summary

- Hungary continues its plan to renationalize Budapest Airport.

- However, it will not be a complete nationalization as VINCI and possibly the Qatar Investment Authority will be involved.

- AviAlliance, which has long operated the airport since 2005, doesn't appear to have a long lifespan.

- According to reports, the stake held by VINCI may be small and may not fit into its business model.

- Hungary is struggling to raise funds, but the project has been fenced off as a “crown jewel” and other assets have been moved accordingly.

- As the political landscape begins to change in Eastern and Central Europe, other countries in the region will likely take note of these developments.

Hungarian government says renationalization of Budapest airport will happen 'within days' but likely within weeks

Hungary's Economic Development Minister Marton Nagy recently said that the government plans to acquire an 80% stake in Budapest Ferenc Liszt International Airport (BUD), with the remaining stake to be purchased by VINCI Airports. . Nagy also reiterated plans for the Qatar Investment Authority to join the consortium “later.”

Prime Minister Viktor Orban said the deal had been touted as potentially happening within “days”, but Nagy said it would likely take weeks to finalize the legal details. As I said, you are almost certainly correct about that.

CAPA Aviation Center reported in January 2024 that the European Commission had approved the takeover of Budapest Airport by the Hungarian government/VINCI, and now it is “close to an agreement” that the European Commission has approved the government-led takeover of the airport. There is also a statement that says, The country's economic development minister called it “the most complex situation since the collapse of communism.''

VINCI likely to participate with smaller share than expected, possibly Qatar Investment Authority

It was reported at the time that the plan would see the state-owned company take a 51% stake in the new company, with French operator VINCI taking 49%.

CAPA – Aviation Center was of the view that VINCI benefits in this respect from the management of Belgrade Airport, the only one in Eastern Europe to operate, and from the improved trade relations between Hungary and France.

At that stage, disagreements continued over matters such as management rights.

The ruling party has always opposed the initial privatization in 2005.

The current ruling Fidesz party, which appears to be secure in its victory in the 2022 general election (in which leader Viktor Orbán will win his fourth consecutive term in power), has opposed airport privatization from the beginning. The company has previously tried to repossess its stake through a consortium of companies close to the government, seeking to boost its domestic stake in a sector that was considered strategic before the coronavirus pandemic and energy crisis. This was thwarted by tight funding.

And the financial situation has not improved much since then (see below).

The current government's desire for BUD actually dates back to 2005, when there was no government in place, after the Aviation Directorate was separated into Hungaro Control (ATM) and the state-owned limited liability company Budapest Airport Zrt. In June 2005, the State Privatization Authority launched a tender for concessions and BAA, then the owner and operator of the UK's seven major airports, took over management of the airports.

Other countries in the region may follow suit

With Fidesz in power, some form of renationalization of airports is always on the table, and Hungary is not the only country in the region where a left-wing party is likely to lean toward greater state control over airports. Gain power (again). They include Poland (airports are in any case under state control, but decisions still remain about the financing of a new central Polish airport) and one of the main airports, Kosice, is partially privately owned. Includes Slovakia, which is

However, there is no recent experience within the Hungarian government of operating the former 38 units.th To become Europe's busiest airport in 2023, continued cooperation with one or more private sector partners was always taken into consideration.

The current major shareholder is AviAlliance

BUD was operated by a consortium led by Germany's AviAlliance (formerly Hochtief AirPort) in 2007, taking over from BAA. Initially, the company held a 75% stake and was later fully privatized with the government taking a 25% stake. Abi Alliance's current shareholding rate is 55.44%.

The remaining two minority shareholders are Malton Investments Pte, a subsidiary of Singapore's sovereign wealth fund GIC, and Canadian pension fund Caisse de Depot et Placement du Caisse, which, like AviAlliance, is classified as a “major shareholder”. Québec” (CDPQ). It is registered as a Global Investor in CAPA – Center for Aviation Global Airport Investor's Directory and has airport assets in Budapest, Canada, the United Kingdom, and Cyprus.

Is VINCI in a different position than before?

So there was always a chance that the government might want to take back at least 25%.

After all, the company wants 80%. This may be a little surprising given that VINCI is also present, but the company typically acquires much more than 20% stake in the airport's concession management mechanism, or opts for a management contract. This is because they are doing so. There are no financial commitments (as is the case with smaller airports in France).

Additionally, VINCI typically requires unfettered management rights. I could have expected that if they had acquired 49% of the shares, but with just 20%, they may be at some level of stalemate. Voting rights under the purported agreement are unclear.

Investors and operators are known to often exit deals with limited ownership rights that allow them only peripheral influence over operational and investment matters in China, India and Africa.

The valuation ranges from 4 billion to 5 billion euros.government claims to have cash

The valuation of BUD's airport assets ranges from 4 billion to 5 billion euros, but the actual purchase price has not been disclosed. Its value has more than doubled since it was first sold, although its recovery has been hampered by macroeconomic factors and windfall aviation taxes.

Another complicating factor that remains is Hungary's budget deficit, which is expected to exceed its revised target of 5.2%.

Indeed, just two days after Mr. Nagy's remarks on the BUD airport acquisition (11 April 2024), the government plans to postpone some state investments to ensure that the budget deficit does not exceed the already raised target. As a result, some plans were delayed. Of these investments amounting to HUF 675 billion (US$1.86 billion), a specific list of affected projects has not yet been drawn up. The government faces a cumulative budget shortfall of 2.32 trillion forints by the end of March 2024 due to soaring interest costs.

However, the government insists that it has secured the necessary funds for BUD's purchase plan and that the move will only affect its cash flow deficit.

The company did this by building up a war chest for deals, including the sale of a 15% stake in the local unit of Erste Group Bank AG and a 35% stake in the Hungarian unit of Vienna Insurance Group. It also issues debt.

BUD is not just a strategic asset, but is seen as a “crown jewel” in the tourism and logistics industry.

The government's plan is to expand the airport by building a third terminal, thereby increasing passenger and cargo capacity.

AviAlliance is a loser, but looks like they did a solid job with BUD

That has analysts questioning whether AviAlliance can claim credit for building BUD — certainly since 2011, when it took full ownership, and perhaps even since 2005, when it first invested.

The graph below shows the growth in passenger numbers from 2011 to present.

In just one year from 2011 to 2019 (2012), passenger numbers declined (very slightly) due to the bankruptcy of the national airline Malef.

After four consecutive years of double-digit growth from 2015 to 2018, BUD increased by 8.8% to more than 16 million passengers in 2019, when most European airports suffered a typical pre-pandemic decline. The highest number of passengers was reached.

In 2023, the numbers returned to 2018 levels, and growth in the first quarter of 2024 was strong at +20%.

In other situations, changing the operator now would be frowned upon

In any other situation, changing operating companies at this stage would be frowned upon in the investment community. That's because AviAlliance is well-established, well-respected, and has no known plans to sell the airport.

Rather, it appears that they were simply accused of lack of investment and forced to withdraw. VINCI, which is expected to enter the market in the future, is also facing this claim at some airports in countries such as Portugal and Cambodia.

Lack of investment is a standing government position, but AviAlliance, VINCI and others never comment on these issues.

If there has been a lack of investment, it is probably because operators have been exposed to this threat for too long.

AviAlliance completes acquisition of Athens.Vinci is shaken by the knockback in court.

AviAlliance may not be too concerned about this, as it recently acquired full operational control of Athens International Airport in the Greek capital, but this will undoubtedly occupy most of the immediate attention and the airport This will further emphasize the company's position in the community.

VINCI was informed on April 10, 2024 that a claim for damages of approximately 1.6 billion euros against the French government arising from the abandonment of the Notre-Dame-des-Landes airport project has been rejected by a French court, and there is no doubt that It will be. . The court said only that “certain damages” could be paid at a later stage.

Qatar's sovereign wealth fund could bring financial expertise and resources…

The outsider in all this is the Qatar Investment Authority (QIA), which has been frequently mentioned as a potential investor in this deal if it goes through. QIA is not to be confused with Qatar Airways, which has become an investor in its own airport business.

Rather, QIA is the country's sovereign wealth fund and has been investing for some time in London Heathrow Airport (20% as Qatar Holding) and St. Petersburg Pulkovo Airport, the latter with overall ownership in a Russian state-owned holding company. The changes have made it more complicated. It acquired the company in early 2024 in another strategic political move to marginalize the private sector in the eastern part of the continent.

Lately, QIA has been focusing on Pakistan's airports and possibly investments in Pakistan Airlines.

Although QIA is a “hands-off” investor in airports, its appeal to the Hungarian government is its financial strength as the world's eighth largest sovereign wealth fund with assets of more than $500 billion.

The question is whether the reduced influence Western governments have in Hungary will be enough to deter the Hungarian government from engaging with Qatar and other Gulf states. There are rumors that Western governments “forced” Hungary to abandon its plans.

When this deal goes through, it will come at a time of political change in East-West relations.

Amid growing political pressure to return to the old Iron Curtain and Soviet-era Comecon era, when state parastatals controlled key economic sectors, European countries, especially those in the east of the continent, are We will be watching events carefully. These countries were known before the group disbanded in 1991.

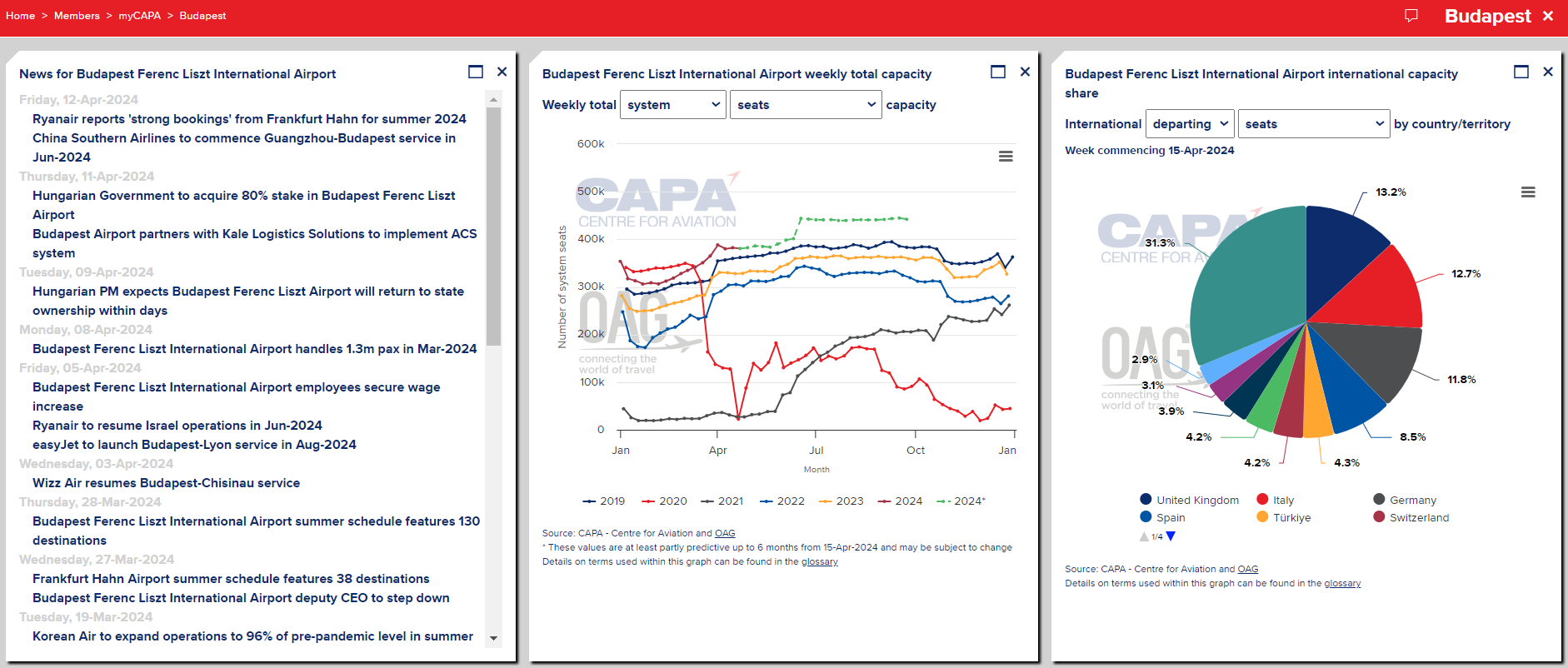

Insight: Create your own customizable Budapest data dashboard with myCAPA

myCAPA is a new feature on the CAPA – Center for Aviation website that provides members with complete customization of their user experience.

This allows you to create personalized dashboards from a variety of intelligence on the CAPA – Center for Aviation website, including data, news, profiles, and more.

Users can see everything in one place and save time searching for information.