Bank of New York Mellon Corp. (NYSE:BK), a global financial services company, witnessed significant insider selling transactions, according to recent SEC filings. Executive Vice President Catherine Keating sold 54,070 shares of the company's stock on April 18, 2024. The transaction was reported through her SEC filing, which can be accessed here.

Bank of New York Mellon Corp is a leading investment firm providing investment management, investment services and wealth management that enables individuals and institutions to manage and service their financial assets throughout the investment lifecycle.

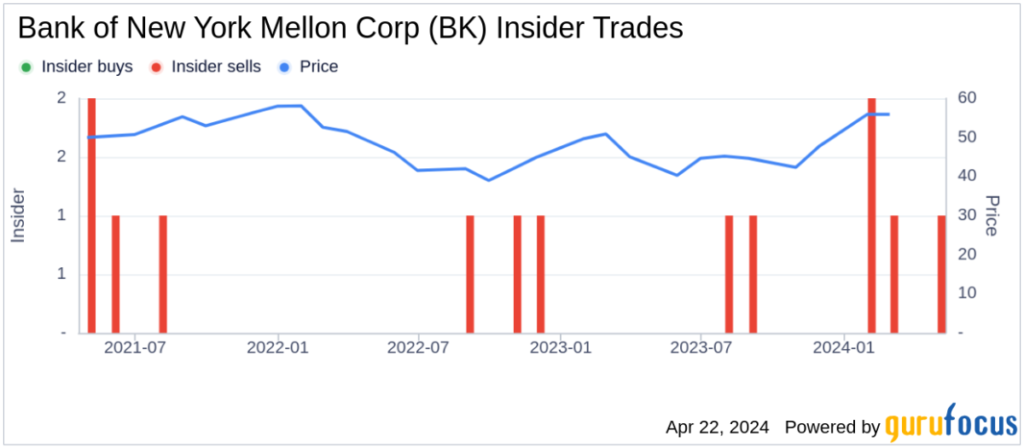

Insiders sold a total of 89,890 shares, but didn't buy any shares in the company over the past year. The recent selling by Catherine Keating represents a continuation of this selling trend among Bank of New York Mellon insiders, with a total of 6 insider selling and no insider buying over the past year. Ta.

In the most recent insider sale, shares of Bank of New York Mellon Corporation traded at $54.88, giving the company a market cap of $42.745 billion. The company's price-to-earnings ratio was 13.94x, slightly higher than the industry median of 13.38x and the company's historical median price-to-earnings ratio.

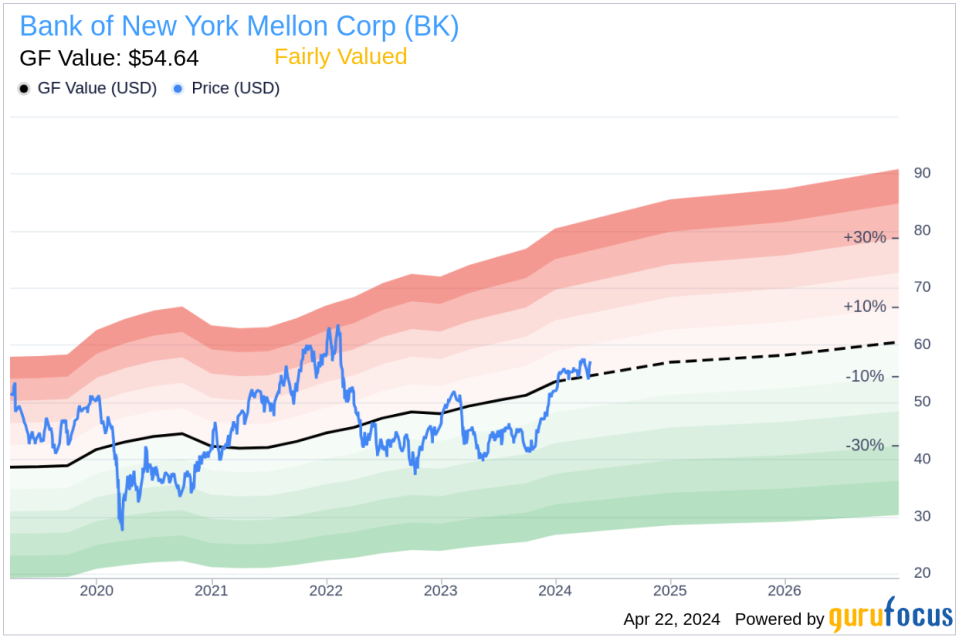

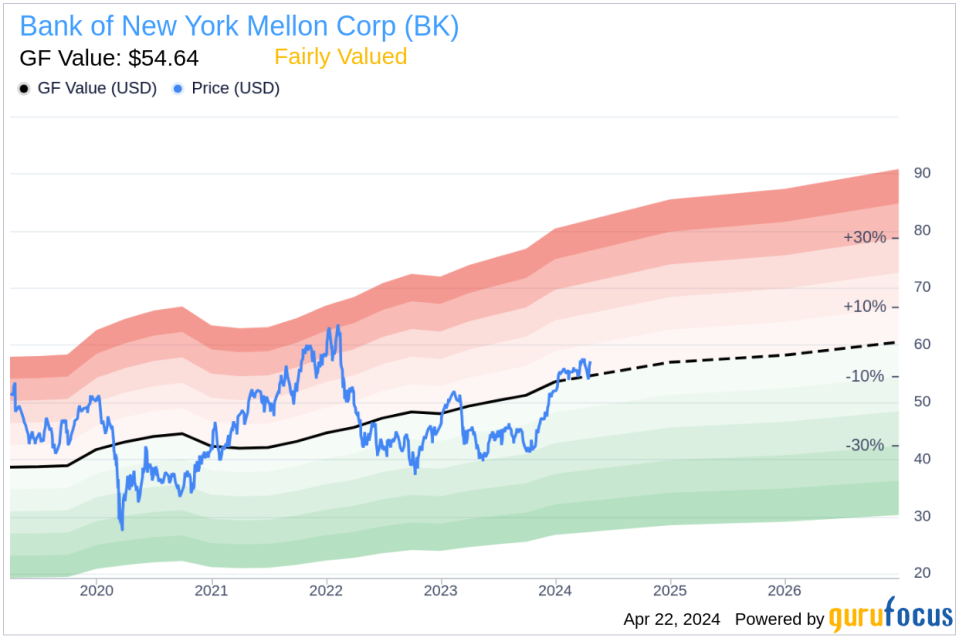

According to GuruFocus Value chart, with a stock price of $54.88 and a GF value of $54.64, Bank of New York Mellon Corporation has a price to GF value ratio of 1, which is considered fair value. The GF values are: Proprietary intrinsic value estimates from GuruFocus that consider historical trading multiples, GuruFocus adjustment factors based on past earnings and growth, and Morningstar analyst forecasts of future performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.