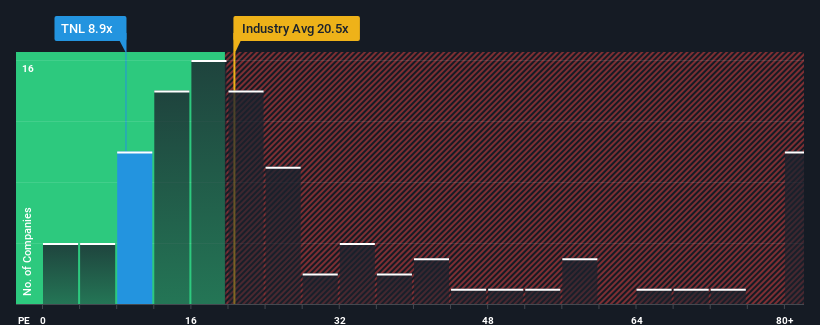

Given that nearly half of U.S. companies have a price-to-earnings ratio (or “P/E”) of more than 18 times, you may want to consider the following. Travel + Leisure Co., Ltd. (NYSE:TNL) is an attractive investment with a P/E ratio of 8.9x. However, there may be a reason for the low P/E ratio, and further investigation is needed to determine if it's justified.

Travel + Leisure has been doing really well lately, with revenue growth in positive territory compared to declining revenue for most other companies. Many are probably expecting the strong performance to deteriorate significantly, perhaps even worse than the market that drove down the P/E ratio. Even if it doesn't, existing shareholders have reason to be very optimistic about the future direction of the share price.

See the latest analysis for Travel + Leisure.

Want to know how analysts think the future of Travel + Leisure compares to the industry? free Reports are a great place to start.

What are the growth trends in Travel + Leisure?

Travel + Leisure's P/E ratio is probably typical for a company that is expected to have limited growth and, importantly, perform worse than the market.

First, looking back at the past, we can see that the company grew its earnings per share by an impressive 23% in the last year. However, his last three years haven't been all that great as he hasn't shown any growth. So it looks like the company has had mixed results in terms of revenue growth over this period.

Looking ahead, 9 analysts who follow the company say that EPS is expected to increase by 5.8% over the next year. The company's earnings are expected to worsen as the market predicts he will grow by 11%.

With this in mind, it's understandable that Travel + Leisure's P/E is lower than most other companies. Apparently, many shareholders were reluctant to continue holding on to the company, given the possibility that it would lose its future prosperity.

What can we learn from the Travel + Leisure PER?

Generally, we like to limit our use of price-to-earnings ratios to establishing what the market thinks about a company's overall health.

As expected, we find that Travel + Leisure maintains a low P/E ratio due to its weaker growth forecast than the broader market. For now, shareholders are accepting the low P/E ratio as they accept that future earnings probably won't come as a pleasant surprise. Unless this situation improves, a barrier to stock prices will continue to form around these levels.

You should always think about risk.Good example we found 3 warning signs for travel and leisure Note that one of them is important.

of course, You might even find a better stock than Travel + Leisure.So you might want to see this free A collection of other companies with reasonable P/E ratios and strong earnings growth.

Valuation is complex, but we help make it simple.

Please check it out travel + leisure Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.