parable S&P500 and Dow Jones Industrial Average Although they have fallen back from their all-time highs, many stocks remain many It was higher than a year ago. But most of the real estate industry isn't like that.

Real estate investment trusts (REITs) are particularly sensitive to rising interest rates due to the income-driven nature of their businesses and the reliance on debt financing that is standard in the real estate industry. Many REITs with solid businesses have seen significant declines even though their businesses are doing well.

One great example is real estate income (New York Stock Exchange: O), is down 20% from its 52-week high despite the portfolio's strong results. With his dividend yield of over 6%, it's a great time to add this reliable income machine with a track record of market-beating total returns to your portfolio.

Realty Income's business is built on consistency

For those unfamiliar, Realty Income owns a portfolio of over 15,000 net lease properties located throughout the United States and parts of Europe. About 80% of your rental income comes from retail tenants, but don't let that scare you. Real estate income typically acquires real estate that is already occupied by tenants and typically falls into one of four categories:

-

non-discretionary: Business that sells people need. walgreens boots alliance (NASDAQ:WBA) and CVS Health (NYSE:CVS) are examples of major real estate income tenants in this category, and these businesses are inherently recession-proof.

-

service base: Businesses that sell services will not be easily disrupted by e-commerce. Restaurants and fitness centers are good examples.

-

discount retail: dollar stores, warehouse clubs, and other discount-oriented businesses actually tend to do so Better in a difficult economic climate.

-

non-retail: Approximately 20% of Realty Income's portfolio consists of industrial, gaming, and agricultural properties.

The general business model is simple. With Real Estate Income, you buy real estate with high-quality tenants, sign long-term leases that let tenants pay for variable costs like taxes and insurance, and enjoy predictable annual increases in income.

Thanks to its superior capital allocation, Realty Income has delivered superior returns to its investors. Since his IPO in 1994, Realty Income has generated an annualized total return of 13.9%. This means that his $10,000 investment when it went public has since compounded into his nearly $500,000. And not only does Realty Income have a high dividend yield, it has increased its dividend for 106 consecutive quarters, and there's no reason to think that streak will be in jeopardy anytime soon.

Stock prices sway due to new interest rate forecasts

As of early 2024, investors generally expect the Fed to begin cutting rates aggressively, with the median expectation that the market is pricing in six quarter-point rate cuts, according to the CME FedWatch tool. was there.

That expectation has changed significantly, to say the least. The median forecast now calls for only two rate cuts, thanks to persistent inflation and comments from Fed leaders. As a result, Realty Income's stock price fell.

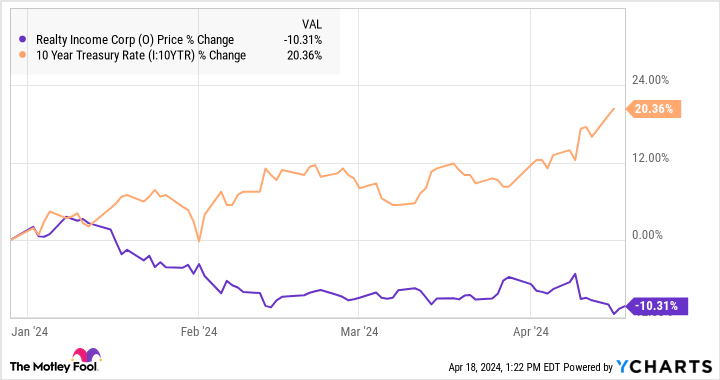

Mathematics class will be omitted. But the simple fact is that as yields on risk-free instruments (particularly Treasury bills) rise, the value of income-based stocks tends to fall. If you look at the year-to-date chart, you'll see a clear inverse relationship between real estate income stocks and his 10-year Treasury yield.

Great long-term opportunity

The key takeaway is that Realty Income is a solid REIT with an impressive track record of above-market returns and growing dividend income, and it trades at a discount for the following reasons: short term Headwind. Now, while it's on sale, could be a great time to add shares in this great business.

Need to invest $1,000 in real estate income right now?

Before purchasing real estate income stocks, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and real estate income wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $466,882!*

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 15, 2024

Matt Frankel works in the Real Estate Revenue Department. The Motley Fool has a position in and recommends Realty Income. The Motley Fool recommends his CVS Health. The Motley Fool has a disclosure policy.

Beat the Dow Jones with this Cash-Guzzling Dividend Stock was originally published by The Motley Fool