hapa bapa

Rubric (New York Stock Exchange:RBRK) was the first major software IPO of the year, and the listing was a huge success, with the stock up 15% at the close of trading. I break down the financial results and explain the confusing difference between revenue and ARR growth.company is not yet profitable, but expects solid returns in the long term. Post-IPO, the company should have plenty of net cash on its balance sheet, but we note that operating cash burn is already quite modest. It's unclear exactly how much sales growth will slow going forward, but the current valuation still looks like a buy. Start coverage with purchase rating.

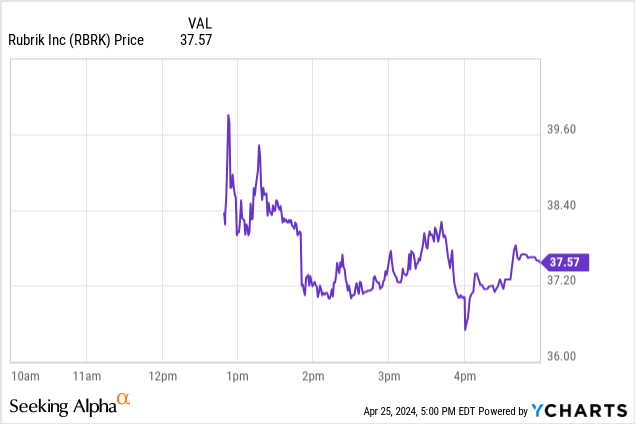

RBRK stock price

RBRK's IPO price was $32 per share, above its initial range of $28 to $31. The company sold 23.5 million shares, raising $752 million.The stock ended its first day of trading At $37.00 per share, the stock was up 15.6% on the first day.

Key indicators of RBRK stock

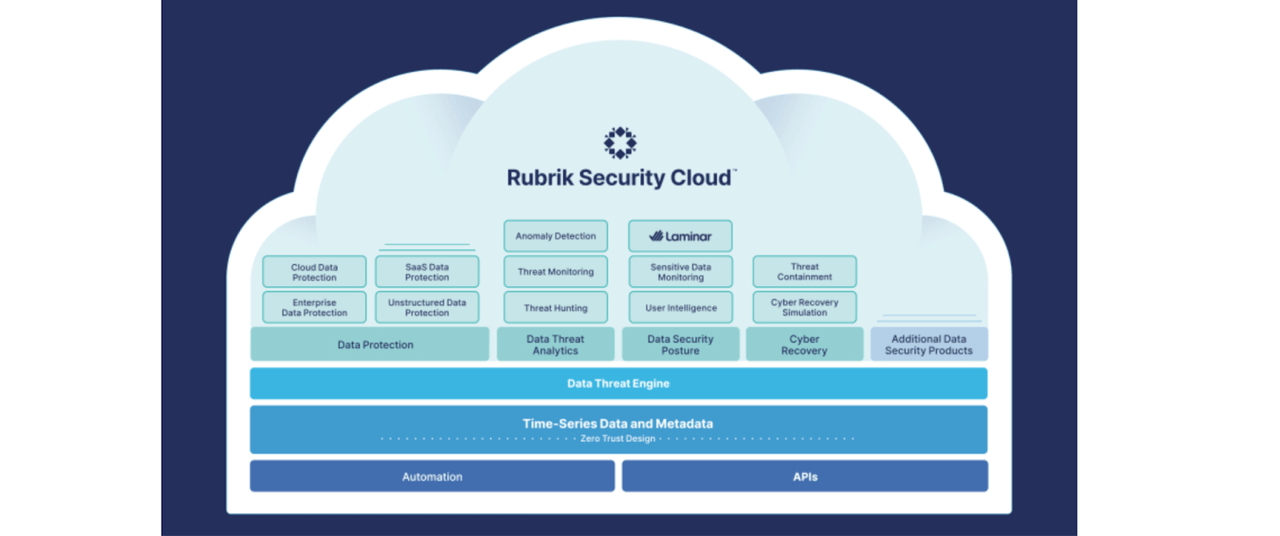

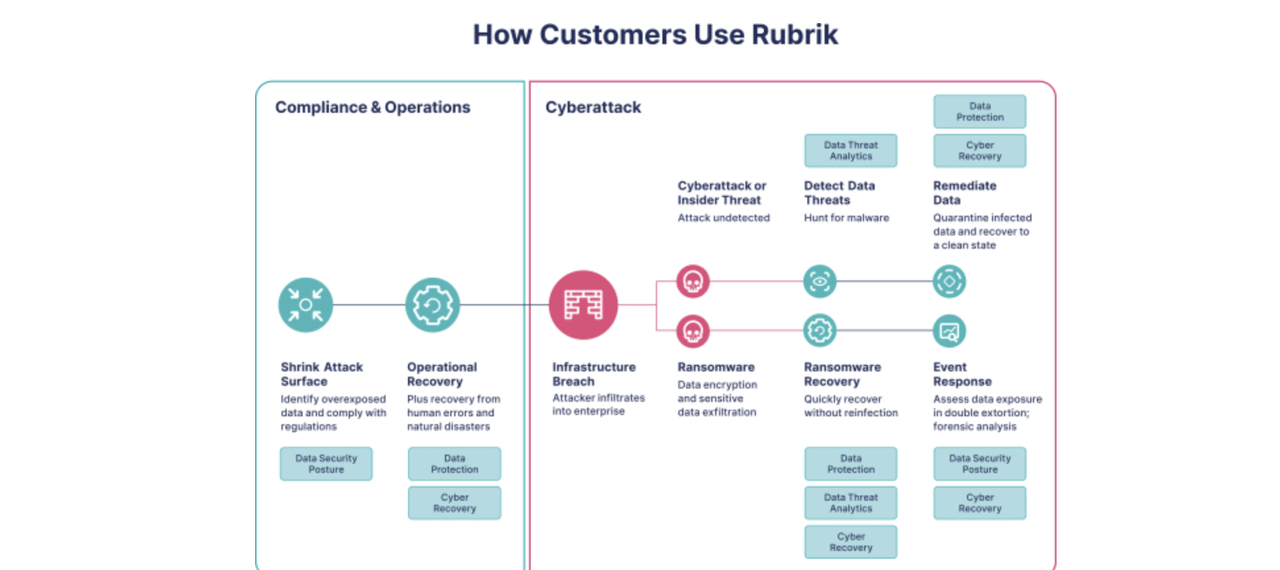

RBRK is a cloud data management and data security company. As stated in the S-1, “Organizations around the world rely on Rubrik to enable business resiliency in the face of cyber-attacks, malicious insiders, and business interruptions. Masu.”

Rubric S-1

A simple way to understand what RBRK does is to help customers back up their data. This is extremely valuable, especially in the case of a cyber attack, where customers end up relying on these backups to ensure uninterrupted business. We recommend watching Rubrik's video for a detailed explanation of their business.

Rubric S-1

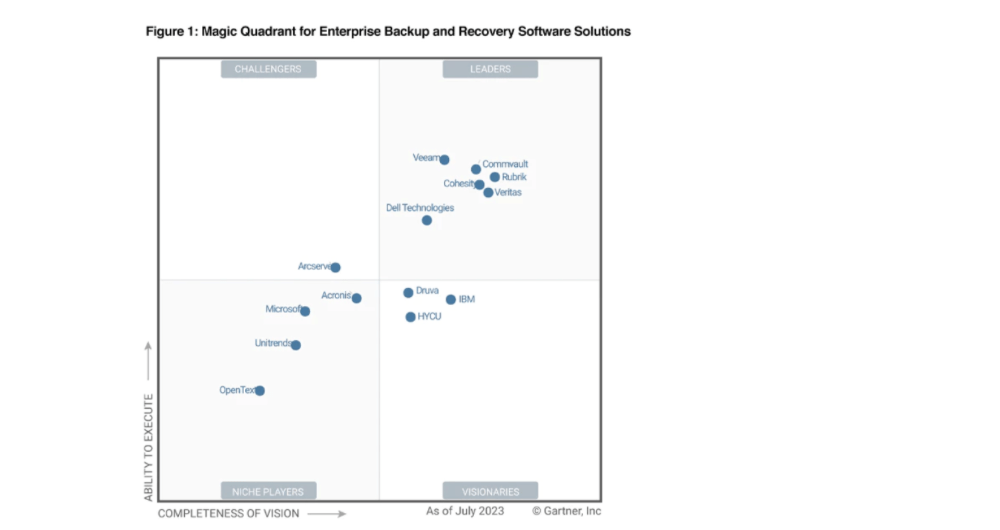

Although RBRK operates in a highly competitive field, it is recognized by Gartner as one of the market leaders. Note that Commvault (CVLT) is a notable competitor and is publicly traded.

rubric

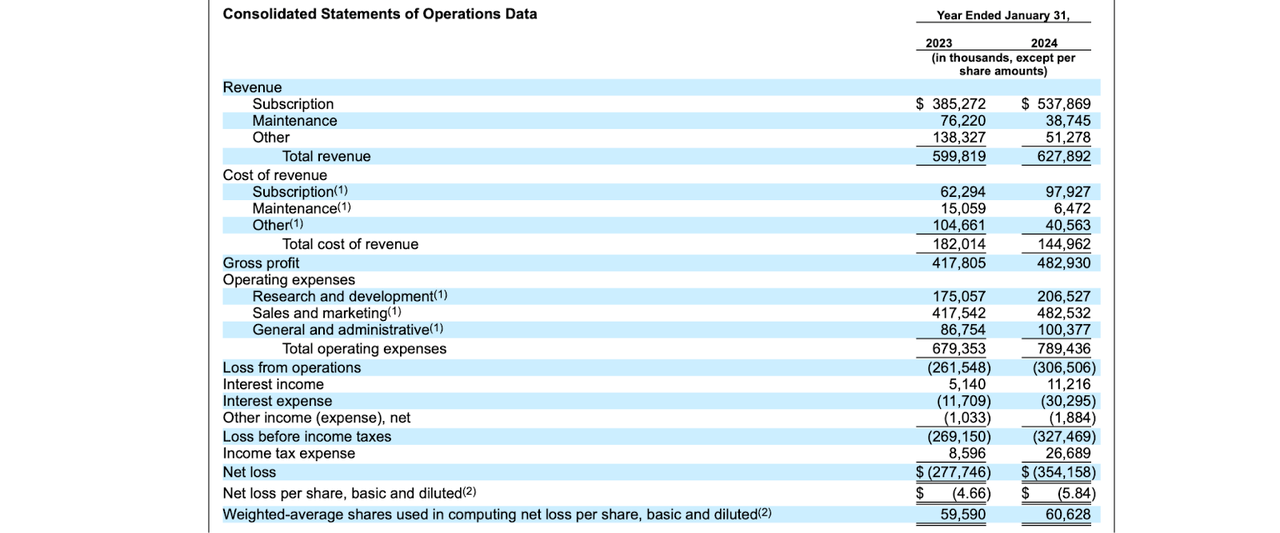

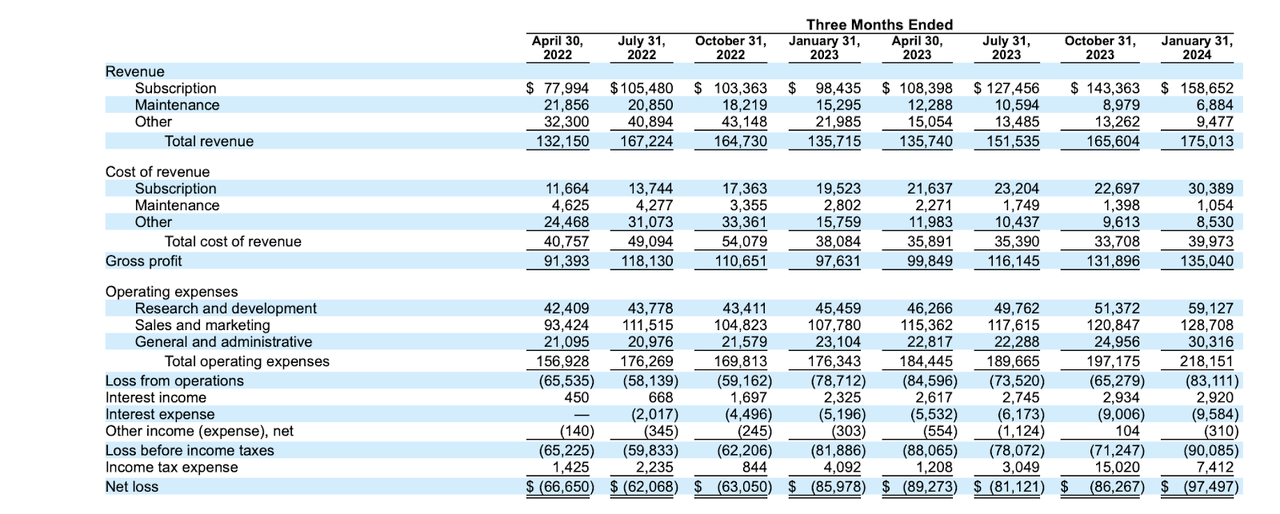

Over the past year, RBRK's revenue increased 4.7% year over year to $627.9 million. While the company's profitability is still far from GAAP, we note that free cash flow burn was just $24.5 million for the full year.

Rubric S-1

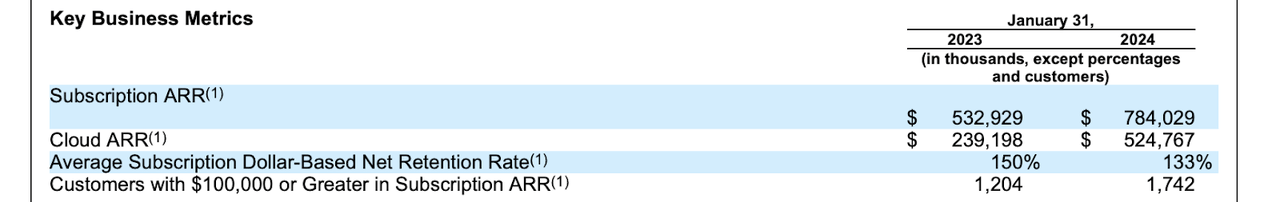

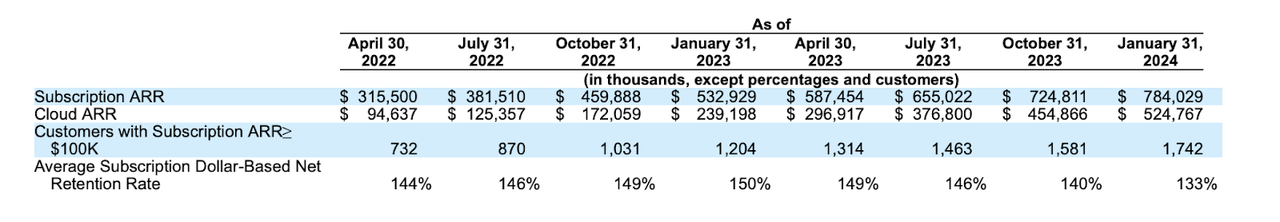

Over the past two years, the company has been transitioning customers from perpetual licenses to subscription-based products. The Company discloses that Subscription Annual Recurring Revenue (“ARR”) is the more important metric to track. At year-end, subscription ARR was $784 million, up 47% year-over-year. Management said that “approximately 4 percentage points were the result of migrating existing maintenance customers to subscription editions.” This is an important detail. Because if much of the growth in subscription ARR is due to conversions of existing customers (which is not the case here), growth in subscription ARR means little. The company posted an impressive 133% net retention rate on a subscription dollar basis. This makes it one of the most powerful, if not the most powerful in technology.

Rubric S-1

That said, I have noted that dollar-based net retention rates have decelerated rapidly in recent quarters, and I expect them to decelerate further going forward.

Rubric S-1

You can see quarterly snapshots of Financials below. As you can see, the company is not as aggressive about cost discipline as high-tech companies. I'm interested to see whether the management team will change their attitude now that the company has become a listed company.

Rubric S-1

With subscription gross margins hovering above 80%, operating leverage is key to sustainable profitability. RBRK ended the year with $279 million in cash and $293.6 million in debt, but the IPO raised an additional $752 million in cash, leaving it with just over $1 billion in cash and $8.8 billion in net cash. It became a billion dollars.

Buy, sell or hold RBRK stock?

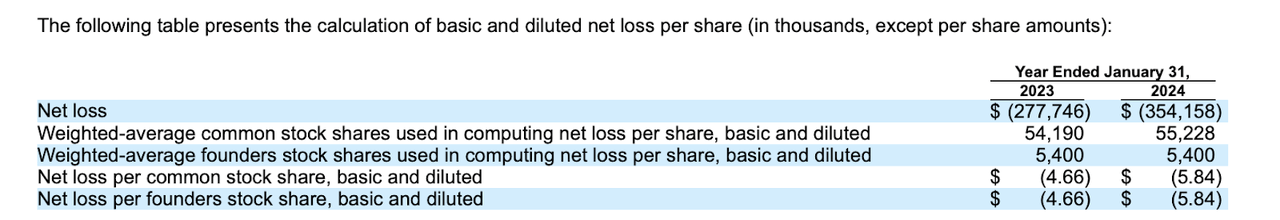

Next, let's calculate the stock's current valuation and target fair value. There are just over 60 million shares outstanding.

Rubric S-1

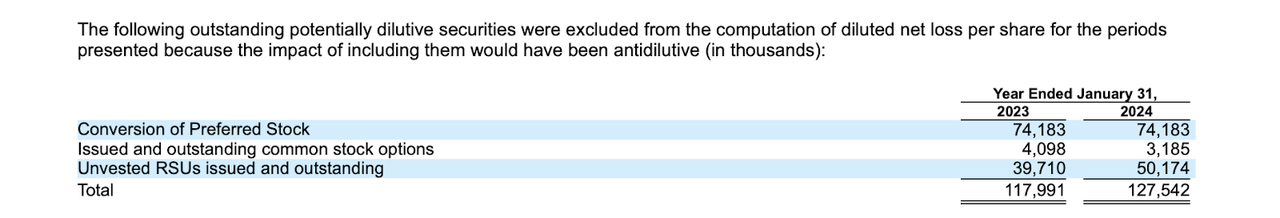

The 74.2 million preferred stock conversion, additional RSUs and outstanding options bring the number of outstanding shares to 188 million.

Rubric S-1

Adding the 23.5 million shares issued in the IPO, the number of shares outstanding is approximately 211 million. Please note that it is always difficult to determine the exact number of shares outstanding, and the number I calculated is a little higher than the number reported elsewhere.

The company's market capitalization is currently approximately $7.8 billion, and its enterprise value is $7 billion. With the ongoing shift to subscription services, it's difficult to value the stock based on revenue. Assuming 25% ARR growth this year, the stock would trade at 8x sales and 7x EV/S. Will RBRK be valued like a typical data storage company like Box (BOX) at 3.7x sales, or like a cybersecurity stock like CrowdStrike (CRWD) at 18x sales? I don't know yet whether it will be done. My guess is that the company will be valued like a cybersecurity stock, but I doubt it will be able to achieve such a high multiple since there don't seem to be many cross-selling opportunities in its business. . I don't mean to suggest that there is no future growth – RBRK appears to offer exposure to increasing amounts of data – but there are notable differences in typical platform cybersecurity names. Investors are cautioned against thinking this will double soon. Over the next two to three years, we expect subscription ARR growth to remain in the 20% to 25% range. That may justify a valuation of about 9 times sales. Based on a long-term net margin of 25%, this equates to a valuation of approximately 36 times long-term earnings, which seems reasonable when compared to top-line growth. This translates to a stock price of approximately $44 per share, considering the net cash on the balance sheet.

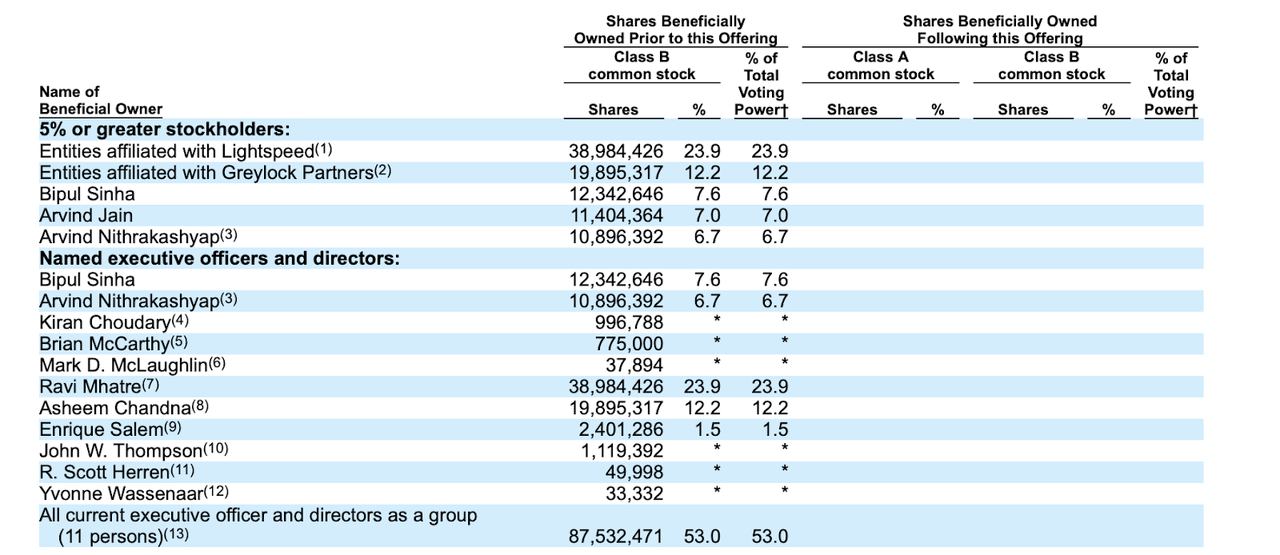

We note that insiders own a large number of shares in the company, including 87M shares owned by the executive officers and board of directors.

Rubric S-1

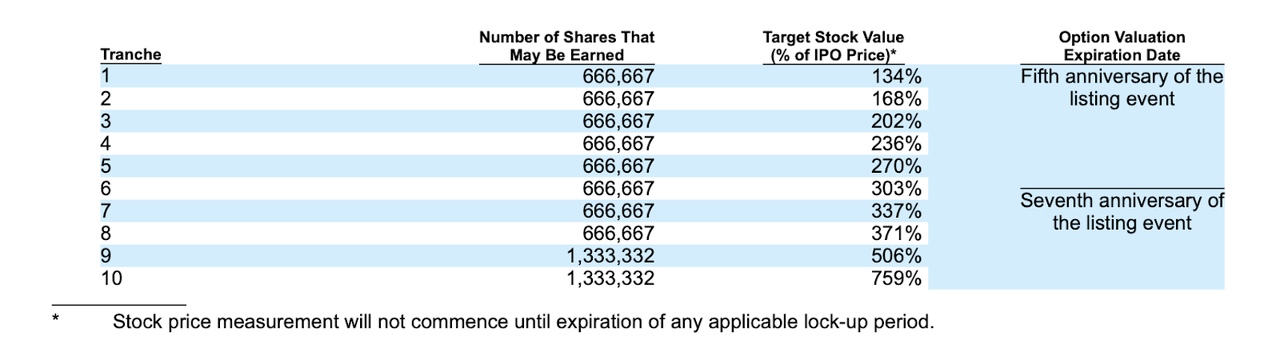

It's also worth noting that CEO Bipul Sinha has a stock performance plan in which he will receive a large amount of stock on the assumption that the stock will deliver strong returns over the next few years.

Rubric S-1

However, don't get too excited about the above performance plans given that many tech stocks have similar programs for a 2022 tech crash that ultimately prove to be pointless. I would like to be careful.

Rubrik stock risks

RBRK operates in a highly competitive field. From my point of view, it is not clear whether RBRK has a clear advantage over competitors such as his CVLT. We note that CVLT's ARR growth rate is in the 15% range, and RBRK's own growth rate may decelerate much more rapidly than expected. Since the company is not yet profitable, there is no clear support for its valuation, and the stock could see significant volatility if investors lose confidence in the business' long-term growth trajectory.

conclusion

RBRK is an interesting new IPO, offering another way to invest in long-term growth themes like data and cybersecurity. The company has a strong balance sheet, and I wouldn't be surprised if there is more focus on improving profitability going forward. It's unclear where subscription ARR growth will reach in the coming quarters, but the current valuation doesn't reflect a high number. I initiate coverage with a Buy rating and $44 price target.