The cybersecurity industry has been expanding at a healthy pace for many years. This is not surprising given the increasing adoption of cloud computing and connected devices, the escalation of cyber attacks, and the increasing sophistication of cyber threats.

I can explain the reason to some extent gartner predicts that global cybersecurity spending will increase by 14.3% in 2024 to nearly $215 billion. This comes after cyber spending increased by 10.6% last year. The cybersecurity market will continue to expand at a good pace over the next decade, and is expected to generate $534 billion in revenue by 2032.

Given the long-term growth opportunities, buying the right cybersecurity stocks and holding them for the next 10 years can be a profitable move.So now would be a good time to take a closer look. sentinel one (NYSE:S) and data dog (NASDAQ:DDOG)the two companies are on track to capitalize on different but rapidly growing cybersecurity niches.

1. Sentinel One

SentinelOne provides a unified cybersecurity platform powered by artificial intelligence (AI) known as Singularity. This enables businesses to prevent, detect, and respond to threats across all endpoints. Its solutions can also be deployed to protect cloud workloads.

The demand for AI-powered cybersecurity solutions is expected to increase rapidly. According to Grand View Research, the $16 billion AI-enabled cybersecurity market could grow to nearly $94 billion in revenue in 2030. SentinelOne reported revenue of $573 million in the subsequent 12 months. This means we've only scratched the surface of a lucrative market. .

The expanding market explains why the company is growing at an incredible pace. His revenue for the third quarter of 2024 (ending October 31, 2023) was $164 million, an increase of 42% year over year. SentinelOne expects him to end fiscal year 2024 with revenue of $616 million, which would represent a 46% increase compared to his fiscal year 2023 level.

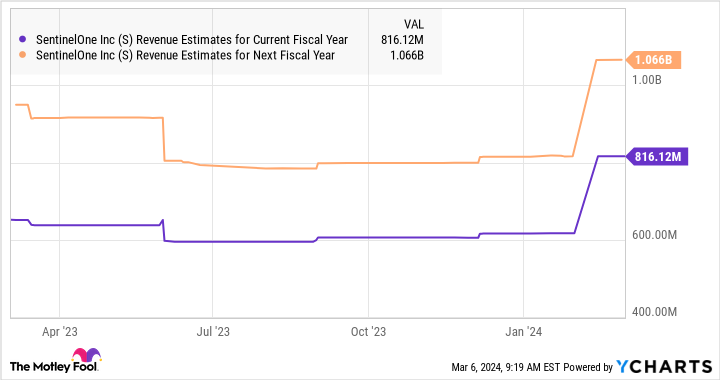

Additionally, SentinelOne is expected to post revenue growth of over 30% over the next few fiscal years as well, as the following chart shows.

However, don't be surprised if SentinelOne beats Wall Street expectations going forward and posts faster growth. That's because the company is expanding its customer base and capturing a larger share of customers' wallets. SentinelOne's client count increased approximately 28% year-over-year to 11,500 in the last reported quarter. The number of customers with annual recurring revenue (ARR) over $100,000 grew at a fast 33% year over year.

ARR refers to the annual revenue run rate for SentinelOne's subscription and capacity contracts at the end of the term. Therefore, an improvement in the number of customers with an ARR of more than $100,000 indicates an increase in demand for the product. Given that SentinelOne is integrating AI-powered generation tools into its cybersecurity platform, it could be able to win more business from existing customers and attract new ones as well. .

Not surprisingly, analysts predict SentinelOne's revenue to grow at an annualized rate of 40% over the next five years. The end-market opportunity in the AI-powered cybersecurity space means it could sustain this impressive growth over time, making it a solid investment for the next decade.

2. Data Dog

Unlike SentinelOne, Datadog is not a pure cybersecurity provider as it sells a cloud-based monitoring and analytics platform. Datadog's Software-as-a-Service (SaaS) platform allows customers to monitor cloud infrastructure, networking performance, databases, application performance, and more.

But at the same time, the company also offers security products for cloud applications. This means the company is well-positioned to take advantage of significant growth opportunities. Datadog's cloud security platform allows customers to detect threats, manage vulnerabilities, and perform risk assessments in real-time.

Management noted during the fourth quarter 2023 earnings conference call that more than 6,000 customers use the company's cloud security products. The company doesn't reveal exactly how much revenue it generates from the cloud security segment, but it expects this market to be a major growth driver. Datadog said in an investor presentation that the revenue opportunity in the cloud security market is worth $21 billion at the end of 2023.

Datadog expects this addressable market to grow at 16% annually through 2027. Meanwhile, Datadog points out that the revenue opportunity in the cloud observability market was worth $51 billion last year. This market is projected to grow by 11% annually over the next five years, indicating the company is sitting on multiple catalysts.

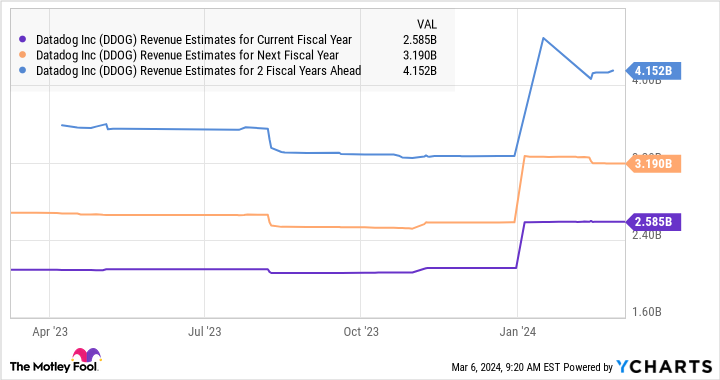

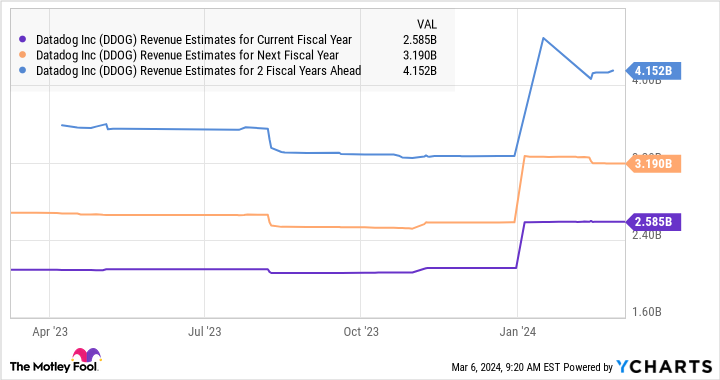

Datadog generated revenue of $2.13 billion in 2023, an increase of 27% year over year. The company expects revenue to increase 21% to $2.57 billion in 2024 due to a cautious customer spending environment, but its long-term growth story remains unchanged. The company's customer base continues to grow at a steady pace, with existing customers increasingly adopting the company's services.

As a result, remaining performance obligations, the total amount of contracts the company will fulfill in the future, increased significantly last quarter to $1.84 billion, an increase of 74% from the same period last year. This suggests that Datadog is building a solid revenue pipeline, so it's no surprise that analysts expect strong performance from Datadog going forward.

Given that the global cloud security market is expected to generate $148 billion in annual revenue in 2032, Datadog has the potential to maintain such a healthy growth rate over the long term and deliver significant returns to investors. There is a gender.

Should you invest $1,000 in SentinelOne now?

Before purchasing SentinelOne stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and SentinelOne wasn't among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has a position in and recommends Datadog. The Motley Fool recommends his Gartner. The Motley Fool has a disclosure policy.

“2 Cybersecurity Stocks to Buy and Hold for the Next 10 Years” was originally published by The Motley Fool