(Bloomberg) — Gold prices soared to an all-time high of more than $2,400 an ounce this year, captivating global markets. China, the world's largest producer and consumer of precious metals, is at the center of this extraordinary rise.

Most Read Articles on Bloomberg

Escalating geopolitical tensions, including wars in the Middle East and Ukraine, and the prospect of lower US interest rates are all making gold more valuable as an investment. But fueling the rally is China's relentless demand as retail shoppers, fund investors, futures traders and even central banks turn to bullion as a store of value in uncertain times. is.

largest purchaser

China and India have typically competed to be the world's biggest buyers. But that changed last year as Chinese spending on jewelry, bars and coins soared to record levels. China's demand for gold jewelery increased by 10%, while India's demand fell by 6%. Meanwhile, Chinese bullion and coin investment soared 28%.

Philipp Klapwijk, managing director of Hong Kong-based consultancy Precious Metals Insights, said there was still room for demand to grow. A protracted crisis in the real estate sector, a volatile stock market and a weakening yuan are all contributing to limited investment options in China. Direct funds to assets that are perceived to be safer.

“In these circumstances, the weight of assets like gold, and indeed the money coming in with new buyers, is quite significant,” he said. “There aren't many alternatives in China. There are exchange controls and capital controls, so you can't look at other markets and put money into them.”

import jump

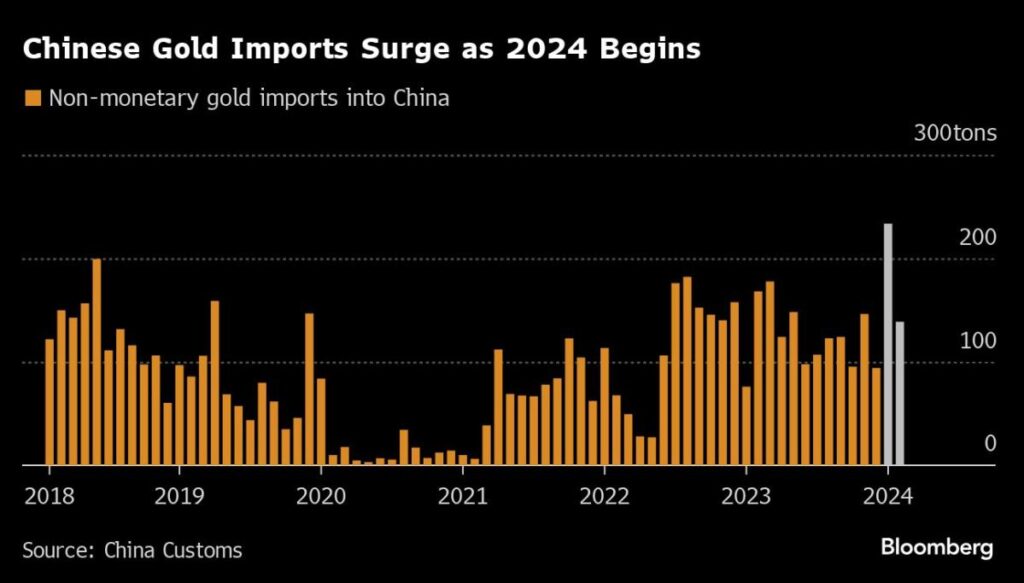

Although China mines more gold than any other country, it still needs to import large amounts of gold, and the amount continues to grow. Over the past two years, more than 2,800 tons have been purchased from abroad, more than the entire amount of metal backing exchange-traded funds around the world, or about a third of the stockpiles held by the U.S. Federal Reserve.

However, the pace of shipments has been accelerating recently. Imports surged ahead of the Chinese New Year, the peak gift-giving season, increasing by 53% in the first two months of this year compared to 2023.

Central Bank

The People's Bank of China has been increasing its purchases for 17 consecutive months, the longest on record, in an effort to diversify its foreign exchange reserves away from the dollar and hedge against a currency depreciation.

It has become the most avid buyer of the many central banks that support gold. The government sector drove the price of precious metals to near-record levels last year, and purchases are expected to continue rising in 2024.

shanghai premium

Gold's appeal is evidenced by the fact that demand in China remains very strong despite record prices and a weakening yuan that takes away purchasing power from buyers.

Gold buyers in China, a major importer, often have to pay a premium compared to international prices. It rose to $89 an ounce at the beginning of the month. The average over the past year is $35, but the historical average is only $7.

Sure, rising prices may dampen enthusiasm for bullion, but the market has proven to be unusually resilient. Chinese consumers typically tend to buy up gold when prices drop, which has helped establish a market floor during market downturns. Not this time, as China's appetite is pushing prices to much higher levels.

This suggests the bull market is sustainable, and Nikos Cavalis, managing director at consultancy Metals Focus, said gold buyers everywhere should take comfort in strong demand from China. .

Chinese authorities can be very hostile to market speculation, but they are not very optimistic. State media has warned investors to be cautious when chasing rising markets, while the Shanghai Gold Exchange and Shanghai Futures Exchange have increased margin requirements for some trades to curb excessive risk-taking. I pulled it up. SHFE's latest move comes after its daily trading volume soared to its highest level in five years.

ETF flow

A less enthusiastic way to invest in gold is through exchange-traded funds. Mainland gold ETFs have seen inflows almost every month since June, according to Bloomberg Intelligence. This is comparable to huge outflows from gold funds in other parts of the world.

So far this year, capital inflows have totaled $1.3 billion, while outflows from overseas funds have totaled $4 billion. Restrictions on investing in China are also a factor here, given that Chinese people have few options other than domestic real estate and stocks.

BI analyst Rebecca Singh said in a note that Chinese demand could continue to rise as investors look to diversify their holdings into commodities.

–With assistance from Jack Wang and Eddie Spence.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP