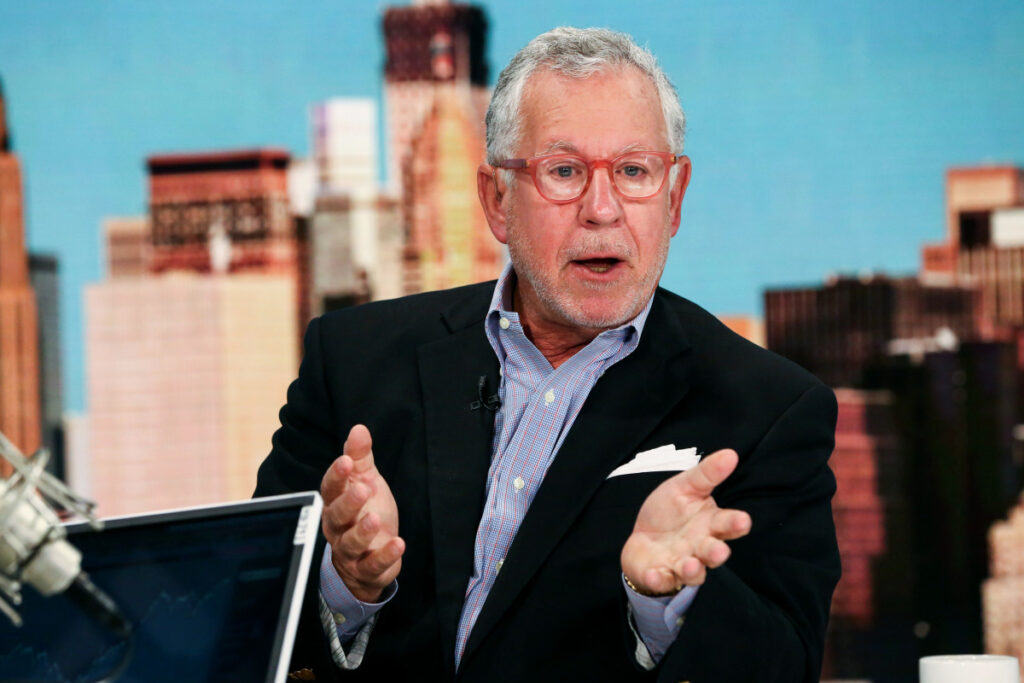

Jim Davis/Boston Globe (via Getty Images)

Summers sees possibility of rate hike

Larry Summers, a Harvard economist and former Treasury secretary, thinks there's a 15% to 25% chance the Fed will raise rates this year.

A strong economy is fueling stock market gains due to changes in interest rate forecasts. Growth slowed to 2.4% in the first quarter, according to the Atlanta Fed's GDPNow forecasting tool, but the numbers are still encouraging.

Investors expect economic strength to boost earnings. Analysts expect first-quarter earnings for the S&P 500 to rise 3.2% from a year ago, marking the third straight quarterly increase, according to FactSet.

Related article: Analysts overhaul S&P 500 targets ahead of earnings season

Earnings season began on April 12th, with major banks reporting mixed results.

Another factor that has pushed stocks higher over the past year is, of course, investor enthusiasm for artificial intelligence. This led to a rise in technology stocks in particular. The Nasdaq Composite Index, which has a high proportion of tech stocks, hit an all-time high on April 11th. AI giant Nvidia is up about 125% from its lows last October.

S&P 500 valuation is soaring

The market rally has pushed stock valuations above historical levels. According to FactSet, the S&P 500's price-to-earnings ratio (P/E) as of April 5 was 20.5, higher than the five-year average of 19.1 times and the 10-year average of 17.7 times.

For some experts, this is a sign that the stock is overvalued (overvalued). One bear is Vincent Mortier, chief investment officer at Amundi, Europe's largest asset manager. “It feels like we're at the beginning of 2000,” when tech stocks crashed, he told Bloomberg.

Fund manager interview:

Problems in the commercial real estate market mean it's “a little bit like 2007” when the financial system started to become unstable, he said.

Fund manager Doug Kass' harsh view on stocks

Another notable bear is Doug Kass of TheStreet Pro. He is a hedge fund manager whose career spanned the 1970s and included a stint as director of research at Leon Cooperman's Omega Advisors.

Like Summers, he doesn't think inflation will go away easily. “The Fed's 2024 narrative that inflation is under control is as reckless and misguided as its 2021 narrative that inflation is temporary,” Kass wrote on April 11.

On April 6, he cited a number of factors that could weigh on future stock prices.

Related: Risks are immediate: Doug Kass

Kass' long bearish list of headwinds suggests that a lot has to go right for the stock to continue rising, but not too much bad for the stock to fall.

Related: Veteran fund manager picks stocks to watch in 2024