera is looking to expand its team and digital asset product pipeline. “Hong Kong will occupy an important position in the global virtual asset space,” she added. “We're very confident about that.”

Digital assets recovered from the crash in 2022. Bitcoin has risen about 287% since the beginning of last year, hitting a record of $73,798 in March, while Ether is up 169%. The rally has stalled recently, with Bitcoin down about $10,000 from its highs.

The largest digital asset rose 1.7% to $64,000 as of 9:35 a.m. in Hong Kong as new ETF trading began. Ether, the second largest token, increased by about 1%.

Investors will likely scrutinize incoming data from issuers to understand the net inflows into Hong Kong cars. Comparable numbers for U.S. funds have sometimes caused fluctuations in cryptocurrency prices as demand rises and falls.

(Updated from the first paragraph to reflect the start of trading.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP