-

Net income: Q1 2024 was reported at $110.3 million, beating estimates of $86.18 million.

-

Earnings per share (EPS): The price was $2.25, higher than the expected $1.76.

-

Revenue: Total revenue reached $398.68 million, significantly exceeding estimates of $368.03 million.

-

Net operating income: The total amount was $120.7 million, reflecting solid performance.

-

Pretax operating profit (PTPP): Sales were $157.5 million, indicating strong earnings before taxes and provisions.

-

Loan and deposit growth: Average loan amount increased 9.8% to $23.4 billion. Deposits increased by $2 billion or he 6.2% over the previous year.

-

Dividends and share buybacks: The company announced a quarterly cash dividend of $0.39 per share and authorized the repurchase of up to 1 million shares.

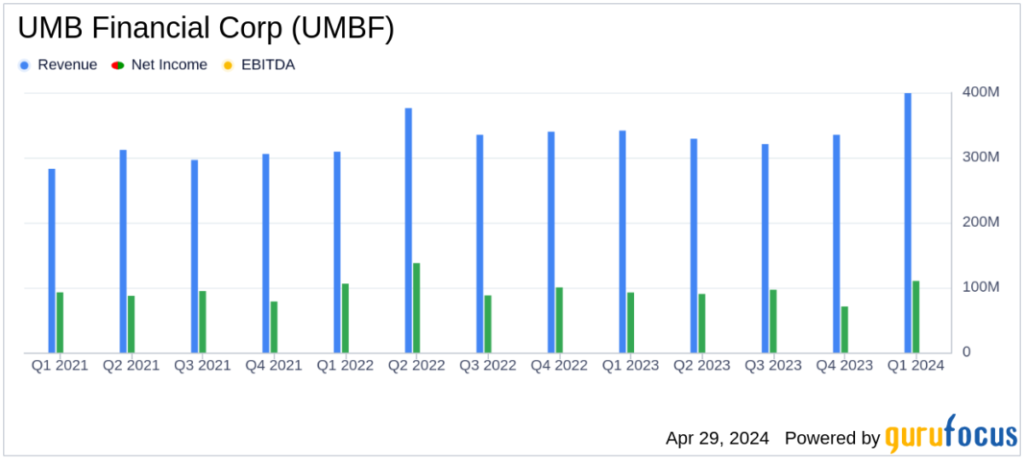

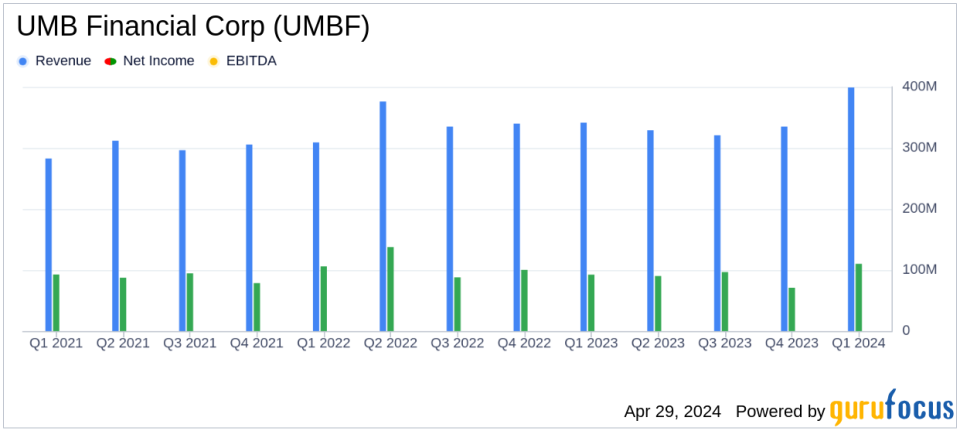

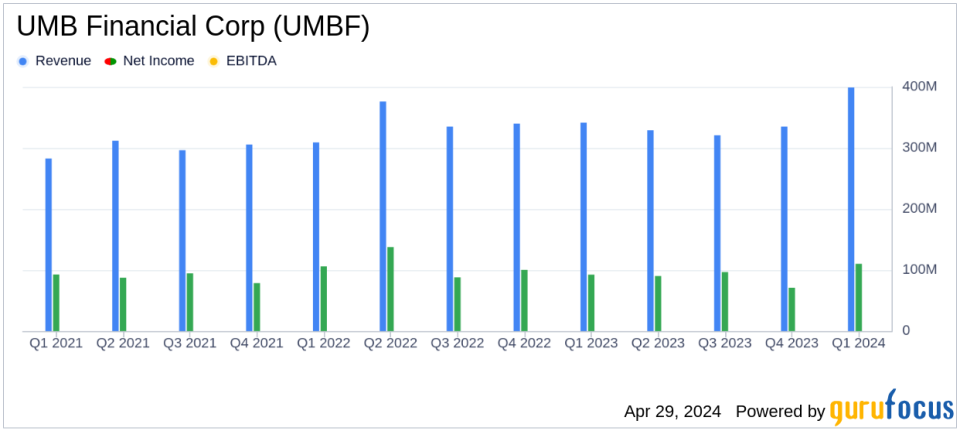

On April 29, 2024, UMB Financial Corp (NASDAQ:UMBF) announced its first quarter 2024 financial results, with net income of $110.3 million ($2.25 per diluted share), above analyst estimates. EPS of $1.76 and net income of $86.18 million. income. Detailed financial results are available in UMBF's recent 8-K filing. This performance represents solid growth compared to $70.9 million in the previous quarter and $92.4 million in Q1 2023.

UMB Financial Corp is a prominent financial services holding company offering comprehensive banking, wealth management and healthcare spending solutions. UMB's subsidiaries operate primarily in the Midwest and Southwest United States and provide essential financial services such as mutual funds and alternative investment services, brokerage services, insurance, and registered investment advisors.

Financial highlights and strategic results

The company reported net operating income of $120.7 million ($2.47 per diluted share) and pre-tax and pre-provision operating profit (PTPP) of $157.5 million ($3.22 per diluted share). . These numbers represent significant improvement both quarter-over-quarter and year-over-year, highlighting UMB's effective management and solid operational strategy.

Commenting on the results, UMB Chairman and CEO Marriner Kemper said, “Our company is off to a great start in 2024, with balance sheet and net interest income growth, net interest margin expansion, and We achieved strong first quarter results due to growth of orders of magnitude.” in our fee income and stable credit metrics. ” This statement underscores our resilience and strategic focus amid changing economic conditions.

Comprehensive financial review

Average loans increased 9.8% to $23.4 billion in the first quarter, and average deposits increased 6.2%, demonstrating strong business activity and customer confidence. UMB's loan portfolio remains healthy, with net charge-offs averaging less than 10 basis points over the past seven quarters and non-performing loans accounting for at least 8 basis points of total loans.

Revenue for the quarter was $398.68 million, with net interest income of $239.43 million and non-interest income of $159.24 million. These numbers represent increases from both the prior quarter and year-over-year period and reflect strong underlying performance. The efficiency ratio improved to 63.44% from 77.65% in the previous quarter, indicating improved operational efficiency.

Challenges and economic outlook

Despite its strong performance, UMB recognizes the challenges posed by continued high inflation and the potential economic impact of the Federal Reserve's monetary policy. The upcoming presidential election cycle also increases economic uncertainty. However, UMB's management remains confident in its strategic position and the stability of the regional banking sector as a whole.

Strategic moves and future prospects

During the quarter, UMB completed the acquisition of a co-branded credit card portfolio partnership with Rural King, strengthening its product offering and market reach. Additionally, the Board of Directors announced a quarterly cash dividend of $0.39 per share and authorized a share repurchase of up to 1 million shares, affirming the company's commitment to delivering shareholder value.

As UMB Financial Corp continues to navigate complex economic conditions, our strong first quarter performance and strategic initiatives position us to ensure continued growth and stability. Investors and stakeholders may expect continued prudent management and strategic growth initiatives consistent with UMB's long-term financial objectives.

For more information, see UMB Financial Corp's full 8-K earnings release here.

This article first appeared on GuruFocus.