(Bloomberg) — Apple's iPhone shipments fell 10% more than expected in the March quarter, reflecting weak sales in China despite a broad recovery in the smartphone industry.

Most Read Articles on Bloomberg

The company shipped 50.1 million iPhones in the first three months, according to preliminary figures from IDC, which was below the average of 51.7 million expected by analysts for the same period compiled by Bloomberg.

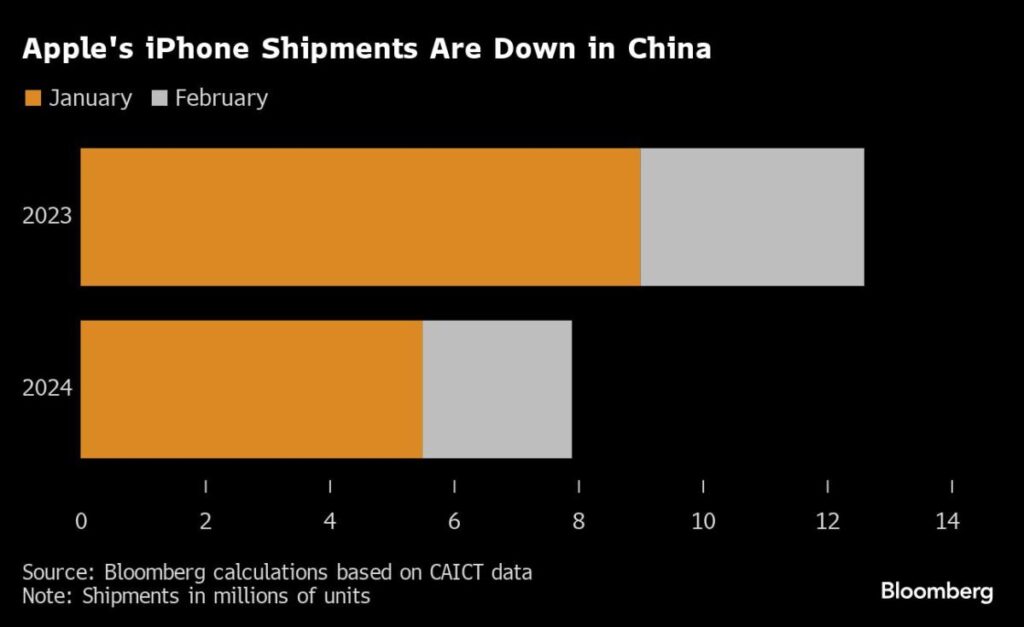

The Cupertino, California-based company has struggled to maintain sales in the world's largest smartphone market since the latest generation iPhone debuted in September. Sales have been weighed down by the resurgence of Huawei Technologies Co., Ltd., increased domestic competition and the Chinese government's ban on the use of foreign-made equipment in the workplace.

This slump is especially noticeable as the overall mobile market is registering its highest growth in years. Smartphone makers shipped 289.4 million devices during the period, an increase of 7.8% from the lows a year ago, when many manufacturers were struggling with unsold devices. Samsung Electronics regained the top spot in the March quarter, while budget brand Transsion increased shipments by 85% and Xiaomi rebounded to close the gap with second-place Apple.

“The smartphone market is emerging from the turbulence of the past two years stronger and changing,” said Nabila Popal, research director at IDC. “Although the top two companies both recorded negative growth in the first quarter, Samsung appears to be in a stronger position overall than it has been in recent quarters.”

Key Apple suppliers Hon Hai Precision Industries, Murata Manufacturing, LG Innotek and TDK fell in early Asian trading on Monday amid widespread selling on concerns about escalating conflict in the Middle East.

Apple's iPhone has shown the most resilience during the pandemic, as consumers refrained from buying smartphones from most of its Android-powered rivals. This stockpile led to aggressive pricing by Chinese competitors like Xiaomi, which took months to exhaust the excess supply but is now starting to resume shipments. Huawei made a surprising comeback last year with its Mate 60 series equipped with its own Chinese chips and HarmonyOS operating system, and has been eating into Apple's share of China's premium market since August.

“Increased competition in China was a major reason for Apple's weakness in the first quarter,” Popal said. Elsewhere, many regions started the year with excess iPhone inventory due to heavy shipments in the final months of 2023, he added.

IDC researchers found that consumers are increasingly choosing premium models that they intend to keep for a long time, driving up the average selling price of devices. Apple is leading the way in this area, consistently having the highest ASP in the industry, and consumers clearly prefer its top models. Still, the company has resorted to unusual discounts this year to boost sales, with some retail partners in China offering up to $180 off regular prices.

In March, Apple opened a major new store in the heart of the financial capital of Shanghai, with CEO Tim Cook in attendance. China is home to the company's largest retail network outside the United States, accounting for about a fifth of its sales, and is still driven by the iPhone. However, many of the participants interviewed by Bloomberg at the Shanghai store's launch had purchased their iPhones more than two years ago. And while these Apple fans said they intended to stay within the Apple ecosystem, some said they were also considering foldable device options from rivals and Huawei's Mate 60 successor.

Bloomberg intelligence statement

–With assistance from Jessica Sui.

(Update stock reactions and comments)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP