Cybersecurity executives are embroiled in a war of words. In a recent conference call and subsequent follow-up on his Twitter/X, the national CEO said: palo alto networks (NASDAQ:PANW) and crowdstrike holdings (NASDAQ: CRWD) Both sides fired at competitors, including each other. CrowdStrike CEO George Kurtz even mentioned Palo Alto by name in prepared remarks. This is despite the fact that the two giants do not directly compete in their core businesses of network security (Palo Alto) and endpoint security (CrowdStrike).

Meanwhile, small businesses are achieving solid, profitable growth behind the scenes. One such cybersecurity provider is: Qualis (NASDAQ: QLYS), just reported new consistent financial results. Despite the recent decline, the stock price has doubled in the past five years. Here's what investors need to know about his Qualys in 2024 and beyond.

Attractive cybersecurity stocks

Qualys provides a set of cloud-based software tools to help organizations with security compliance. Scans for security vulnerabilities and suggests fixes for any weaknesses found. As IT infrastructures become more complex with a mix of traditional internal networks and public clouds, the number of devices and apps that large enterprises need to track and keep secure is rapidly increasing. The Qualys platform plays a critical role in your company's cybersecurity efforts.

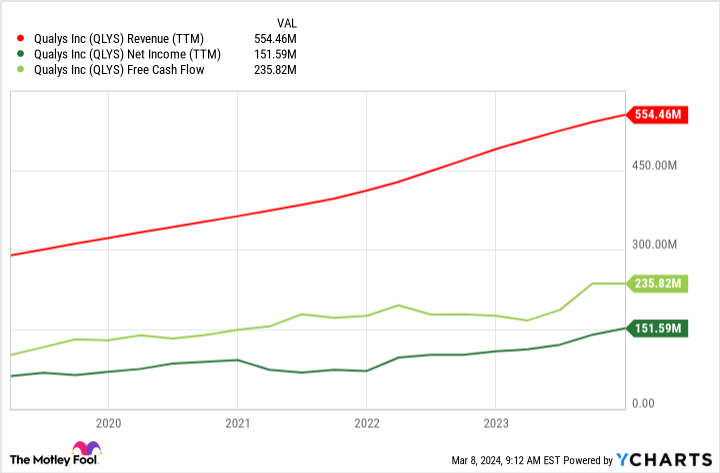

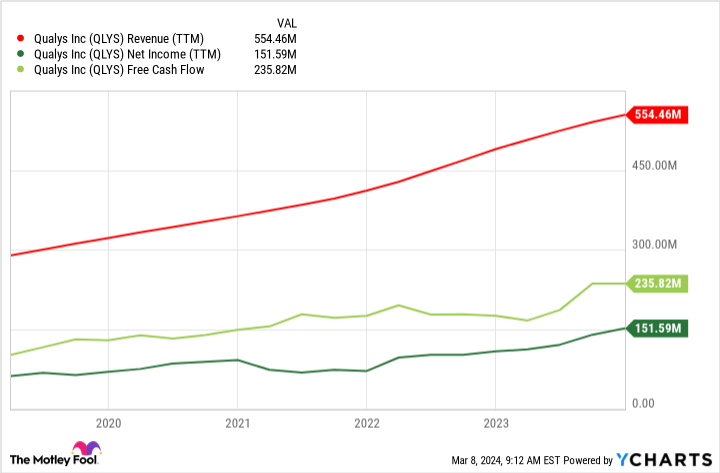

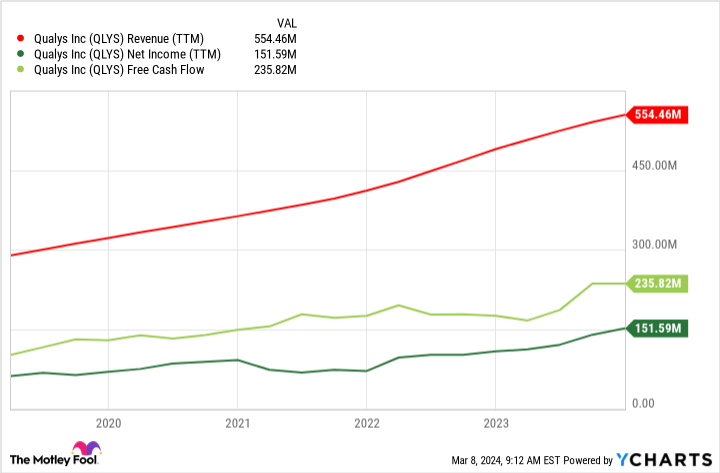

Qualys isn't the fastest-growing cyber specialist in the industry, but its average revenue growth since 2020 has been in the low to mid-10s. It's a small company with only $555 million in revenue in 2023 (compared to the company's billions in annual sales). (The largest pure cybersecurity initiative). And while many security software platform providers struggle with profitability, Qualys actually offers investors an attractive proposition with solid GAAP net income and free cash flow (FCF) generation despite its size. provided to you. His FCF return last year was an impressive 42.5%, making him one of the highest cash generators among its peer group.

Qualis is channeling the majority of this FCF into share buybacks, returning $171 million and $317 million to shareholders in 2023 and 2022, respectively. The company's balance sheet is solid with $426 million in cash and short-term investments, and no debt.

Qualys expects revenue to grow between 8% and 10% in 2024, based on management's current outlook. Again, you won't find a growth record here, but when combined with its profitability and healthy balance sheet, there could be a lot to like about Qualys for the right investor.

Will competition kill Qualys?

As a highly profitable company, Qualys stock is a rare value play in the high-growth but usually expensive cybersecurity market. Qualys' stock currently trades at 42 times its trailing 12-month earnings per share (EPS) and 27 times his trailing-12-month FCF.

But some of the maneuvering between Palo Alto and CrowdStrike could actually hurt smaller companies like Qualis the most. The two cybersecurity giants are also expanding into ancillary areas. This includes Compliance and Data Security Posture Management (DSPM), the very niche Qualys, and other smaller peers. Tenable It works.

both in palo alto and CrowdStrike has acquired DSPM in recent months to grow its own platform and expand its security software market share (Palo Alto just announced its acquisition of Dig and Flow Security and joining CrowdStrike) is).

This year's Qualys is definitely worth watching. The company is still putting up respectable numbers and clearly provides a valuable service that many organizations need right now. However, due to increased competition, the stock still looks a little expensive to me at the moment, even in relative value compared to its larger peers. Still, I'm interested enough to keep an eye on this small business as 2024 progresses and the cybersecurity wars intensify.

Should you invest $1,000 in Qualys right now?

Before purchasing Qualys stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Qualys wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Nicholas Rossolillo and his clients have positions at CrowdStrike and Palo Alto Networks. The Motley Fool has positions in and recommends CrowdStrike, Palo Alto Networks, and Qualys. The Motley Fool has a disclosure policy.

1 Little-Knowed Cybersecurity Stocks Investors Should Watch in 2024 was originally published by The Motley Fool