Financial Practice Week National Survey Results

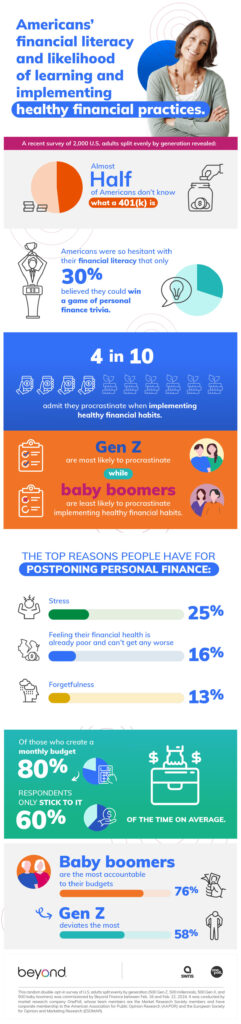

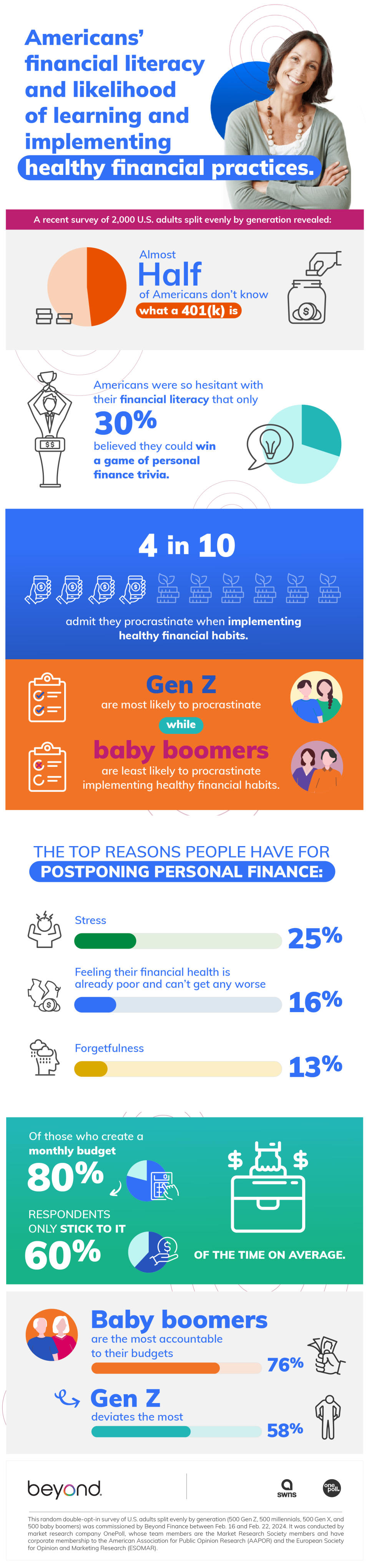

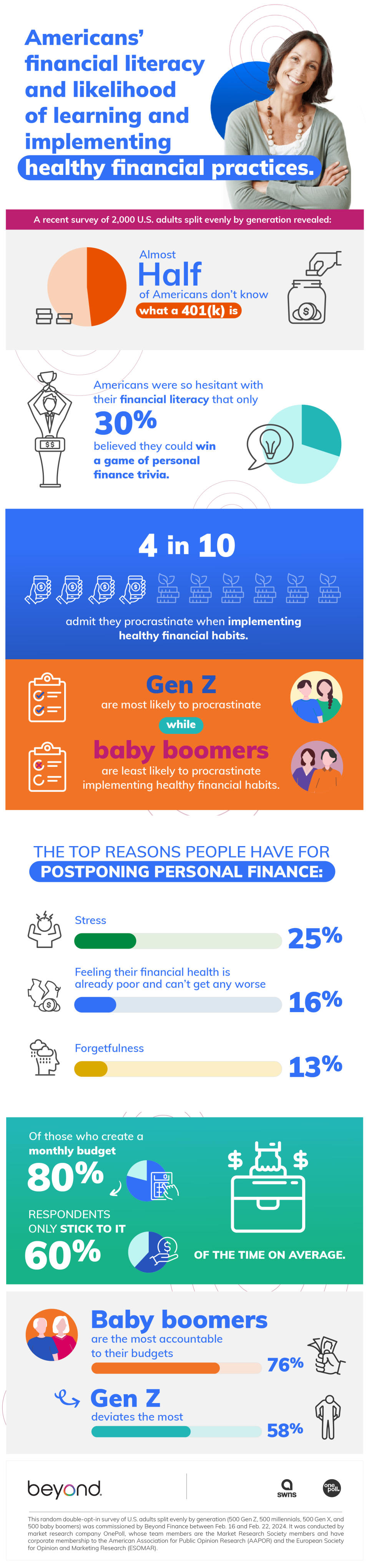

HOUSTON, April 18, 2024 (Globe Newswire) — A national survey of 2,000 Americans, evenly divided by generation, found: Almost half of respondents (43%) don't know what a 401(k) is. This comprehensive survey examined Americans' financial literacy, their commitment to learning and developing healthy money habits, and their feelings about their bank accounts and financial future.

This research Beyond finance Conducted by OnePoll for Financial Practice WeekDespite these alarming knowledge gaps, only two in five respondents, or 39%, revealed that they considered themselves to be more financially literate than the average person. .

The results show that respondents lacked a significant amount of confidence in their financial literacy, with only 30% believing they could win a personal finance trivia game. More than one in three (35%) confessed that they did not know the term “interest” in a financial context.

Four in 10 Americans admit to procrastinating when it comes to practicing healthy financial habits. Gen Z is the most likely to improve their finances, while Millennials are the least likely to make changes to improve their finances.

The main reasons for postponing personal finance tasks are stress (25%), feeling that the financial situation is already bad and can't get any worse (16%), and forgetfulness (13%) can be mentioned.

The survey also found that Americans typically check their banking apps twice a day. However, exactly half of respondents said they feel nervous when opening a banking portal, with Gen Z feeling the least comfortable (65%) and baby boomers feeling the least comfortable (26%).

“Unfortunately, it's all too common to avoid reviewing your finances and making healthy changes,” he said. Dr. Erica LasleChief Financial Wellness Advisor at Beyond Finance. “Some people tend to neglect to keep track of their finances, while others become overly sensitive about their finances. There is a middle ground when it comes to improving your financial health. It’s about learning your habits, paying attention, and making small, achievable adjustments to your spending and habits.”

When it comes to budgeting habits, 8 in 10 respondents try to hold themselves accountable to their monthly budgets, with Millennials and Baby Boomers tied for having the most thorough financial plans (81 %) is.

Among those who create a monthly budget, only 66% of respondents adhere to it on average, with baby boomers showing the highest level of accountability (76%) and the most deviations from their budget. Gen Z (58%).

For people trying to save money, the most popular strategies include buying items on sale (53%), using coupons or discount codes (47%), and limiting spending on clothing (45%) ) and shopping at discount stores (42%).

However, a significant portion of respondents say they go out to bars and restaurants less often (39%), limit or not travel at all (36%), and rarely or never buy coffee at coffee shops. They resort to more drastic measures to save money. (35%) and rarely or never buy gifts (32%). Notably, 33% of respondents said their girlfriends don't take vacations.

Financial habits are also a factor, as nearly four in 10 (39%) respondents report that their or their partner’s unhealthy spending habits have negatively impacted their relationships. It can also affect relationships.

A majority (63%) of people in a relationship agreed that learning about their personal finances as a couple increases their chances of successfully improving their financial habits in the future.

“The first step to a happier financial future is education,” Dr. Rasul said. “The more you know about money and personal finance, the better prepared you will be to make better decisions and create a plan to reach your goals. That’s why Financial Practice Week is so important. We want to help you learn about the money habits and habits you've been putting off and encourage you to move towards a more stable and optimistic future.”

To learn more about Accredited Debt Relief and Beyond Finance or the great work we do with our clients to overcome debt, please visit: www.accrediteddebtrelief.com or www.beyondfinance.com.

Research method:

This randomized, double-opt-in survey surveyed U.S. adults evenly divided by generation (500 Gen Z, 500 Millennials, 500 Gen Commissioned by Beyond Finance to date.Conducted by a market research company One polewhose team members are members of the Market Research Association and a corporate member of the American Association for Public Opinion Research (Arpol) and the European Public Opinion Marketing Research Association (esomal).

About Beyond Finance, LLC

Houston-based Beyond Finance, LLC is one of the nation's largest and most influential debt consolidation services and financial technology organizations. Beyond Finance is with customers wherever they are on their debt journey, using personalized, integrated services and innovative technology to give them the clarity, confidence, and tools they need to get through debt. Since 2017, Beyond Finance has freed over 300,000 of his customers from over $1 billion in debt. In 2024, Beyond Finance won ConsumerAffairs' inaugural “Buyer's Choice Awards” for best customer service, staff experience, and transparency for personal finance and its debt consolidation programs. We also have additional offices in Houston, Texas and Chicago, Illinois. For more information, please visit BeyondFinance.com.

Media contact:

Yolanda Shuford

yschufford@beyondfinance.com

sean paul wood

swood@beyondfinance.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3cc22514-e186-473b-b4e5-b101da30dc40.