Cybersecurity will be a key part of the digital economy going forward. Businesses are financially incentivized to use the best security tools to protect their data and systems. Did you know that the average breach costs a business nearly $4.5 million? This is because IBM.

But outdated products like antivirus software are often no longer cutting it – that's where next-gen solutions come in. Investors have a wide variety of cybersecurity stocks to choose from, but after some due diligence, three have emerged that could be long-term winners.

Here are three cybersecurity stocks to buy and hold for the next decade.

1. Palo Alto Networks

Firewalls have been important for security for many years. Palo Alto Networks (Nasdaq:PANW) A firewall is like a security guard at a party checking the guest list to make sure only invited people get in. A firewall monitors the traffic in and out of your network, looking for anything suspicious. Palo Alto Networks firewall security is top-notch. GartnerThe prestigious Magic Quadrant The rankings rate this product as a leader in its category.

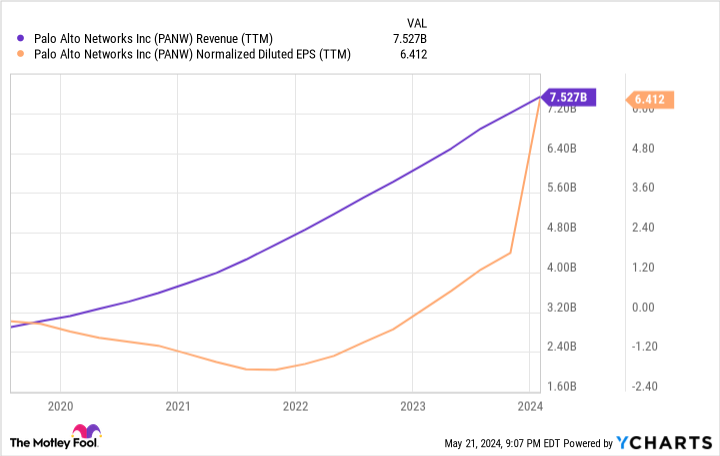

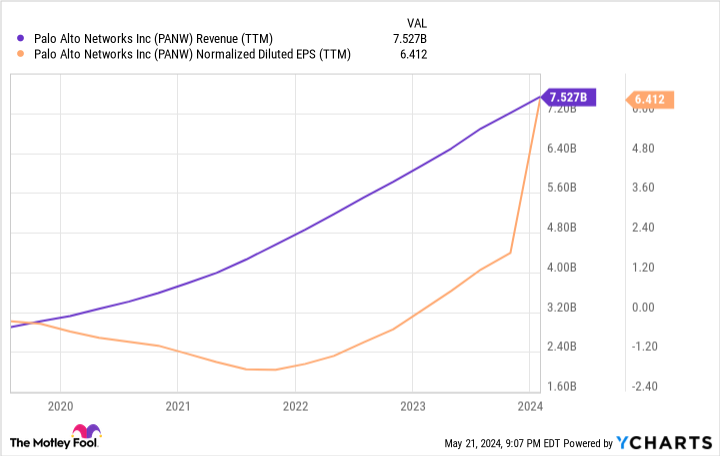

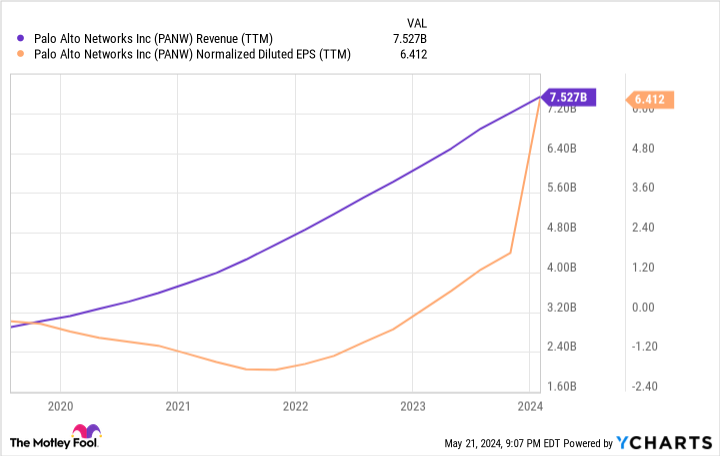

Currently, Palo Alto Networks has over 70,000 active customers and continues to grow by expanding its product offering to include additional security categories with two other platforms, bringing the company's platforms to three: network security, cloud security, and security operations. Currently, only half of the company's customers use two of the three platforms, and only 13% use all three, so there is an opportunity for cross-selling.

Palo Alto is one of the largest security companies with annual revenues of over $7.5 billion. Revenues have skyrocketed in recent years, and analysts believe profits will continue to grow at an average annual rate of 22% over the next three to five years. The company's large customer base and scale give it a powerful edge in capturing customer security budgets for the next decade.

2. CrowdStrike Holdings

Endpoint security is one of the focuses of next-generation solutions, CrowdStrike Holdings (Nasdaq: CRWD) is quickly proving to be a winner in this space. Endpoint security protects devices on a network (endpoints), such as computers and mobile devices. CrowdStrike uses artificial intelligence (AI) and a cloud-based platform to provide immediate and effective protection against potential threats. The platform learns from threat encounters, so the product grows and improves as it encounters more threats.

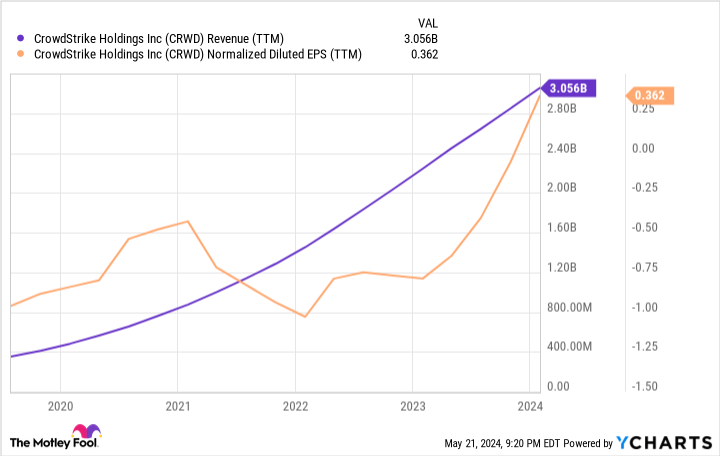

CrowdStrike sells different products and services as modules, which makes it very easy to cross-sell products. Customers can choose what they need based on their needs. CrowdStrike has released modules as it expands into new categories. Today, 27% of CrowdStrike customers use at least seven modules, and the number of customers using at least eight modules has more than doubled since the end of 2023.

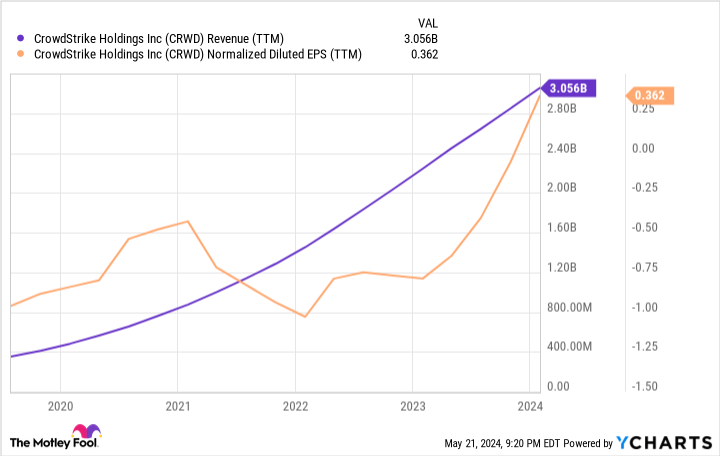

A combination of growing customer base and cross-selling has driven the company's phenomenal growth, with revenues increasing from $400 million to $3 billion in just four years. And with revenues reaching a scale where they can start to skyrocket, the stock is a bright spot for long-term investors. Analysts believe CrowdStrike's revenues will grow at an average annual rate of 22% over the next three to five years.

3. Microsoft

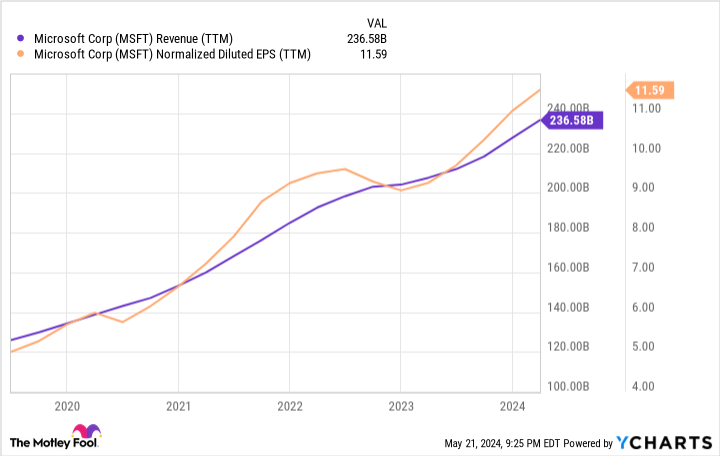

Technology giants Microsoft (Nasdaq: MSFT) When discussing cybersecurity growth stocks, Microsoft isn't the first stock that comes to mind. And it's not growing as fast as some of the other companies on this list. But Microsoft offers a much higher bottom line because it's a diversified company with top-tier operations in multiple industries. Microsoft Defender security products are built into Windows and Office software.

Want investments that will help you sleep better at night? Look no further. Palo Alto Networks and CrowdStrike are a fraction of what Microsoft makes each year. The company has a rock-solid balance sheet with a AAA rating, one of only two publicly traded companies with such a status. It's also the only company on this list that pays a dividend; Microsoft has paid dividends for over 20 consecutive years.

Microsoft Defender will never be the center of shareholder attention, and that's OK. The stock could give investors exposure to cybersecurity with the added bonus of enterprise software, cloud, gaming, and more. Microsoft is still growing despite its massive size. Analysts are predicting the company's revenue to grow 16% annually over the next three to five years, making Microsoft a well-rounded company that investors can hold for the long term with confidence.

Should I invest $1,000 in Palo Alto Networks right now?

Before you buy Palo Alto Networks stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Palo Alto Networks wasn't among them. The 10 stocks selected could generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $652,342.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 13, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends CrowdStrike, Microsoft, and Palo Alto Networks. The Motley Fool recommends Gartner and International Business Machines and recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The article 3 Cybersecurity Stocks to Buy for the Next Decade was originally published by The Motley Fool.