Last year, the artificial intelligence (AI) boom shook the technology industry. His announcement of OpenAI's ChatGPT reignited interest in the technology and highlighted how far AI has come. As a result, countless companies are pivoting their operations to emerging areas in hopes of getting a piece of the $200 billion pie.

According to Grand View Research, the AI market is expected to expand at a compound annual growth rate of 37% through at least 2030, and its valuation is expected to reach nearly $2 trillion by the end of the decade.

So it's never too late to invest in AI, making chip stocks one of the most attractive options. These companies are developing the hardware needed to train and run AI models, suggesting they are well-positioned to benefit from AI market tailwinds for years to come.

As a major chip manufacturer, Nvidia (NASDAQ:NVDA) and intel (NASDAQ:INTC) AI has great potential. However, these companies are at very different stages in their AI journeys, which could mean there is more room for them in the long term.

So let's take a closer look at these chipmakers to determine whether Nvidia or Intel is the better AI stock right now.

Nvidia

Nvidia's business has exploded over the past year. The company's stock price has risen 230% since April last year. Meanwhile, quarterly sales and operating profit rose 207% and 536%, respectively, due to a surge in semiconductor sales.

In 2023, Nvidia cornered the AI graphics processing unit (GPU) market while many competitors scrambled to catch up. Nvidia had a head start and was able to take full advantage of the increased demand for AI GPUs, capturing an estimated 90% market share.

Nvidia's rapid growth has led some analysts to question how much room the company has left. But the company's stock continues to beat expectations, rising 60% in the past three months. On the other hand, NVIDIA's free cash flow is Last year, it increased by 430% to more than $27 billion. This shows that the company has the funds to continue investing in AI and maintain its market dominance.

Given AI's huge potential and Nvidia's position in the market, I'm not against AI long-term.

intel

Nvidia's established role in AI makes it one of the more reliable options. However, it may be worth looking at companies like Intel that are less entrenched in the industry but have more growth potential.

Intel has faced some obstacles in recent years. The company's stock price has fallen about 45% over the past three years as its market share for central processing units (CPUs) has declined and a partnership with the company of more than a decade has ended. apple.

However, Intel has made significant changes to its business and could be back on track in the coming years. Last June, Intel announced a “fundamental shift” in its business, adopting an in-house foundry model that it believes will lead to savings of $10 billion by 2025.

Additionally, Intel is making inroads into AI. In December 2023, the company debuted various AI chips, including his Gaudi3, a GPU designed to compete with similar products from Nvidia. Intel also showed off new Core Ultra processors and Xeon server chips, which include neural processing units to run AI programs more efficiently.

Intel is on the road to recovery, but it will take time for its financial position to reflect recent changes. As a result, investing in Intel is recommended for patient investors who are willing to hold for at least 10 years.

Which is a better AI stock: Nvidia or Intel?

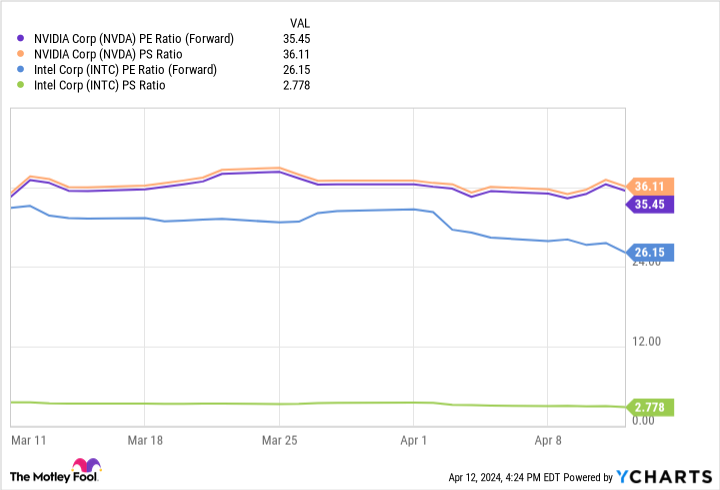

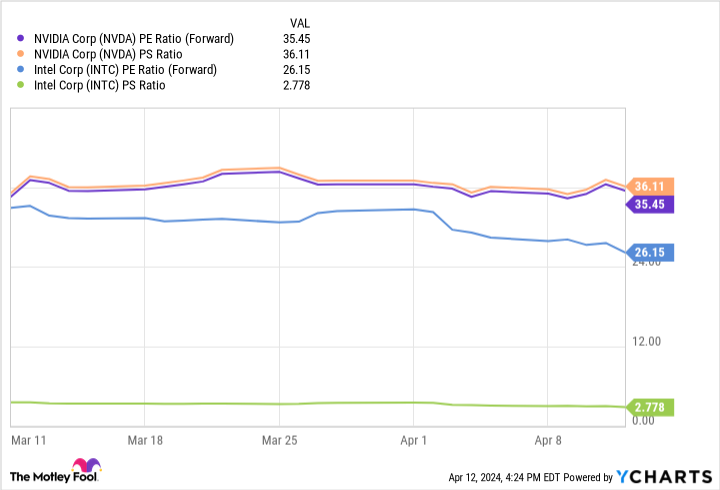

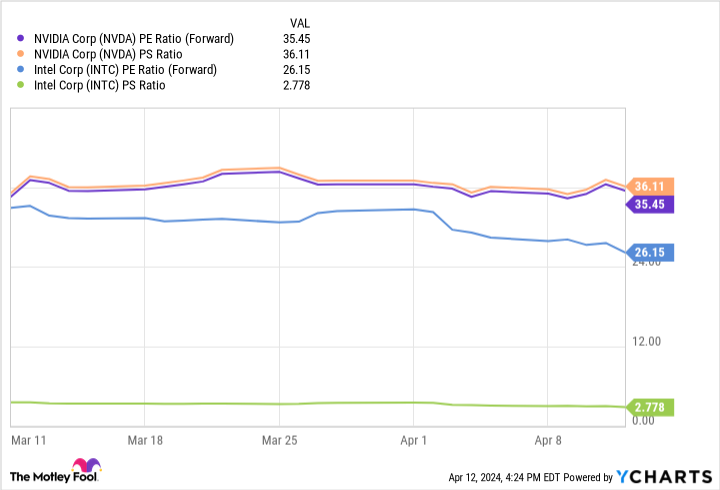

This chart shows that Intel's stock is trading significantly better than Nvidia's, with a much lower forward price-to-earnings (P/E) and price-to-sales (P/S) ratio.

Forward P/E ratio is calculated by dividing a company's current stock price by its estimated earnings per share. P/S, on the other hand, is market capitalization divided by last 12 months' earnings. These are useful evaluation indicators because they take into account a company's financial health. In both cases, the lower the number, the more valuable it is.

As a result, Intel's low forward P/E and P/S suggest that its stock is trading at a discount compared to Nvidia. However, the question is which AI stock is better, not which value is better.

So the answer lies with investors. If you're looking to invest in an established AI company that will deliver consistent but potentially small returns over many years, Nvidia is the answer. But if you're betting on Intel's ability to turn things around and potentially reap big rewards for your efforts, AI stocks are the ones to buy.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of April 8, 2024

Dani Cook has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia. The Motley Fool recommends Intel and recommends the following options: These are a long call on Intel at $57.50 in January 2023, a long call on Intel at $45 in January 2025, and a short call on Intel at $47 in May 2024. The Motley Fool has a disclosure policy.

“Better AI Stock: Nvidia vs. Intel” was originally published by The Motley Fool.