In another important week, we saw the battle for artificial intelligence continue to escalate.

Google LLC reorganized to focus more on AI, Meta Platforms Inc.'s Llama 3 was released, Taiwan Semiconductor Manufacturing Co. doubled Nvidia Corp.'s high-end chip manufacturing capacity, and Samsung Electronics Co. Ltd. has acquired a tranche of $6.4 billion, the value of the chip functions as money, a Microsoft paper describes the VASA-1 that turns photos into slightly creepy talking heads, and the Mistral AI was released just four months ago. Raising $500 million in funding at more than double its final valuation, SAS Institute Inc. introduced the industry model in a sign that demand for domain-specific AI is taking shape.

Since the AI awakening in November 2022, the spending landscape for enterprise technology has changed. Customers are scraping money from other budgets to fund AI and run experiments in a desperate race to monetize. Names that were virtually unknown in early 2022, such as OpenAI, Meta Llama, and Anthropic PBC, are competing with cloud-scale companies for a piece of the pie. And notably, while Google remains a distant third in overall cloud computing spending, according to the latest Enterprise Technology Research research data, it has dramatically accelerated its position in the all-important AI space. This means that we are closing the gap with Amazon Web Services Inc.

In this shortened version of our breaking analysis, we show how spending patterns have changed since early 2022, before the launch of ChatGPT, and share what bets customers are making on AI platforms.

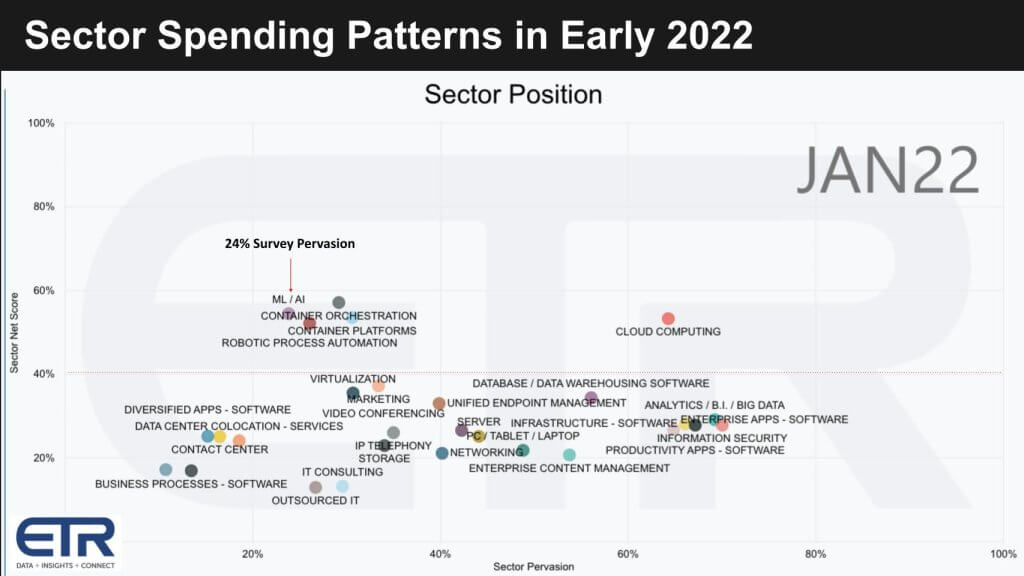

Spending on innovation will be more balanced in early 2022

Let's take a look back at the spending environment in 2022. The graph below shows net score, or spending momentum, on the vertical axis. The horizontal axis is penetration, which is the number of customers who spend in a particular sector divided by the total N, according to a survey of approximately 1,800 IT decision makers. The 40% red line on the vertical axis represents a very high net score.

The following important points are important:

- At the time, there were four sectors above the magical 40% mark, including AI, containers, robotic process automation, and cloud computing.

- At that time, the penetration rate in the machine learning/AI sector was 24%. This means that 24% of her surveyed customers responded with details of how they spent on their ML/AI.

- This data shows that there was a healthy balance of spending in the key growth areas listed above.

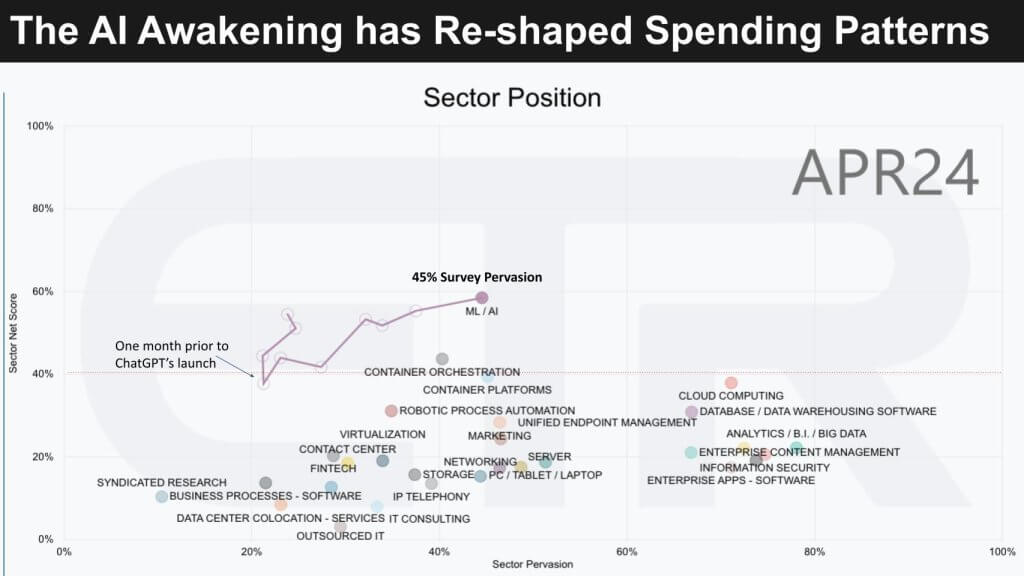

Research shows AI sector penetration has doubled

Fast forward to 2024, and the landscape changes dramatically as ML/AI gains momentum over other sectors, nearly doubling account penetration.

The key points are:

- The ML/AI sector started to slow down due to the coronavirus and bottomed out a month before ChatGPT.

- Since then, ML/AI has been on an upward trajectory.

- A more significant pattern is illustrated by trends in other sectors that have been pushed below the 40% mark.

- An impressive data point is that Pervasion's research for AI has risen from 24% to 45% in just over two years.

As we have previously reported, AI is stealing budgets from other sectors of the tech economy. And in general, monetization is not there, or at least not to the extent that it expands the overall spending environment. In fact, exactly the opposite is happening. In other words, the overall outlook for spending remains challenging. So until AI projects start putting in the necessary funding for themselves and other efforts, macro is expected to be difficult.

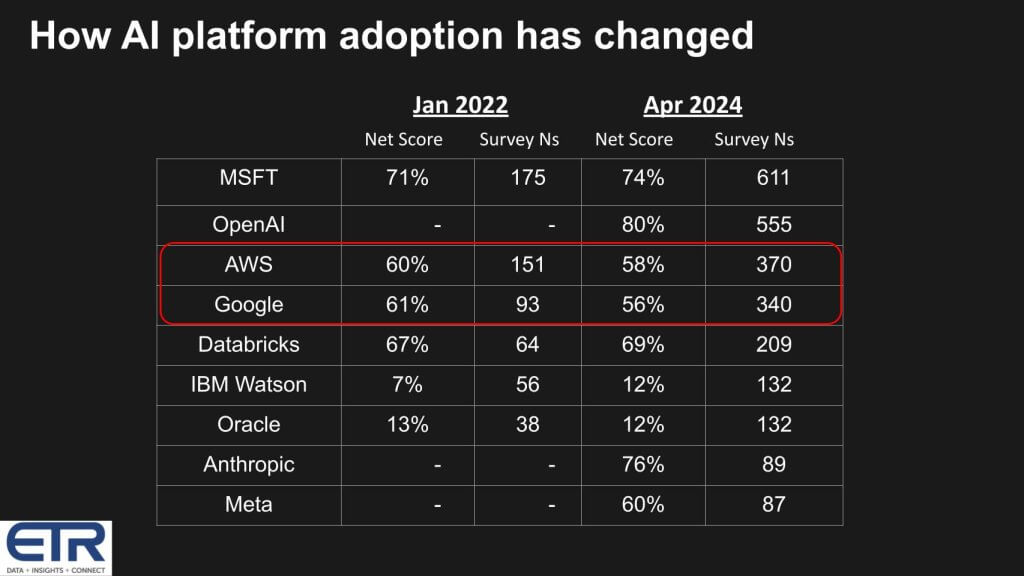

Google's AI dramatically increases account penetration

Let's take a look at how spending on various AI platforms has changed over the past two years.

The table above shows AI adoption by platform vendor over the past two years. We synthesized data from two key points in the ETR study. One snapshot from January 2022 and one from April 2024. Shows the net score for each period and the number of respondents (Ns) who say they use a particular platform.

Net score methodology: ETR's proprietary Net Score metrics are obtained quarterly over time. This is a metric that shows the percentage of customers who are increasing their investment in a particular AI platform. This metric is the result of a subtraction process that subtracts the percentage of customers who reduce spending or leave the platform from those who increase investment or start new engagements.

Main findings:

- The study finds significant changes in the technology spending landscape, with AI and machine learning gaining greater “market share”, consistent with the sector's growing importance.

- Noteworthy in 2022 is the absence of prominent entities such as OpenAI, Anthropic, and Meta's Llama, along with strong net scores from incumbents AWS and Google, along with Microsoft's significant lead. That's it.

- A comparison of N, which represents the number of respondents using a particular platform, reveals that AWS's margin over Google in the ML/AI space has shrunk from 60% to just 8% as of the latest data. , suggesting that competition between them is becoming even more intense. 2 companies.

- While Microsoft and OpenAI have impressive net scores and respondent numbers, new entrants like Anthropic and Meta Llama are emerging with significant N and net scores, disrupting the market status quo.

- Databricks Inc.'s traditional ML platform remains prominent, but has undergone enhancements with the recently announced DBRX, which is not reflected in the current survey data.

- Snowflake is not included in this space, but we understand that ETR is adding its platform to the mix.

Integrated insights:

- The dominance of AI is clear, overshadowing other sectors and attracting new investment and customer attention.

- The industry is experiencing dynamic change, with new players rapidly gaining traction and traditional giants such as Oracle and IBM showing growth, albeit at a slower pace.

- There is a growing trend for AI to be integrated into broader applications and systems as an embedded component, rather than just being purchased standalone, as seen by companies like Cisco and Juniper.

Conclusion: Although the AI sector is undergoing accelerated evolution, uncertainties remain. Our research shows that as AI continues to mature, it will become more connected to a variety of existing technology areas. Spending patterns are becoming increasingly dynamic and can be volatile as many accounts have not yet achieved a return on investment.

We see this wave as a transformation, not just a transition, and we believe our customers need to remain agile in their platform mindset to navigate the changing landscape of AI. Specifically, we believe that customers need to develop an internal architecture focused on people and processes with the necessary change management protocols. Customers need the ability to quickly test, prove, and deploy new technologies and innovations as they come to market. Given the high level of financing and capital investment, the market has a dizzying array of options and is likely to remain highly competitive.

Platform thinking allows enterprises to optimize for specific use cases based on performance, cost, energy, and time-to-value requirements specific to the organization's imperatives. The momentum and adoption of AI spending from survey data will continue to serve as a barometer of innovation and market position for the foreseeable future.

keep in touch

Your upvote is important to us and helps us keep our content free.

Your one click below will support our mission of providing free, deep and relevant content.

Join our community on YouTube

A community of over 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies Founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many other celebrities and experts. Please join us.

thank you