Cybersecurity has been one of the hottest investment areas in recent years. This is perhaps not surprising considering the number of high-profile cybersecurity attacks and breaches. For example, the casino industry was attacked by: MGM Resorts and caesars entertainment Last year, early this year united health group Subsidiary Change Healthcare fell victim to a ransomware attack.

Meanwhile, relentless cybersecurity attacks across various industries continue to increase spending to stop and prevent these attacks. One company trying to help prevent these cybersecurity attacks is Z scaler (NASDAQ:ZS).

The company is in an attractive industry, but the question is whether the stock is a buy after the recent sell-off.

Benefit from Zero Trust

Not all cybersecurity companies are created equal or focused on the same things. For example, Zscaler is primarily focused on the zero trust space. This cybersecurity model is based on the idea that individual users and devices should not be trusted, even if they reside on an organization's network. Therefore, all users must be verified, authorized, and continually verified.

Zero trust is one of the fastest growing areas in cybersecurity, with global spending expected to grow at a compound annual growth rate (CAGR) of nearly 17% through 2028. In the case of Zscaler, its most recent results showed strong revenue growth of 35%. Billings increased 27% in the quarter. Billings represent the amount a company charges its customers and is often a good indicator of future revenue growth.

Within Zero Trust, Zscaler offers three main solutions for both users and workloads: Zscaler Internet Access (ZIA), Zscaler Private Access (ZPA), and Zscaler Digital Experience (ZDX). ZIA is used to provide secure access to an organization's websites and apps, and ZPA can grant users access without revealing their identity or location. ZDX, on the other hand, helps organizations determine whether the issue is caused by the Internet connection, service provider, or user device.

Upselling and large customer growth

One of the biggest strengths Zscaler has shown is its growing customer base. This is evidenced by the high net dollar retention rate. For the fiscal year that ended in July, the company's net dollar retention rate was 121%. In the most recent quarter ending in January, this metric was 117%. Net dollar retention measures the amount of revenue you earn from existing customers after cancellations, upgrades, and downgrades. This metric shows that customers not only continue to use her Zscaler, but also continue to purchase more of its services.

Zscaler does a particularly good job of upselling and bundling solutions to large organizations. The company ended last quarter with 497 customers spending more than $1 million on an annual basis. This was a 31% increase from his 378 customers a year ago and a continued 6% increase from his 468 customers last quarter. Meanwhile, the number of customers who spent $100,000 or more with the company increased 21% year over year to 2,820.

Another area where the company is doing well is that it has begun to leverage industry-specific experts to sell to specific industries. The company launched this approach last year in the public sector and has expanded to other areas such as healthcare. The company signed a large healthcare deal last quarter aimed at securing patient records, and given the recent UnitedHealth Group breach, this appears to be an area of great opportunity.

pay the price for growth

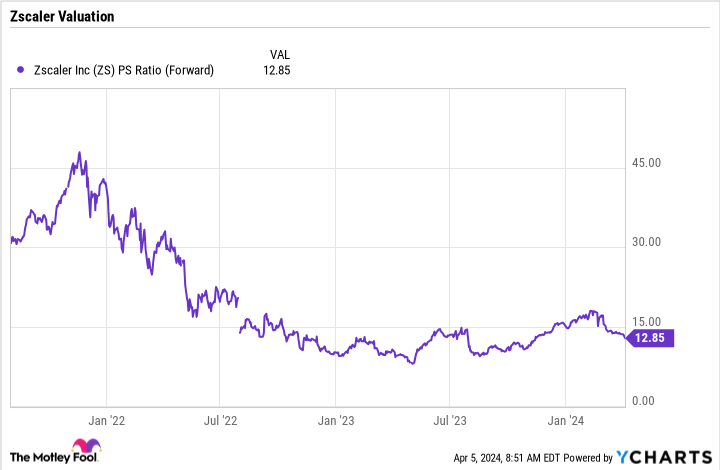

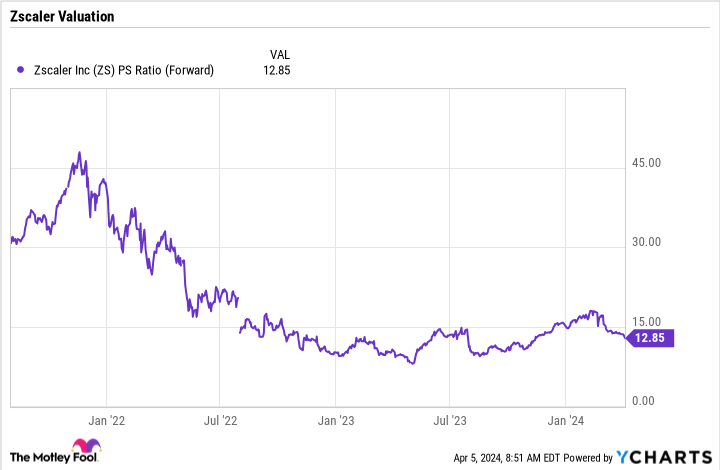

From a valuation perspective, Zscaler trades at just over 13 times forward earnings, which is not a cheap deal. However, this is a significant discount compared to the stock price a few years ago.

Zscaler has fallen from its highs for several reasons. The company's chief operating officer (COO) resigned earlier this year, but investors may not have liked the slowdown in sales growth. The company also announced quarterly results just days after the cybersecurity company. palo alto had warned of signs of “spending fatigue,” so it's likely that investors were a little more critical after the rival's sudden warning. However, none of these issues will impact the company's long-term performance.

ZS PS Ratio (Forward) Data by YCharts

If Zscaler can continue to grow its revenue by 20% to 30% over the next few years (which seems likely given the global growth forecast for Zero Trust Security over the next five years), the stock price will should be well above the current valuation. Therefore, I think Zscaler is a buy at current levels as it should be one of the big winners in the cybersecurity space in the long run.

Should you invest $1,000 in Zscaler now?

Before buying Zscaler stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Zscaler wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

when to think about it Nvidia This list was created on April 15, 2005…if you invested $1,000 at the time of recommendation. you have $539,230!*

stock advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month.of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor will return as of April 4, 2024

Jeffrey Seiler has no position in any stocks mentioned. The Motley Fool owns a position in and recommends Palo Alto Networks and Zscaler. The Motley Fool recommends his UnitedHealth Group. The Motley Fool has a disclosure policy.

Is Zscaler a buy on the spur of the moment?Originally published by The Motley Fool