The Clinuvel Pharmaceuticals (ASX:CUV) share price has increased by a significant 8.7% over the past month. Since the market usually pays for a company's long-term fundamentals, we decided to investigate whether a company's key performance indicators are influencing the market. Specifically, in this article we decided to examine Clinuvel Pharmaceuticals' ROE.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. In other words, it is a profitability ratio that measures the rate of return on the capital provided by a company's shareholders.

Check out our latest analysis for Clinuvel Pharmaceuticals.

How do I calculate return on equity?

of Calculation formula for return on equity teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, Clinuvel Pharmaceuticals' ROE is:

17% = AUD 30 million ÷ AUD 179 million (based on the trailing twelve months to December 2023).

“Earnings” is the amount of your after-tax earnings over the past 12 months. One way he conceptualizes this is that for every A$1 of shareholders' equity, the company earned him A$0.17 in profit.

What is the relationship between ROE and profit growth rate?

It has already been established that ROE serves as an indicator of how efficiently a company will generate future profits. Now we need to evaluate how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company's growth potential. Assuming everything else remains constant, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily have these characteristics.

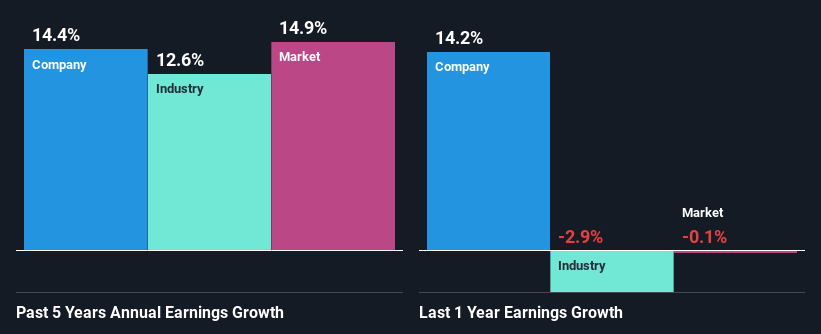

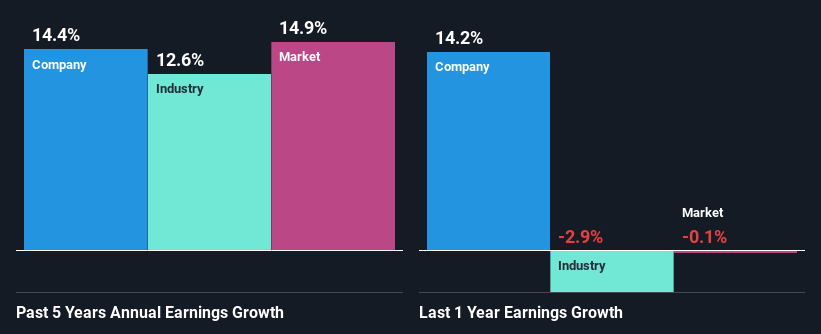

A side-by-side comparison of Clinuvel Pharmaceuticals's earnings growth and ROE of 17%.

At first glance, Clinuvel Pharmaceuticals appears to have a decent ROE. Moreover, his ROE for the company is very good compared to the industry average of his 9.2%. Perhaps as a result of this, Clinuvel Pharmaceuticals has been able to grow at a respectable 14% over the past five years.

As a next step, we compared Clinubel Pharmaceuticals's net income growth with its industry and found that the company has grown at a similar rate when compared to the industry's average growth rate of 13% over the same period.

Earnings growth is a big factor in stock valuation. Investors should check whether expected earnings growth or decline has been factored in in any case. Doing so will help you determine whether a stock's future is promising or ominous. One good indicator of expected earnings growth is the P/E ratio, which determines the price the market is willing to pay for a stock based on its earnings outlook. So you might want to check whether Clinuvel Pharmaceuticals is trading on a higher or lower P/E ratio compared to its industry.

Does Clinuvel Pharmaceuticals reinvest its profits efficiently?

Clinuvel Pharmaceuticals' three-year median payout ratio is a low 6.9%, meaning the company retains the remaining 93% of its profits. This suggests that management is reinvesting most of its profits into growing the business.

Additionally, Clinuvel Pharmaceuticals has been paying dividends for six years. This shows that the company is committed to sharing profits with shareholders. According to our latest analyst data, the company's future dividend payout ratio is expected to rise to 10% over the next three years. In any case, despite the higher expected dividend payout ratio, ROE is not expected to change significantly.

conclusion

Overall, we feel that Clinuvel Pharmaceutical's performance is very positive. Specifically, we like that the company reinvests a huge amount of its profits at a high rate of return. Of course, this significantly increased the company's revenue. According to the latest industry analyst forecasts, the company is expected to maintain its current growth rate. If you want to know the latest analyst forecasts for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.