investors in Sage Therapeutics Co., Ltd. (NASDAQ:SAGE) had a good week after the company released its quarterly results, with its stock up 2.7% to close at $13.69. Revenues were US$7.9 million, 52% above analyst model forecasts. Perhaps unsurprisingly, the statutory loss was also slightly higher than expected, at US$1.80 per share. This reflects the likely increase in costs incurred to generate revenue. Earnings earnings are an important time for investors as they can track a company's performance, see what analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We've collected the latest statutory forecasts to see if the analysts have changed their earnings model following these results.

Check out our latest analysis for Sage Therapeutics.

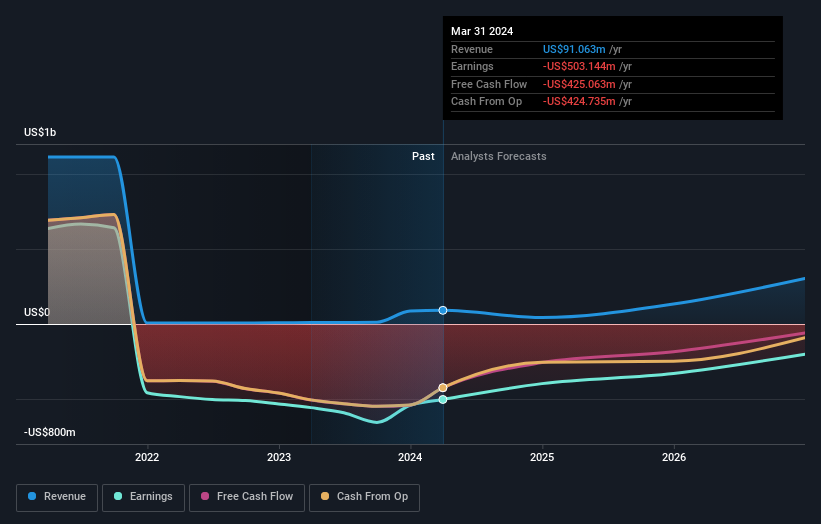

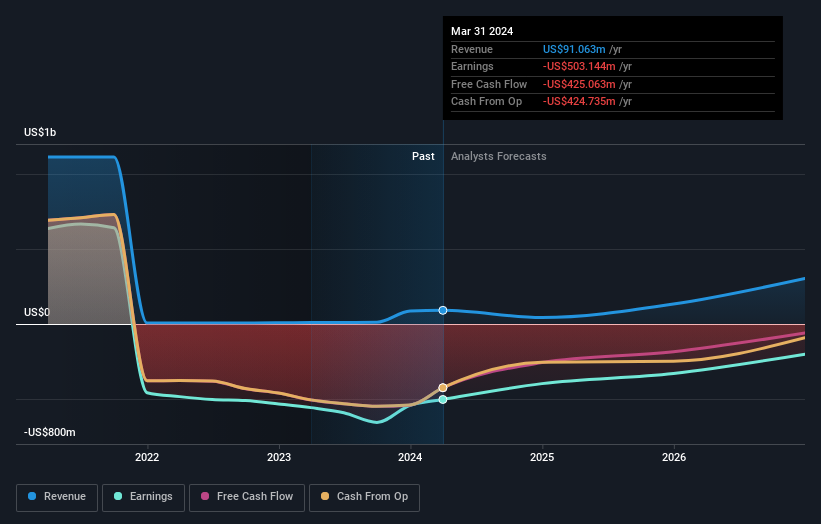

Following the latest results, the consensus among Sage Therapeutics' 21 analysts is for revenue of US$42.7m in 2024, reflecting a significant 53% revenue decline compared to last year's results. It will be what you do. Losses are expected to decline significantly, narrowing by 21% to $6.58. Before this latest report, consensus had been expecting revenue of $32.5 million and loss of $6.37 per share. So, the view has changed significantly after the recent consensus update, with the analysts now expecting losses per share to increase, while also significantly raising their revenue estimates. It appears that sales growth cannot be achieved without additional costs.

With the widening losses, it's no surprise that the consensus price target has fallen 8.9% to US$22.22. Analysts implicitly rank continued losses as a bigger concern than revenue growth. However, there is another way to think about price targets. The key is to pay attention to the range of price targets offered by analysts. This is because a wide range of estimates can suggest diverse views on possible outcomes for your business. Currently, the most bullish analyst values Sage Therapeutics at $70.00 per share, while the most bearish values it at $14.00. In such a situation, it would reduce the value of analyst forecasts. This is because too wide a range of expectations could mean it is difficult to accurately assess the future of this business. With this in mind, we don't rely too much on the consensus price target, as it's just an average and analysts clearly have vastly different views on the business.

One way to get more context about these forecasts is to compare them to their past performance and to the performance of other companies in the same industry. Another thing that was notable about these estimates is the idea that Sage Therapeutics' decline is expected to accelerate, with revenues expected to decline at an annualized rate of 64% through the end of 2024. This exceeds historic declines. Over the past five years, it has been 13% per year. Compare this to analyst forecasts for companies in the broader industry. This suggests that revenue (in total) is expected to grow by 18% per year. So while many companies are expected to grow, unfortunately, Sage Therapeutics is expected to see its earnings hit more than other companies in the industry.

conclusion

Most importantly, the analysts raised their loss per share estimates for next year. It also revised up its revenue forecast for next year, even though growth is expected to be slower than the industry as a whole. Analysts don't seem reassured by the latest results, with the consensus price target dropping significantly, leading to a reduction in Sage Therapeutics' future valuation.

With this in mind, we think the long-term trajectory of the business is far more important for investors to consider. We have his forecasts from multiple Sage Therapeutics analysts out to 2026, available for free on our platform here.

Remember, there may still be risks. For example, we identified 1 warning sign for Sage Therapeutics. What you need to know.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.