Florida based Celsius Holdings (NASDAQ:CELH) We produce energy drinks with differentiated properties. According to the company, these drinks are “thermogenic,” meaning consumers who drink them burn calories even during their breaks. This claim, as well as our bold flavor lineup, helps Celsius stand out in a crowded space.

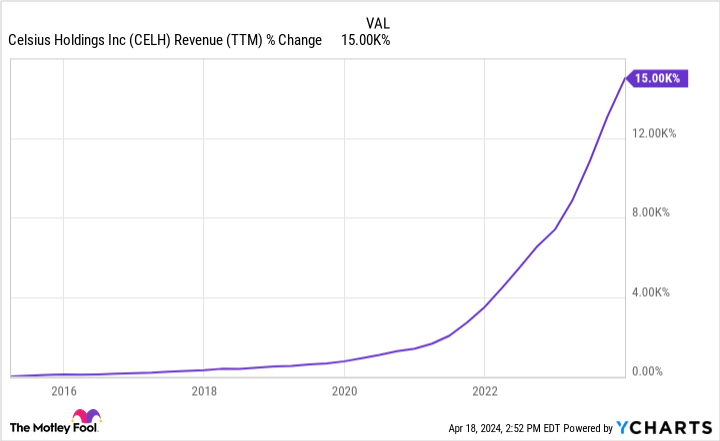

Celsius' rise from obscurity was astonishing. In the beginning, the challenge was simply to get in front of consumers. But once that materialized, sales quickly gained momentum over the past decade, with revenues increasing by 15,000%. That's amazing.

Celsius was already on the hot road. But in recent years, missteps at rival Van Energy have added to the momentum.This energy drink brand flopped in a distribution deal with pepsico, it was costly.and lost several lawsuits monster energy. Out of nowhere, the van suddenly went bankrupt.

Bang reportedly had sales of $1.4 billion in 2021, but as of the fourth quarter of 2023, annual sales were only $250 million, according to new parent company Monster.

As Mr. Bang languished, Mr. Celsius suddenly emerged and gained market share. In addition, Mr. Bang regained the distribution contract he had lost with Pepsi, and Celsius' profits soared.

As of this writing, Celsius stock is down 27% from its 2024 high. Here's what investors need to know.

Is this a buying opportunity?

When investing, we believe that both business growth and valuation are important. Golden growth stocks can be a bad investment if the price gets too high. However, if the business outlook is poor, no matter how good the “deal” is, it is not a good investment. Therefore, business is more important than reputation.

Let's take a look at the business outlook and valuation of Celsius stock to determine whether the 27% decline from its 2024 highs represents a buying opportunity.

On the business side, Celsius' revenue may have increased by 15,000% over the past decade, but there's still plenty of room for growth and it shows no signs of slowing down. In 2023, her revenue was $1.3 billion, an increase of 102% from the previous year. For perspective, this includes an impressive 95% growth in the fourth quarter.

Two growth options for 2024 include international expansion and expanding into restaurant chains. Growth opportunities could help Celsius generate $1.7 billion in revenue this year, according to consensus estimates. S&P Global Market intelligence.

Celsius isn't just growing. We also get great profits. In 2023, his net income was $182 million, with a profit margin of nearly 14%. Its profit margins could take a step back this year as it enters new markets. It tends to be an expensive task. But the 2023 results show its capabilities, and that bodes well for the long term.

Celsior remains a golden growth stock due to its growth opportunities and profit potential. But looking at valuation, the 27% decline in Celsius stock requires additional context. Despite the drop, the stock is up 28% year-to-date and 140% in the past year alone.

Investors should always keep an eye on Celsius stock. This isn't an unusual dip that warrants a rush to buy. Stock valuations have simply returned to where they were a few weeks ago. So you don't have to be pressured into making a purchase for fear of missing out on a rare entry point.

Finally, as of this writing, Celsius stock has a price-to-sales ratio of less than 13 times. If you think about it normally, I think it's a high valuation. However, higher profit margins justify higher valuations. Moreover, the company is still growing by leaps and bounds, which justifies the higher prices.

In summary, while Celsius' valuation looks high on the surface, it shouldn't be a deal breaker for investors. This price makes sense given the business trajectory and long-term opportunity. In my opinion, this is a growth stock to buy.

Should you invest $1,000 in Celsius now?

Before purchasing Celsius stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors should buy right now…and Celsius wasn't one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $466,882!*

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 15, 2024

John Quast has no position in any stocks mentioned. The Motley Fool has positions in and recommends Celsius, Monster Beverage, and S&P Global. The Motley Fool has a disclosure policy.

This incredible Nasdaq growth stock is currently down 27% from its 2024 high.Is it time to buy? Originally published by The Motley Fool